Question: Cash Flow Statement- Practice Questions Thank you for you help! Current Attempt in Progress Selected information follows for Sheridan Select Corporation at December 31: Additional

Cash Flow Statement- Practice Questions

Thank you for you help!

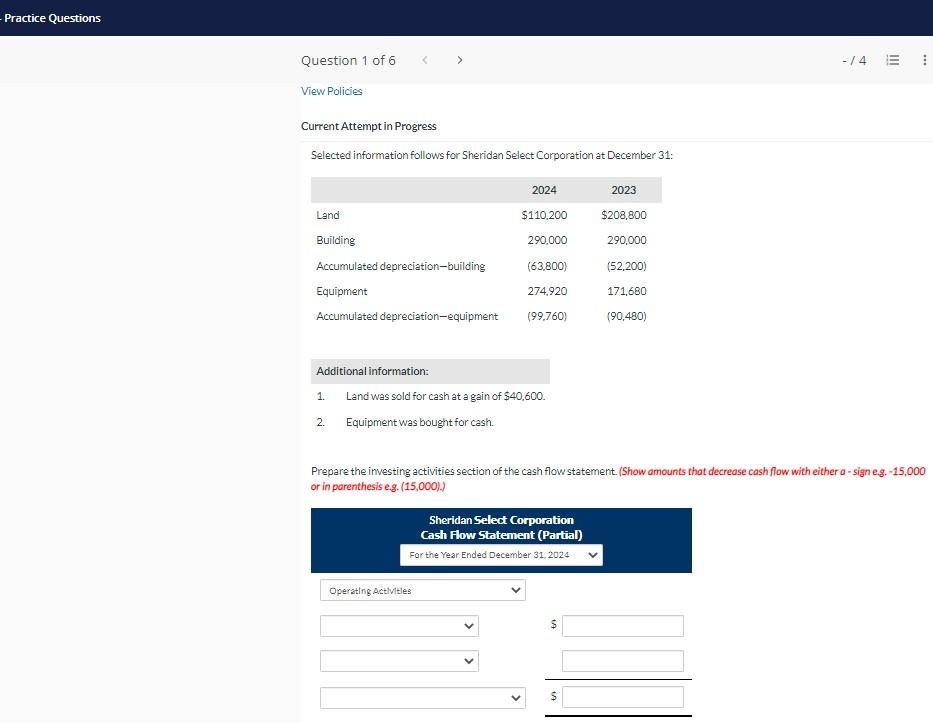

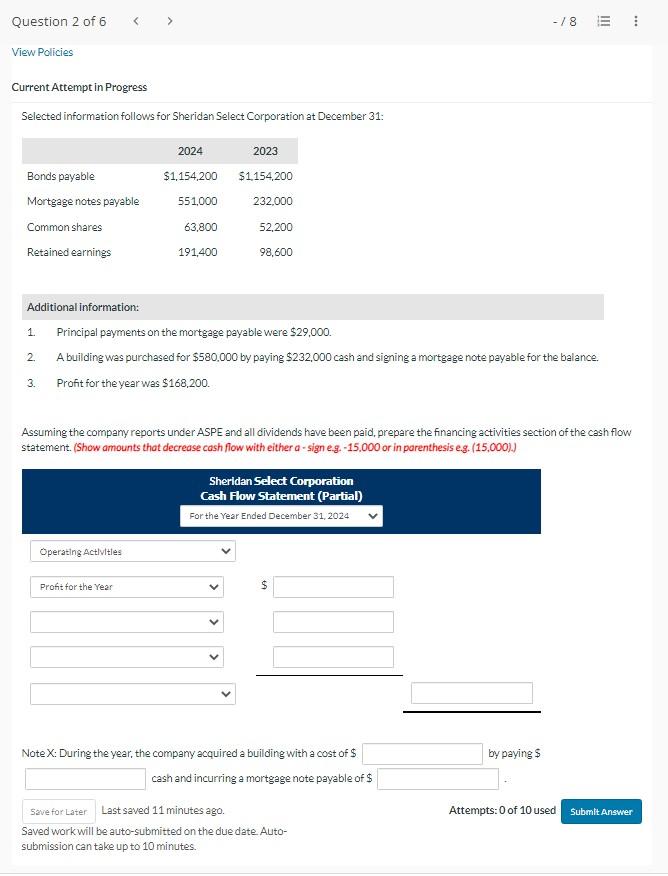

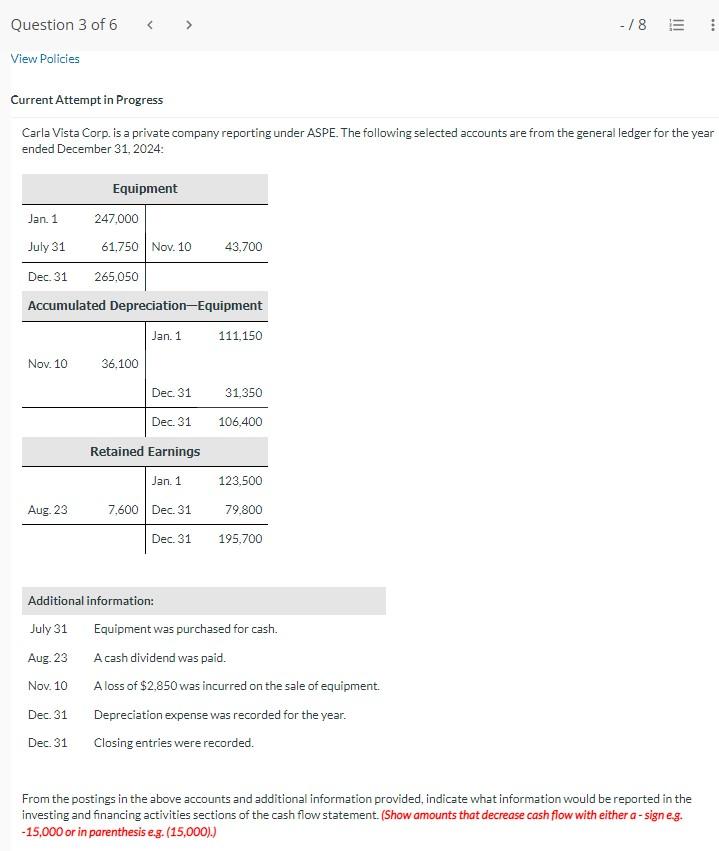

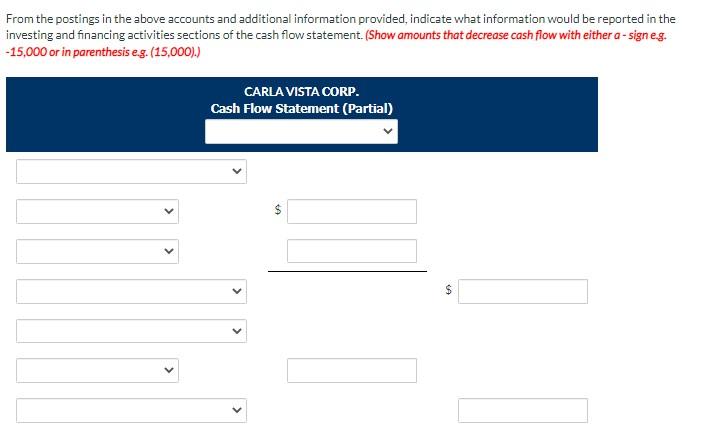

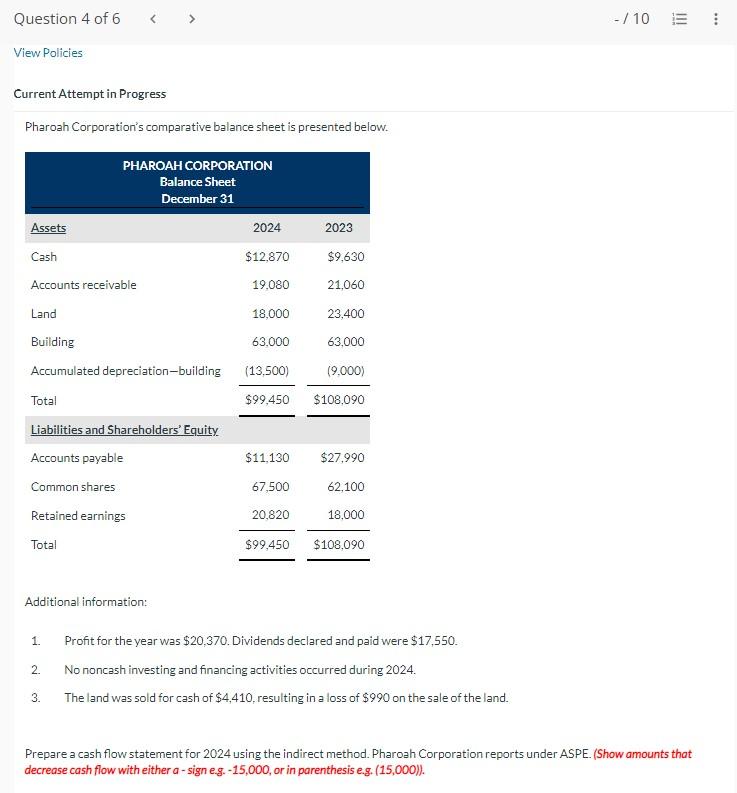

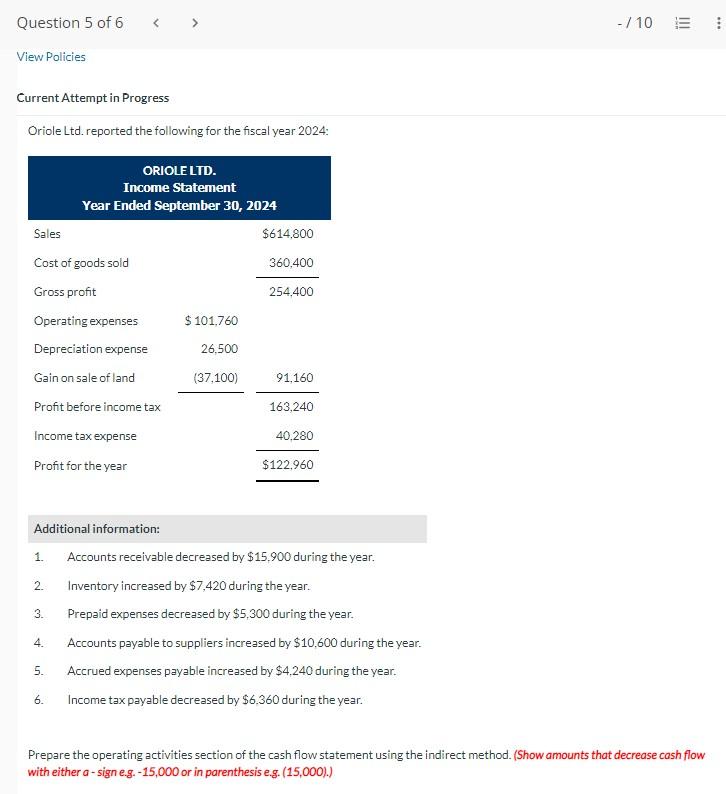

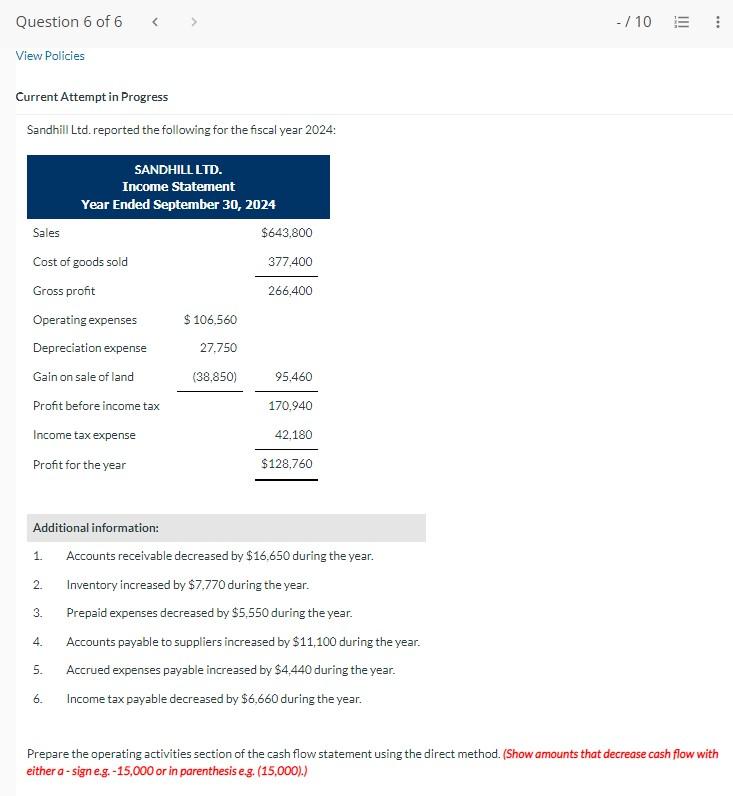

Current Attempt in Progress Selected information follows for Sheridan Select Corporation at December 31: Additional information: 1. Land was sold for cash at a gain of $40,600. 2. Equipment was bought for cash. Prepare the investing activities section of the cash flow statement. (Show amounts that decrease cash flow with either a-sign e.g. 15,000 or in parenthesis e.g. (15,000). Current Attempt in Progress Selected information follows for Sheridan Select Corporation at December 31 : Additional information: 1. Principal payments on the mortgage payable were $29,000. 2. A building was purchased for $580,000 by paying $232,000 cash and signing a mortgage note payable for the balance. 3. Profit for the yearwas $168,200. Assuming the company reports under ASPE and all dividends have been paid, prepare the financing activities section of the cash flow statement. (Show amounts that decrease cash flow with either a-sign eg. 15,000 or in parenthesis e.g. (15,000) ). Carla Vista Corp. is a private company reporting under ASPE. The following selected accounts are from the general ledger for the year ended December 31, 2024: From the postings in the above accounts and additional information provided, indicate what information would be reported in the investing and financing activities sections of the cash flow statement. (Show amounts that decrease cash flow with either a-sign eg. 15,000 or in parenthesis e.g. (15,000). From the postings in the above accounts and additional information provided, indicate what information would be reported in the investing and financing activities sections of the cash flow statement. (Show omounts that decrease cash flow with either a-sign e.g. 15,000 or in parenthesis e.g. (15,000). Current Attempt in Progress Pharoah Corporation's comparative balance sheet is presented below. Additional information: 1. Profit for the year was $20,370. Dividends declared and paid were $17,550. 2. No noncash investing and financing activities occurred during 2024 . 3. The land was sold for cash of $4,410, resulting in a loss of $990 on the sale of the land. Prepare a cash flow statement for 2024 using the indirect method. Pharoah Corporation reports under ASPE. (Show amounts that decrease cash flow with either a - sign e.g. 15,000, or in parenthesis e.g. (15,000)). Current Attempt in Progress Oriole Ltd. reported the following for the fiscal year 2024: Additional information: 1. Accounts receivable decreased by $15,900 during the year. 2. Inventory increased by $7,420 during the year. 3. Prepaid expenses decreased by $5,300 during the year. 4. Accounts payable to suppliers increased by $10,600 during the year. 5. Accrued expenses payable increased by $4,240 during the year. 6. Income tax payable decreased by $6,360 during the year. Prepare the operating activities section of the cash flow statement using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. 15,000 or in parenthesis e.g. (15,000). ORIOLE LTD. Cash Flow Statement (Partial)-Indirect Method $ Adjustments to reconcile profit to $ Current Attempt in Progress Sandhill Ltd. reported the following for the fiscal year 2024: Additional information: 1. Accounts receivable decreased by $16,650 during the year. 2. Inventory increased by $7,770 during the year. 3. Prepaid expenses decreased by $5,550 during the year. 4. Accounts payable to suppliers increased by $11,100 during the year. 5. Accrued expenses payable increased by $4,440 during the year. 6. Income tax payable decreased by $6,660 during the year. Prepare the operating activities section of the cash flow statement using the direct method. (Show amounts that decrease cash flow with either a - sign e.g. 15,000 or in parenthesis e.g. (15,000). Prepare the operating activities section of the cash flow statement using the direct method. (Show amounts that decrease cash flow with

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts