Question: Cash Payback Period, Net Present Value Method, and Analysis Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project

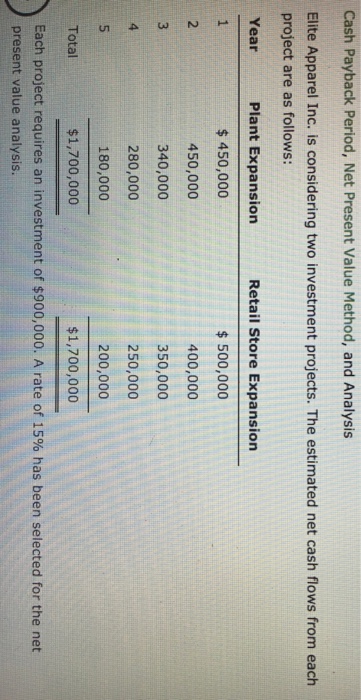

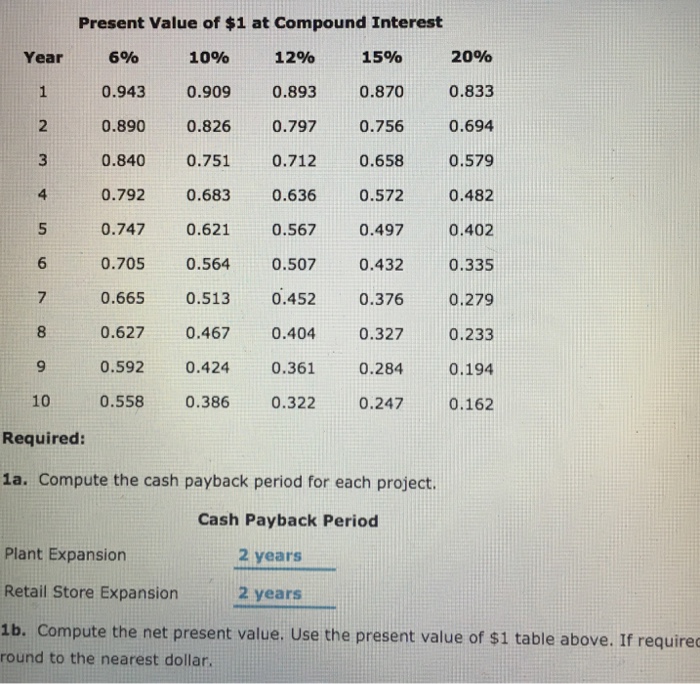

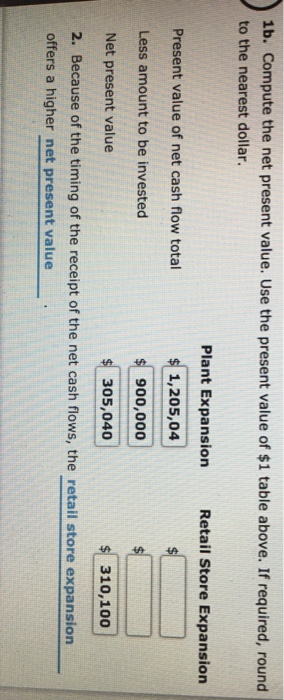

Cash Payback Period, Net Present Value Method, and Analysis Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Retail Store Expansion 500,000 400,000 350,000 250,000 200,000 $1,700,000 Year Plant Expansion $ 450,000 450,000 340,000 280,000 180,000 $1,700,000 Total Each project requires an investment of $900,000. A rate of 15% has been selected for the net present value analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts