Question: Cash Payback Period, Net Present Value Method, and Analysis Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project

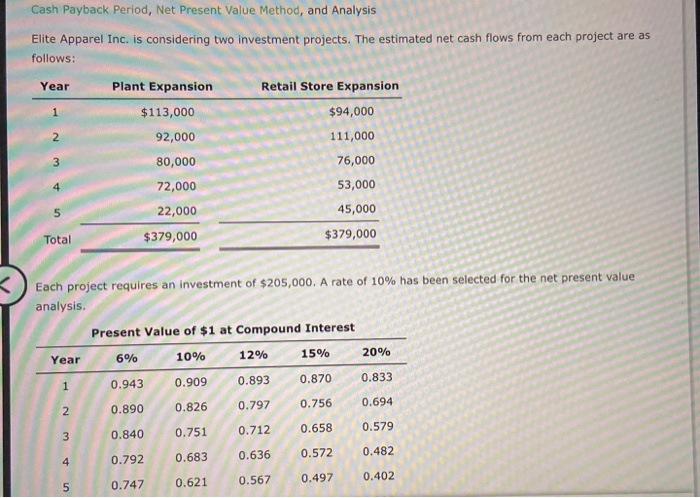

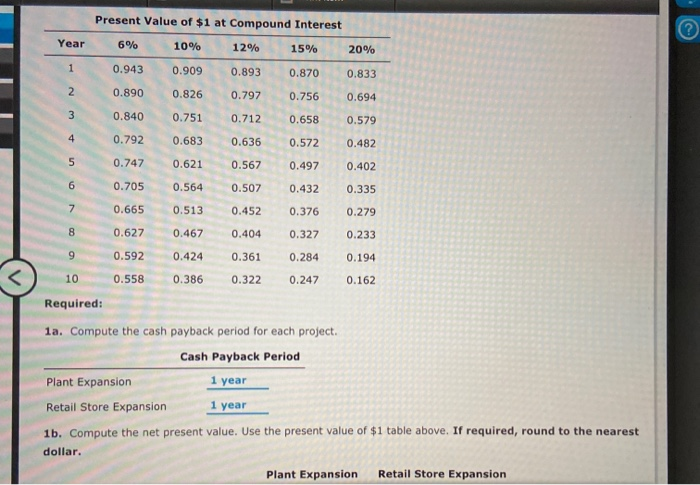

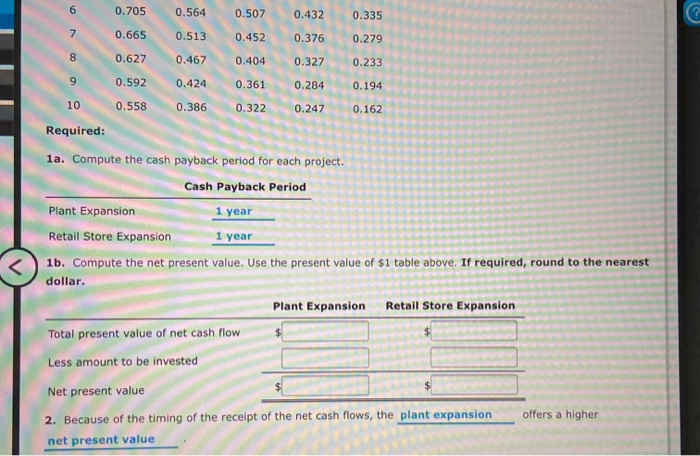

Cash Payback Period, Net Present Value Method, and Analysis Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Year Retail Store Expansion 1 Plant Expansion $113,000 92,000 80,000 2 $94,000 111,000 76,000 53,000 3 4 72,000 5 22,000 45,000 Total $379,000 $379,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts