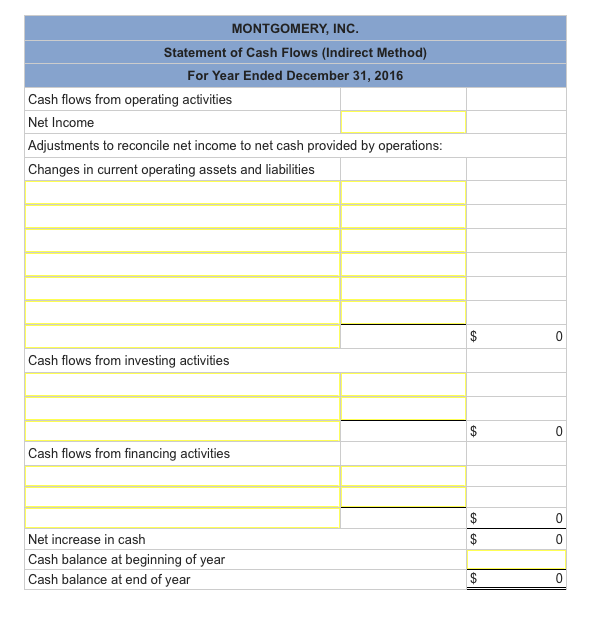

Question: (Cash paid for equipment, Cash received from stock issuance, Decrease in accounts payable, Decrease in accounts receivable, Decrease in inventory, Decrease in salaries payable, Depreciation

(Cash paid for equipment, Cash received from stock issuance, Decrease in accounts payable, Decrease in accounts receivable, Decrease in inventory, Decrease in salaries payable, Depreciation expense, Increase in accounts payable, Increase in accounts receiveable, Increase in inventory, Increase in salaries payable)

(Net cash provided by financing activities, Net cash provided by invensting activities, Net cash provided by operating activities, Net cash used in financing activities, Net cash used in investing activities, Net cash used in operating activities)

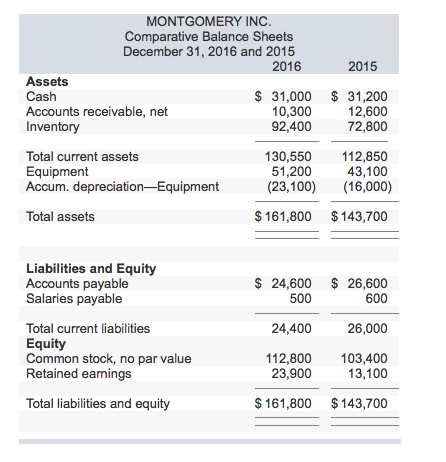

MONTGOMERY INC. Comparative Balance Sheets December 31, 2016 and 2015 2016 2015 Assets 31,000 31,200 Cash Accounts receivable, net 10.300 12,600 92,400 72,800 Inventory 130,550 112,850 Total current assets Equipment 51,200 43,100 Accum. depreciation-Equipment (23,100) (16,000) 161,800 $143,700 Total assets Liabilities and Equity 24,600 26,600 Accounts payable Salaries payable 500 600 24,400 26,000 Total current liabilities Equity Common stock, no par value 112,800 103,400 Retained earnings 23.900 13,100 Total liabilities and equity 161,800 143,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts