Question: Carolyn transfers property with an adjusted basis of $50,000 and an FMV of $60,000 in exchange for Prime Corporation stock in a Sec. 351

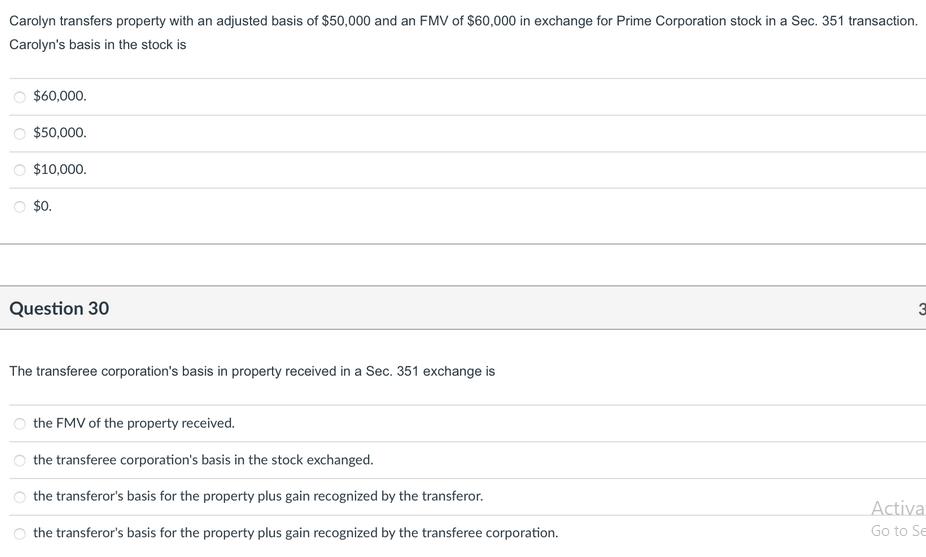

Carolyn transfers property with an adjusted basis of $50,000 and an FMV of $60,000 in exchange for Prime Corporation stock in a Sec. 351 transaction. Carolyn's basis in the stock is $60,000. $50,000. $10,000. $0. Question 30 The transferee corporation's basis in property received in a Sec. 351 exchange is the FMV of the property received. the transferee corporation's basis in the stock exchanged. the transferor's basis for the property plus gain recognized by the transferor. the transferor's basis for the property plus gain recognized by the transferee corporation. 3 Activa Go to Se

Step by Step Solution

3.50 Rating (173 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts