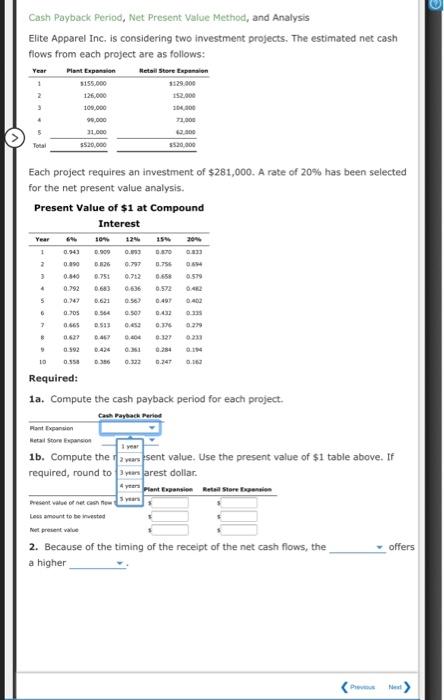

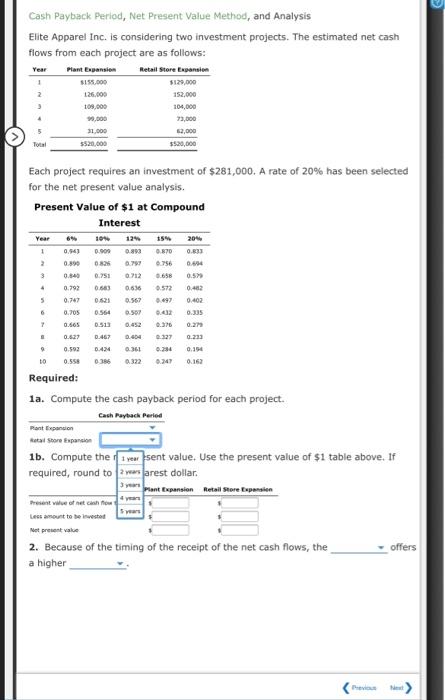

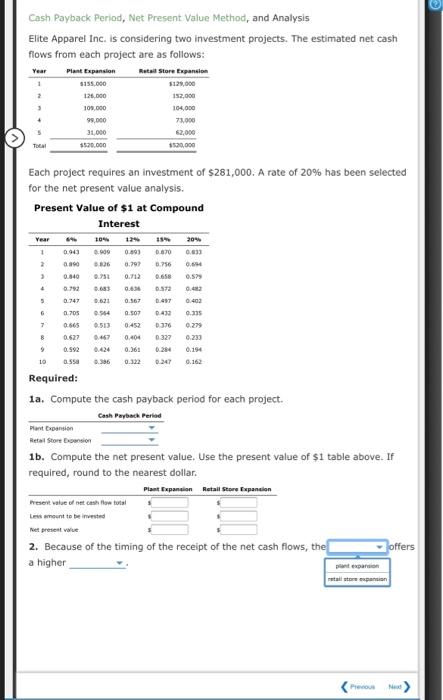

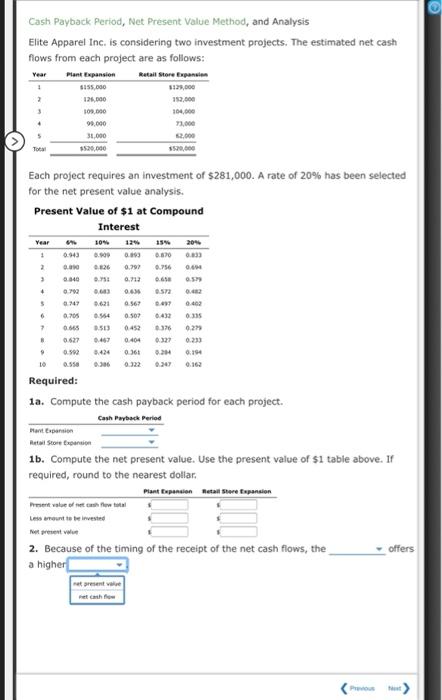

Question: Cash Payback Period, Net Present Value Method, and Analysis Elite Apparel Inc, is considering two investment projects. The estimated net cash flows from each project

Cash Payback Period, Net Present Value Method, and Analysis Elite Apparel Inc, is considering two investment projects. The estimated net cash flows from each project are as follows: Plant Expansion Metall Store Expansion Year 1 2 3 1129.000 192.000 5155.000 126,000 100.000 90.000 31.000 5520,000 71.000 2.000 $520.000 Total Each project requires an investment of $281,000. A rate of 20% has been selected for the net present value analysis. Present Value of $1 at Compound Interest Year 204 0:33 1 0.943 104 125 0.900 0.03 26 0.79 0.751 0.72 0.00 0.870 0.756 0.658 3 0.540 0:57 0.792 0.77 0683 0.61 5 0.36) 0.502 6 0.705 0.564 DS 0.497 0.42 0.26 7 . 0.04 10 0.35 0.3 0.322 0.2470 Required: 1a. Compute the cash payback period for each project. Cash Payback Period Pant Expansion Retail storeExpansion 1b. Compute the aversent value. Use the present value of $1 table above. If required, round to per farest dollar. year prontpansion Retail Store non Les amount to benested offers 2. Because of the timing of the receipt of the net cash flows, the a higher Cash Payback Period, Net Present Value Method, and Analysis Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Plant Expansion Retail Store Expansion Year 1 2 3 3155.000 126.000 109,000 99,000 31.000 5520.000 $129,000 152.000 104,000 73,000 2,000 5520,000 4 Total Each project requires an investment of $281,000. A rate of 20% has been selected for the net present value analysis. Present Value of $1 at Compound Interest Year 204 0.833 1 0.4) 0.69 104 124 0.0090.893 08 0.792 0.751 0712 0.663 0.636 0.567 0.870 0.756 0.658 0.572 3 4 0.792 0.747 5 0.5 0.482 0.402 0.335 0.27 6 0.564 0.50 0.705 0.65 0513 0.452 0.376 327 0.467 0.233 0.62% 0.592 0.44 0.361 10 0.3 0.322 0.47 0.162 Required: la. Compute the cash payback period for each project. Cash Payback Period Ponton Retail Store Expansion 1b. Compute the riversent value. Use the present value of $1 table above. If required, round towers arest dollar. Fant Expansion Retail Store Expansion Less amount to bend offers 2. Because of the timing of the receipt of the net cash flows, the a higher Cash Payback Period, Net Present Value Method, and Analysis Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Year Plant Expansion Retail Store Expansion 5155.000 5128,000 2 126,000 152.000 109.000 104.000 99.000 73.000 31.000 5520.000 1520,000 3 Year 20% 1 3 0540 . 0.79 .633 2.621 5 0.747 0.567 0.554 . Each project requires an investment of $281,000. A rate of 20% has been selected for the net present value analysis. Present Value of $1 at Compound Interest 64 10% 0943 0.000 0.893 0.670 0.633 0.00 0.006 0.797 0.756 2.1 0.712 0658 0.59 0.43 0.497 0.402 2.705 0.507 0.432 0.33 7 0.665 0452 0.376 0.279 8 0.627 0.467 0.404 0327 0.233 9 0.592 10 0.322 0.247 0.162 Required: 1a. Compute the cash payback period for each project. Cash Payback Period Plantpansion Retail store bosion 1b. Compute the net present value. Use the present value of $1 table above. If required, round to the nearest dollar. Plant Expansion Retail Store Expansion Present value of net cash flow total Les out to be invested Net present value 2. Because of the timing of the receipt of the net cash flows, the offers a higher expansion how Cash Payback period, Net Present Value Method, and Analysis Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Retail Store Expansion 312,000 . 2 3 Plant Expansion SISS.000 126.000 309,000 99.000 31,000 104.000 73,000 4 $520,000 Each project requires an investment of $281,000. A rate of 20% has been selected for the net present value analysis. Present Value of $1 at Compound Interest Year * 10% 12% 204 0.943 0.000 0.000 0.870 0.833 2 0.00026 0.797 0.756 0.6 3 0.040 0.12 0.5 4 0.63 0.635 . 0747 621 567 0.463 6 0.705 0507 0335 7 0.513 0.452 0.29 0622 0.467 0.404 0.592 3.424 0:36 0.24 0.19 0.558 0.306 Required: 1a. Compute the cash payback period for each project. Cash Payback Period Hant. Expansion Real Store 1b. Compute the net present value. Use the present value of $1 table above. If required, round to the nearest dollar. Plant Expansion Retail Store Expansion et value of the Less the need offers 2. Because of the timing of the receipt of the net cash flows, the a higher

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts