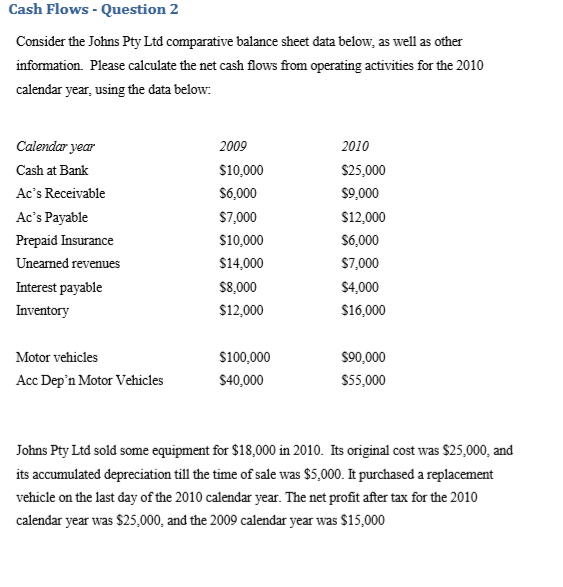

Question: Cash Flows - Question 2 Consider the Johns Pty Ltd comparative balance sheet data below, as well as other information. Please calculate the net cash

Cash Flows - Question 2 Consider the Johns Pty Ltd comparative balance sheet data below, as well as other information. Please calculate the net cash flows from operating activities for the 2010 calendar year, using the data below. Calendar year Cash at Bank Ac's Receivable Ac's Payable Prepaid Insurance Unearned revenues Interest payable Inventory 2009 $10,000 $6,000 $7,000 $10,000 $14,000 $8,000 $12,000 2010 $25,000 $9,000 $12,000 $6,000 $7,000 $4,000 $16,000 Motor vehicles Acc Dep'n Motor Vehicles $100,000 $40,000 $90,000 $55,000 Johns Pty Ltd sold some equipment for $18,000 in 2010. Its original cost was $25,000, and its accumulated depreciation till the time of sale was $5,000. It purchased a replacement vehicle on the last day of the 2010 calendar year. The net profit after tax for the 2010 calendar year was $25,000, and the 2009 calendar year was $15,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts