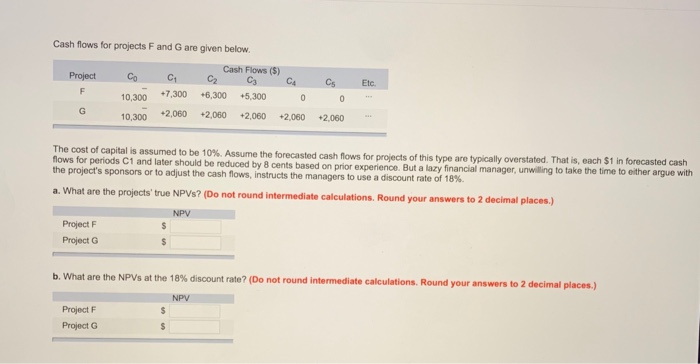

Question: Cash flows for projects F and G are given below Cash Flows (S) C C2 C3 C4 Cs Etc Project Co 10,300 +7,300 6,300 5300

Cash flows for projects F and G are given below Cash Flows (S) C C2 C3 C4 Cs Etc Project Co 10,300 +7,300 6,300 5300 10,300 *2,060 2.060 2.060 +2,060 2.060 flows for periods C1 and later should be reduced by 8 cents based on prior experience. But a lazy financial manager the project's sponsors or to adjust the cash flows, instructs the managers to use a discount rate of 18%. The cost of capital is assumed to be 10%. Assume the forecasted cash ftows forprots ot a iszy fnacial manager, unwilling to take the time to either argue with are typically overstated. That is, each $1 in forecasted cash , unwiling to ake the time to either argue with What are the projects'true NPVs? (Do not round intermediate calculation s. Round your answers to 2 decimal places.) NPV Project F Project G b. What are the NPVs at the 18% discount rate? (Do not round intermediate calculations. Round your answers to 2 decimal p NPV Project F Project G

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts