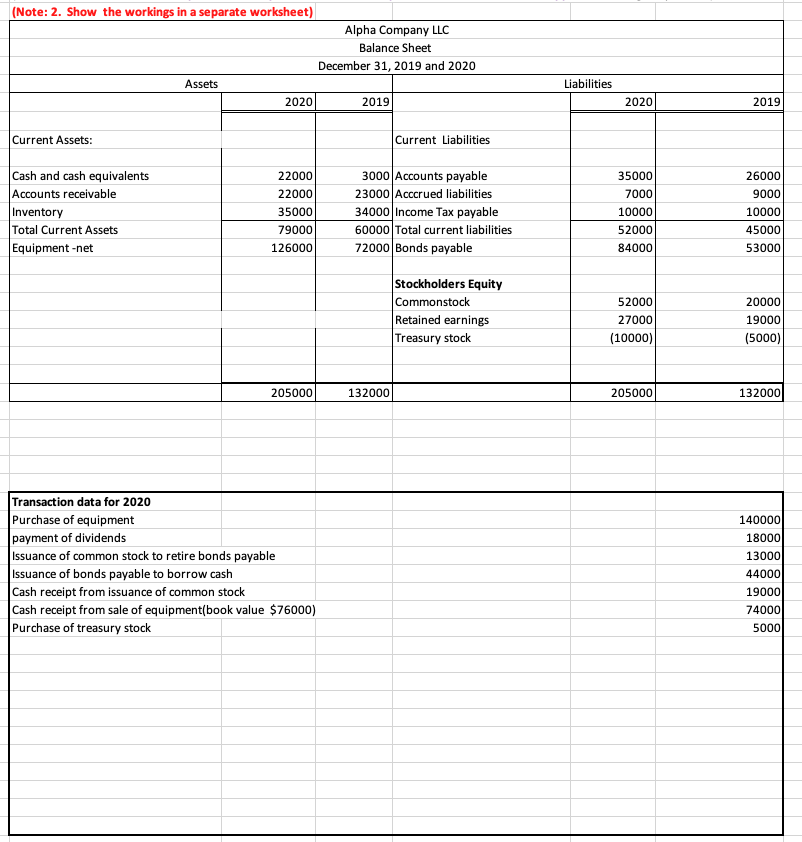

Question: Cash flow statement (Note: 2. Show the workings in a separate worksheet) Alpha Company LLC Balance Sheet December 31, 2019 and 2020 Assets 2020 2019

Cash flow statement

Cash flow statement

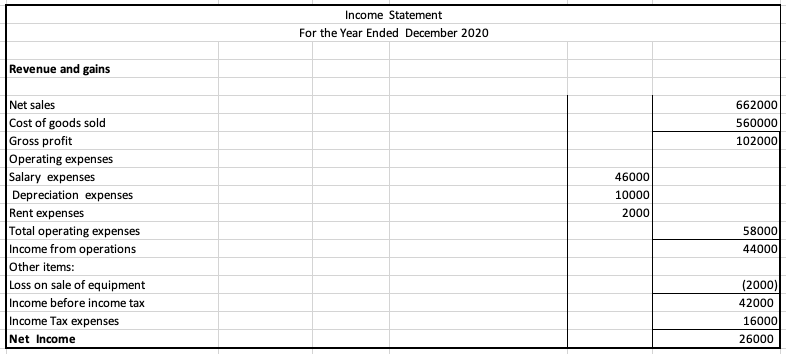

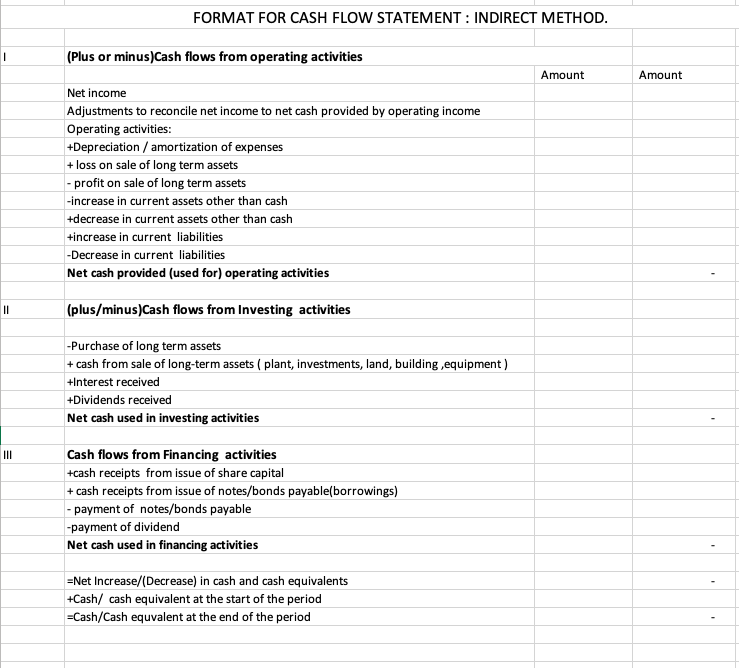

(Note: 2. Show the workings in a separate worksheet) Alpha Company LLC Balance Sheet December 31, 2019 and 2020 Assets 2020 2019 Liabilities 2020 2019 Current Assets: Current Liabilities Cash and cash equivalents Accounts receivable Inventory Total Current Assets Equipment-net 22000 22000 35000 79000 126000 3000 Accounts payable 23000 Acccrued liabilities 34000 Income Tax payable 60000 Total current liabilities 72000 Bonds payable 35000 7000 10000 52000 84000 26000 9000 10000 45000 53000 Stockholders Equity Commonstock Retained earnings Treasury stock 52000 27000 (10000) 20000 19000 (5000) 205000 132000 205000 132000 140000 Transaction data for 2020 Purchase of equipment payment of dividends Issuance of common stock to retire bonds payable Issuance of bonds payable to borrow cash Cash receipt from issuance of common stock Cash receipt from sale of equipment(book value $76000) Purchase of treasury stock 18000 13000 44000 19000 74000 5000 Income Statement For the Year Ended December 2020 Revenue and gains 662000 560000 102000 46000 10000 2000 Net sales Cost of goods sold Gross profit Operating expenses Salary expenses Depreciation expenses Rent expenses Total operating expenses Income from operations Other items: Loss on sale of equipment Income before income tax Income Tax expenses Net Income 58000 44000 (2000) 42000 16000 26000 FORMAT FOR CASH FLOW STATEMENT : INDIRECT METHOD. (Plus or minus)Cash flows from operating activities Amount Amount Net income Adjustments to reconcile net income to net cash provided by operating income Operating activities: +Depreciation / amortization of expenses + loss on sale of long term assets -profit on sale of long term assets -increase in current assets other than cash +decrease in current assets other than cash +increase in current liabilities -Decrease in current liabilities Net cash provided (used for) operating activities II (plus/minus)Cash flows from Investing activities -Purchase of long term assets + cash from sale of long-term assets (plant, investments, land, building,equipment) +Interest received +Dividends received Net cash used in investing activities III Cash flows from Financing activities +cash receipts from issue of share capital + cash receipts from issue of notes/bonds payable(borrowings) - payment of notes/bonds payable -payment of dividend Net cash used in financing activities =Net Increase/Decrease) in cash and cash equivalents +Cash/ cash equivalent at the start of the period =Cash/Cash equvalent at the end of the period (Note: 2. Show the workings in a separate worksheet) Alpha Company LLC Balance Sheet December 31, 2019 and 2020 Assets 2020 2019 Liabilities 2020 2019 Current Assets: Current Liabilities Cash and cash equivalents Accounts receivable Inventory Total Current Assets Equipment-net 22000 22000 35000 79000 126000 3000 Accounts payable 23000 Acccrued liabilities 34000 Income Tax payable 60000 Total current liabilities 72000 Bonds payable 35000 7000 10000 52000 84000 26000 9000 10000 45000 53000 Stockholders Equity Commonstock Retained earnings Treasury stock 52000 27000 (10000) 20000 19000 (5000) 205000 132000 205000 132000 140000 Transaction data for 2020 Purchase of equipment payment of dividends Issuance of common stock to retire bonds payable Issuance of bonds payable to borrow cash Cash receipt from issuance of common stock Cash receipt from sale of equipment(book value $76000) Purchase of treasury stock 18000 13000 44000 19000 74000 5000 Income Statement For the Year Ended December 2020 Revenue and gains 662000 560000 102000 46000 10000 2000 Net sales Cost of goods sold Gross profit Operating expenses Salary expenses Depreciation expenses Rent expenses Total operating expenses Income from operations Other items: Loss on sale of equipment Income before income tax Income Tax expenses Net Income 58000 44000 (2000) 42000 16000 26000 FORMAT FOR CASH FLOW STATEMENT : INDIRECT METHOD. (Plus or minus)Cash flows from operating activities Amount Amount Net income Adjustments to reconcile net income to net cash provided by operating income Operating activities: +Depreciation / amortization of expenses + loss on sale of long term assets -profit on sale of long term assets -increase in current assets other than cash +decrease in current assets other than cash +increase in current liabilities -Decrease in current liabilities Net cash provided (used for) operating activities II (plus/minus)Cash flows from Investing activities -Purchase of long term assets + cash from sale of long-term assets (plant, investments, land, building,equipment) +Interest received +Dividends received Net cash used in investing activities III Cash flows from Financing activities +cash receipts from issue of share capital + cash receipts from issue of notes/bonds payable(borrowings) - payment of notes/bonds payable -payment of dividend Net cash used in financing activities =Net Increase/Decrease) in cash and cash equivalents +Cash/ cash equivalent at the start of the period =Cash/Cash equvalent at the end of the period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts