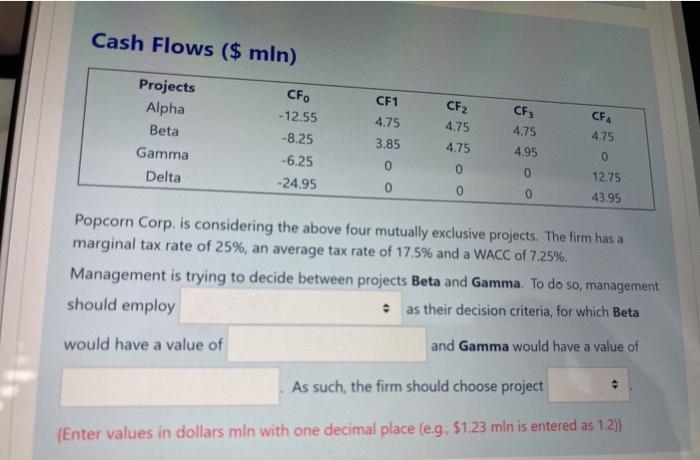

Question: Cash Flows ($ mln) Projects Alpha Beta Gamma Delta CF. -12.55 -8.25 -6.25 -24.95 CF1 4.75 3.85 0 0 CF2 4.75 4.75 CF 4.75 4.95

Cash Flows ($ mln) Projects Alpha Beta Gamma Delta CF. -12.55 -8.25 -6.25 -24.95 CF1 4.75 3.85 0 0 CF2 4.75 4.75 CF 4.75 4.95 CFA 4.75 0 0 0 0 0 12.75 43,95 Popcorn Corp. is considering the above four mutually exclusive projects. The firm has a marginal tax rate of 25%, an average tax rate of 17.5% and a WACC of 7.25%. Management is trying to decide between projects Beta and Gamma. To do so, management should employ as their decision criteria, for which Beta would have a value of and Gamma would have a value of As such, the firm should choose project {Enter values in dollars min with one decimal place (e.g. 51.23 min is entered as 1.2)) Cash Flows ($ mln) Projects Alpha Beta Gamma Delta CF. -12.55 -8.25 -6.25 -24.95 CF1 4.75 3.85 0 0 CF2 4.75 4.75 CF 4.75 4.95 CFA 4.75 0 0 0 0 0 12.75 43,95 Popcorn Corp. is considering the above four mutually exclusive projects. The firm has a marginal tax rate of 25%, an average tax rate of 17.5% and a WACC of 7.25%. Management is trying to decide between projects Beta and Gamma. To do so, management should employ as their decision criteria, for which Beta would have a value of and Gamma would have a value of As such, the firm should choose project {Enter values in dollars min with one decimal place (e.g. 51.23 min is entered as 1.2))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts