Question: Cash flows for the equipment. Present value factor table Present value annuity factor table. Norberto Garcia, general manager of the Argentinean subsidiary of Innovation Inc,

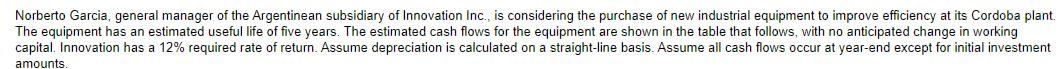

Cash flows for the equipment.

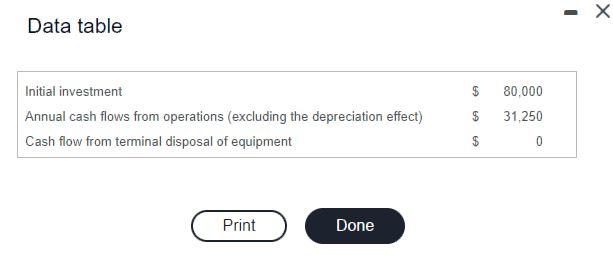

Present value factor table

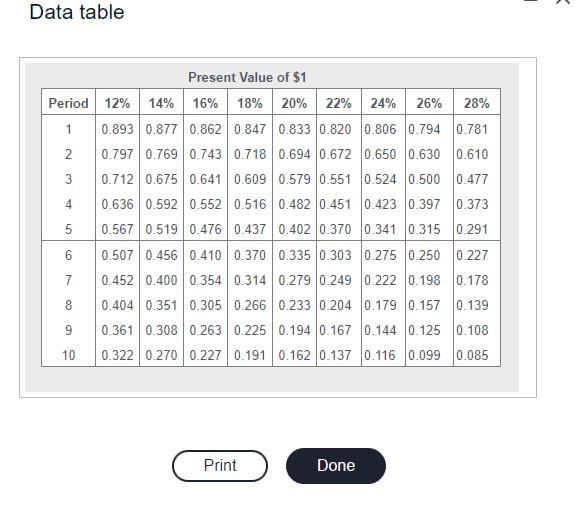

Present value annuity factor table.

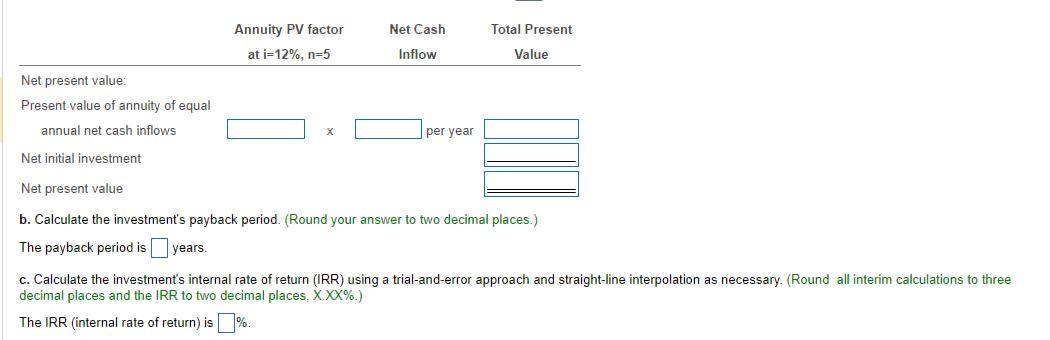

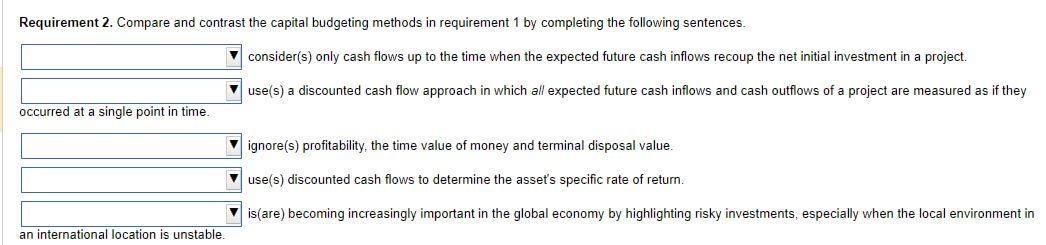

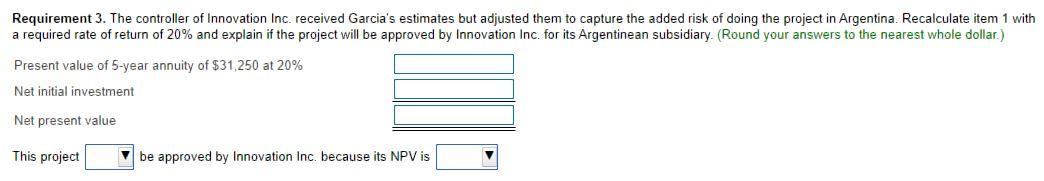

Norberto Garcia, general manager of the Argentinean subsidiary of Innovation Inc, is considering the purchase of new industrial equipment to improve efficiency at its Cordoba plant. The equipment has an estimated useful life of five years. The estimated cash flows for the equipment are shown in the table that follows, with no anticipated change in working capital. Innovation has a 12% required rate of return. Assume depreciation is calculated on a straight-line basis. Assume all cash flows occur at year-end except for initial investment amounts. Data table Data table Data table b. Calculate the investment's payback period. (Round your answer to two decimal places.) The payback period is years. c. Calculate the investment's internal rate of return (IRR) using a trial-and-error approach and straight-line interpolation as necessary. (Round all interim calculations to three decimal places and the IRR to two decimal places, X.XX\%.) The IRR (internal rate of return) is %. Requirement 2. Compare and contrast the capital budgeting methods in requirement 1 by completing the following sentences. consider(s) only cash flows up to the time when the expected future cash inflows recoup the net initial investment in a project. ]use(s) a discounted cash flow approach in which all expected future cash inflows and cash outflows of a project are measured as if they occurred at a single point in time. ignore(s) profitability, the time value of money and terminal disposal value. use(s) discounted cash flows to determine the asset's specific rate of return. I is(are) becoming increasingly important in the global economy by highlighting risky investments, especially when the local environment in an international location is unstable. Requirement 3. The controller of Innovation Inc. received Garcia's estimates but adjusted them to capture the added risk of doing the project in Argentina. Recalculate item 1 with a required rate of return of 20% and explain if the project will be approved by Innovation Inc. for its Argentinean subsidiary. (Round your answers to the nearest whole dollar.) This project be approved by Innovation Inc. because its NPV is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts