Question: Cash Flows from Operating Activities Direct Method The Income statement of Booker Industries Inc. for the current year ended June 30 is as follows: Sales

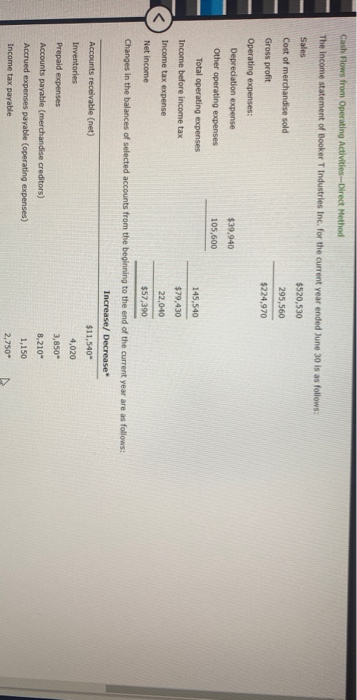

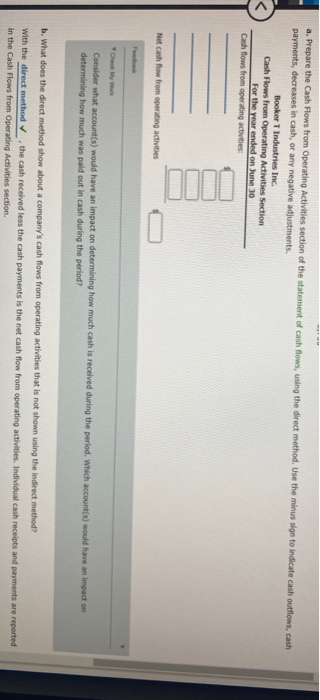

Cash Flows from Operating Activities Direct Method The Income statement of Booker Industries Inc. for the current year ended June 30 is as follows: Sales $520,530 Cost of merchandise sold 295,560 Gross profit $224,970 Operating expenses: Depreciation expense $39.940 Other operating expenses 105,600 Total operating expenses 145.540 Income before income tax $79.430 Income tax expense 22,040 Net Income $57,390 Changes in the balances of selected accounts from the beginning to the end of the current year are as follows: Increase/ Decrease Accounts receivable (net) $11,540" Inventories Prepaid expenses Accounts payable (merchandise creditors) Accrued expenses payable operating expenses) Income tax payable 4,020 3,850 8,210" 1,150 2,750- a. Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the direct method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Booker T Industries Inc. Cash Flows from Operating Activities Section For the year ended on June 10 Cash flows from operating activities: Net cash flow from operating activities My W Consider what account(s) would have an impact on determining how much cash is received during the period. Which accounts) would have an impact on determining how much was paid out in cash during the period? b. What does the direct method show about a company's cash flows from operating activities that is not shown using the indirect method With the direct method , the cash received less the cash payments is the net cash flow from operating activities. Individual cash receipts and payments are reported in the Cash Flows from Operating Activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts