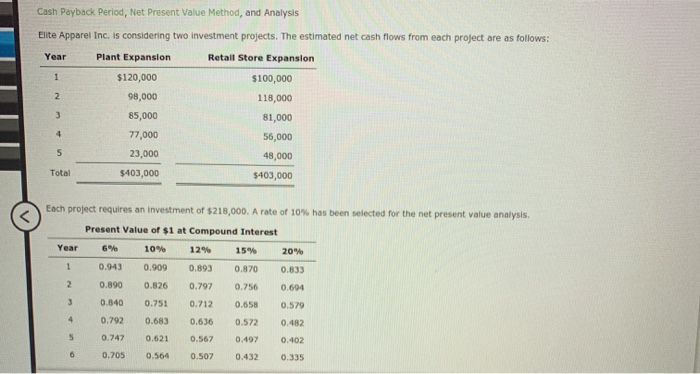

Question: Cash Payback period, Net Present Value Method, and Analysis Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project

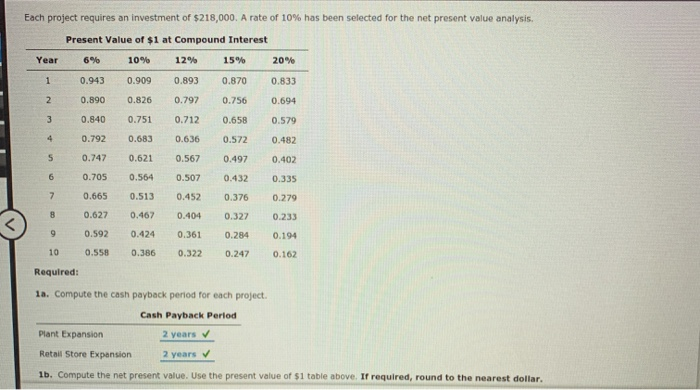

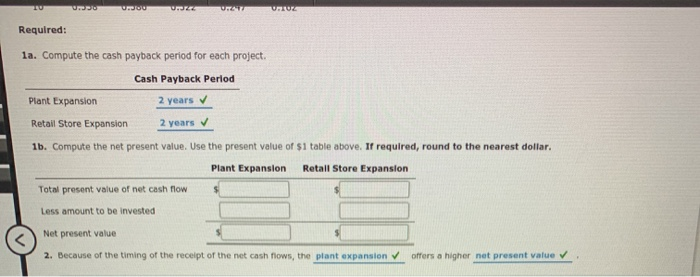

Cash Payback period, Net Present Value Method, and Analysis Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Year Plant Expansion Retail Store Expansion $120,000 $100,000 98,000 118,000 85,000 81,000 77,000 56,000 23,000 48,000 Total $403,000 $403,000 Each project requires an investment of $218,000. A rate of 10% has been selected for the net present value analysis. Present Value of $1 at Compound Interest Year 20% 1 15% 0.870 0.756 0.833 6% 10% 0.9430.909 0.890 0.826 0.840 0.751 0.792 0.683 0.747 0.621 0.705 0.564 12% 0.893 0.797 0.712 0.636 0.658 0.572 0.497 0.432 0.694 0.579 0.482 0.402 0.335 0.567 0.507 Each project requires an investment of $218,000. A rate of 10% has been selected for the net present value analysis. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0 .943 0.909 0.893 0.870 0.833 0.890 0.826 0.797 0.756 0.694 0.840 0.751 0.712 0.658 0.579 0.683 0.636 0.572 0.482 0.567 0.497 0.402 0.507 0.432 0.792 0.747 0.705 0.665 0.627 0.592 .558 0.452 0.376 0.621 0.564 0.513 0.467 0.424 0.386 0.335 0.279 0.233 0.327 0.404 0.361 0.322 0.284 0.247 100 0.194 0.162 Required: 1a. Compute the cash payback period for each project. Cash Payback Period Plant Expansion 2 years Retail Store Expansion 2 years 1b. Compute the net present value. Use the present value of $1 table above. If required, round to the nearest dollar. TUDO UMBUE UTVUSTUS Required: la. Compute the cash payback period for each project. Cash Payback Period Plant Expansion 2 years Retail Store Expansion 2 years 1b. Compute the net present value. Use the present value of $1 table above. If required, round to the nearest dollar. Plant Expansion Retail Store Expansion Total present value of net cash flow Less amount to be invested Net present value 2. Because of the timing of the receipt of the net cash flows, the plant expansion offers a higher net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts