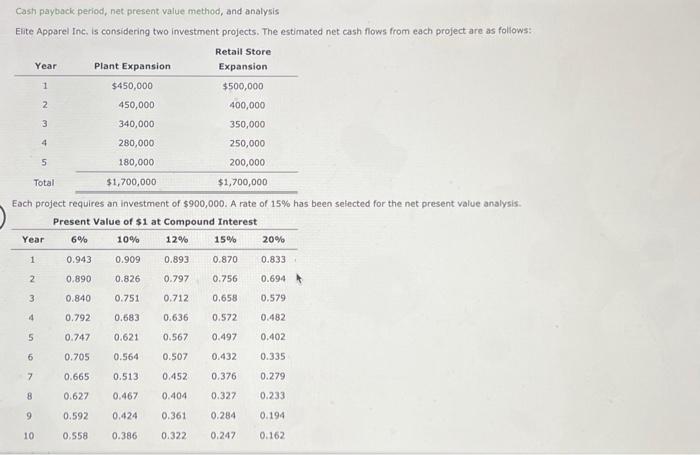

Question: Cash payback period, net present value method, and analysis Eite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project

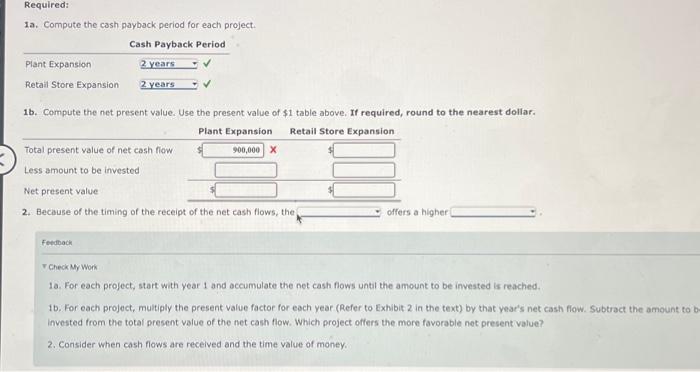

Cash payback period, net present value method, and analysis Eite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Each project requires an investment of $900,000. A rate of 15% has been sefected for the net present value analysis. Present Value of $1 at Combound Interest 1a. Compute the cash payback period for each project. 1b. Compute the net present value. Use the present value of $1 table above. If required, round to the nearest dollar. 2. Because of the timing of the receipt of the net cash flows, the offers a higher Festoach v Check My Work 10. For each project, start with year 1 and accumulate the net cash flows untal the amount to be invested is reached. invested from the total present value of the net cash flow. Which project offers the more favorable not present value? 2. Consider when cash flows are received and the time value of money

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts