Question: Cash Payback Period, Net Present Value Method, and Analysis Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project

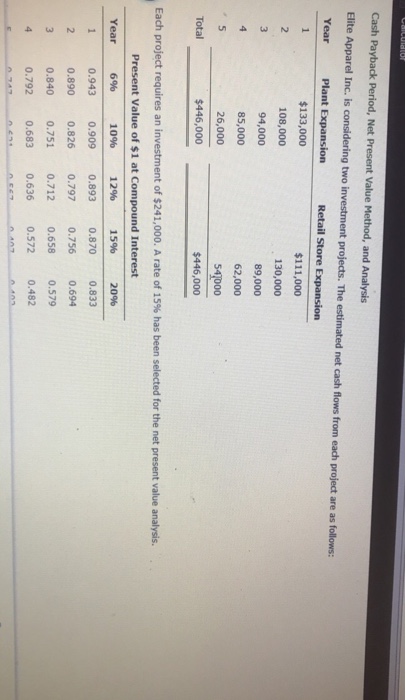

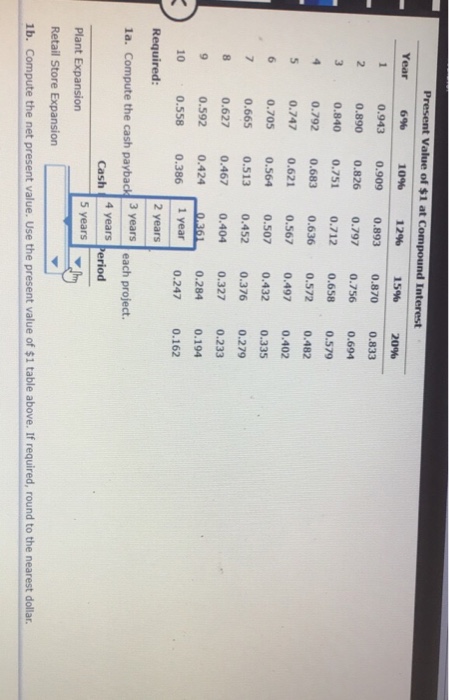

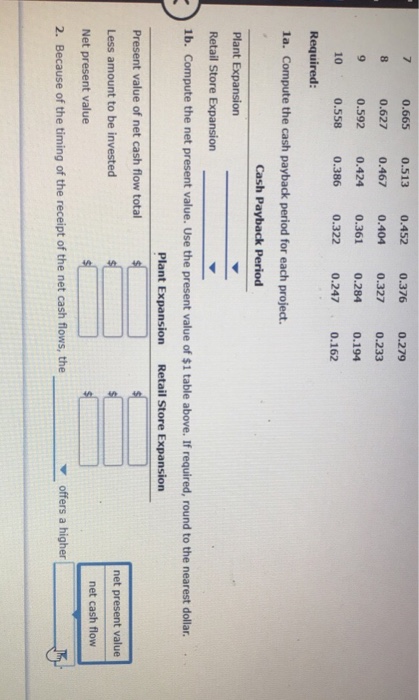

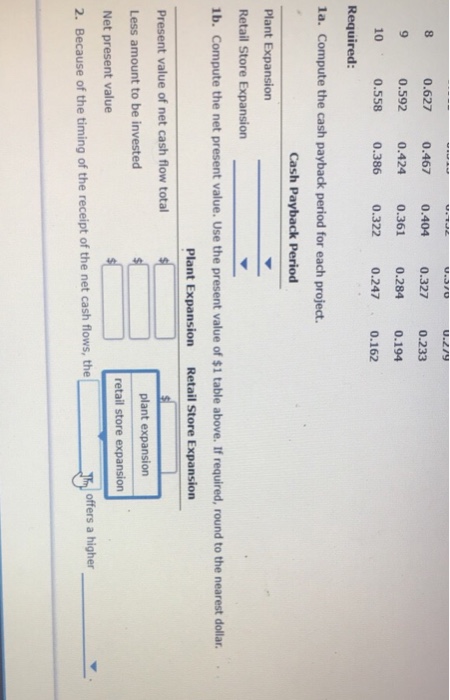

Cash Payback Period, Net Present Value Method, and Analysis Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Year Plant Expansion Retail Store Expansion $133,000 108,000 94,000 85,000 26,000 $446,000 $111,000 130,000 89,000 62,000 541000 $446,000 Total Each project requires an investment of $241,000. A rate of 15% has been selected for the net present value analysis. Present Value of $1 at Compound Interest 6V% 2096 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 15% Year 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts