Question: Cash payback period, net present value analysis, and qualitative considerations The plant manager of Orlando Electronics Company is considering the purchase of new automated assembly

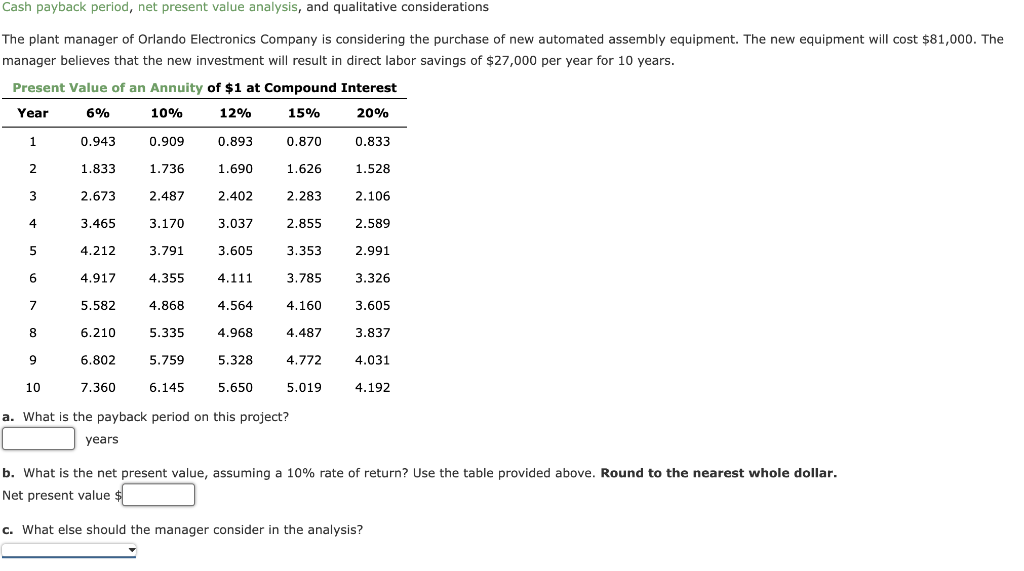

Cash payback period, net present value analysis, and qualitative considerations The plant manager of Orlando Electronics Company is considering the purchase of new automated assembly equipment. The new equipment will cost $81,000. The manager believes that the new investment will result in direct labor savings of $27,000 per year for 10 years. Precent Value of an Annuitw of $1 at Comnound Tnterect W. What is the payback period on this project? years b. What is the net present value, assuming a 10% rate of return? Use the table provided above. Round to the nearest whole dollar. Net present value $ c. What else should the manager consider in the analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts