Question: CAT Handbook Example of Figuring Owning & Operating Costs: Use the CAT Handbook and the attached chart to find the Owning and Operating cost of

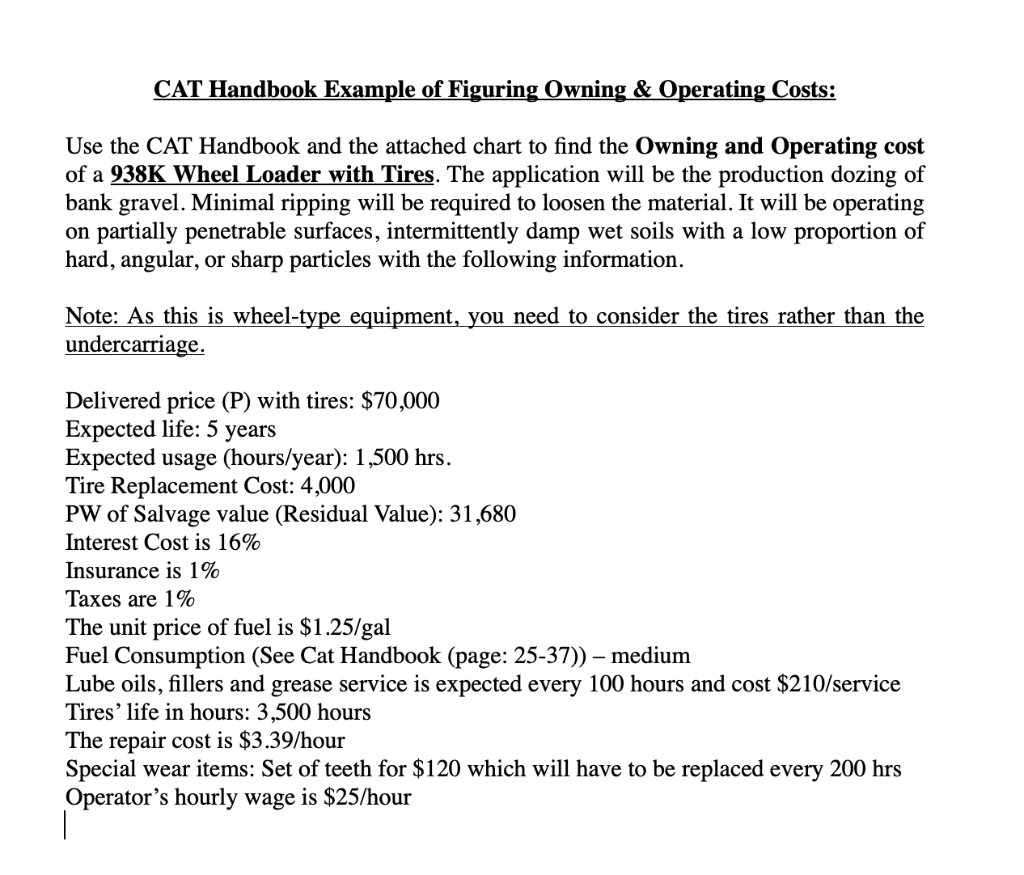

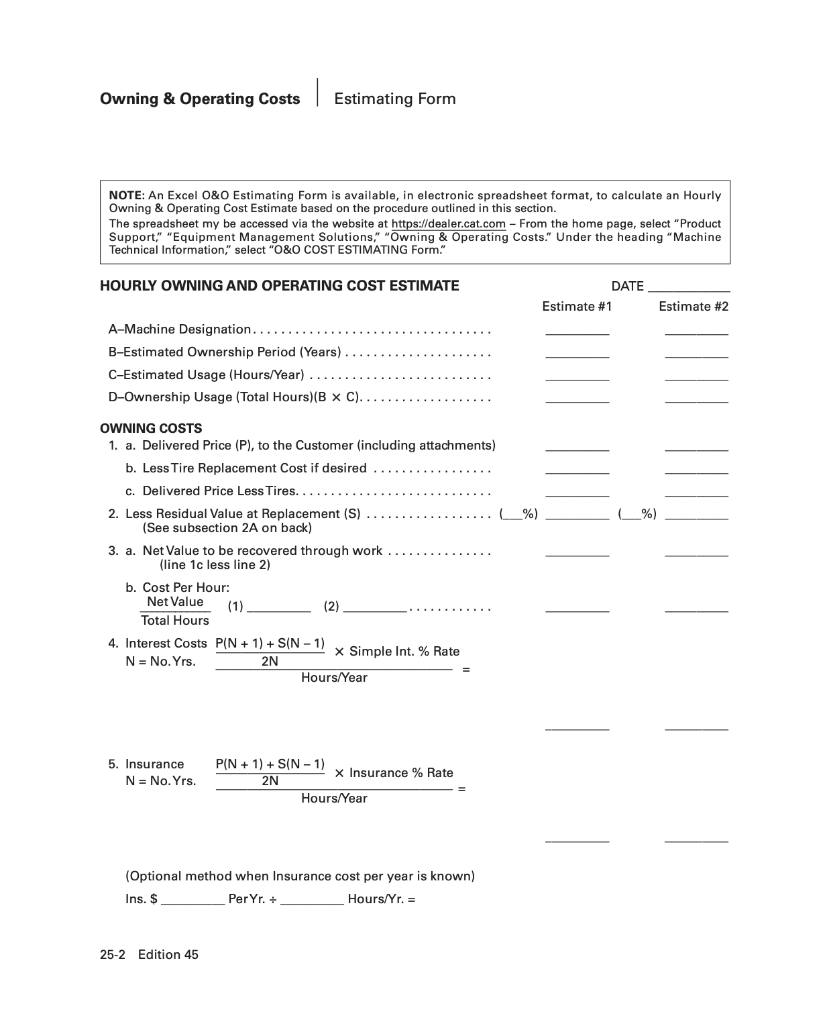

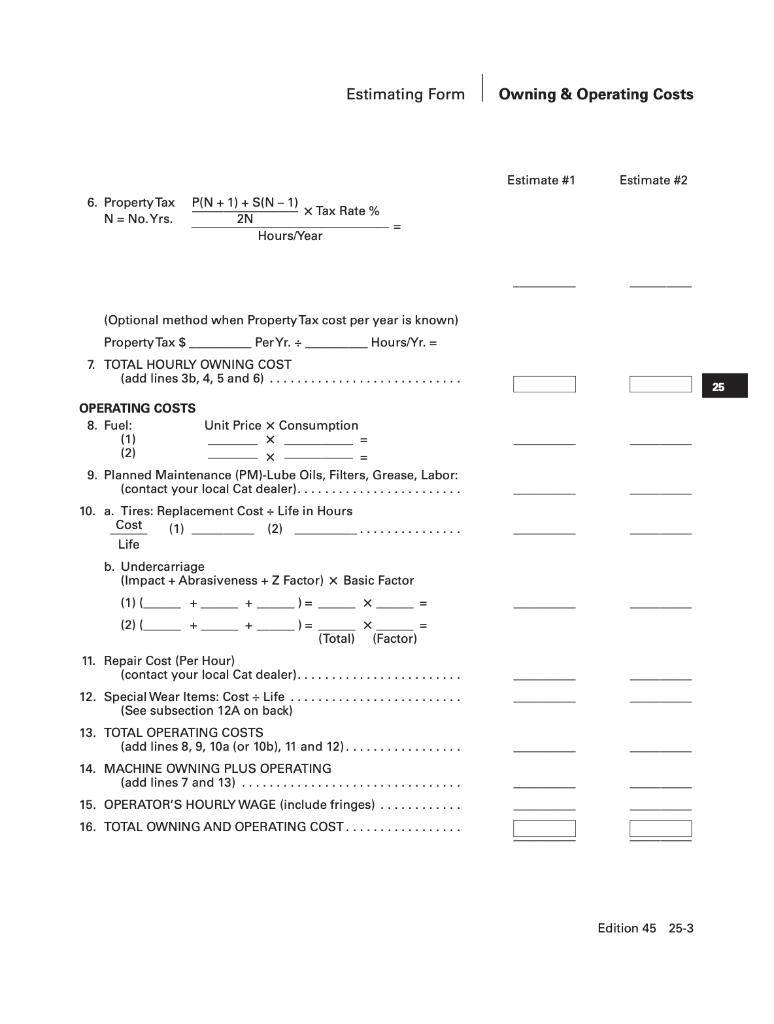

CAT Handbook Example of Figuring Owning \& Operating Costs: Use the CAT Handbook and the attached chart to find the Owning and Operating cost of a 938K Wheel Loader with Tires. The application will be the production dozing of bank gravel. Minimal ripping will be required to loosen the material. It will be operating on partially penetrable surfaces, intermittently damp wet soils with a low proportion of hard, angular, or sharp particles with the following information. Note: As this is wheel-type equipment, you need to consider the tires rather than the undercarriage. Delivered price (P) with tires: $70,000 Expected life: 5 years Expected usage (hours/year): 1,500 hrs. Tire Replacement Cost: 4,000 PW of Salvage value (Residual Value): 31,680 Interest Cost is 16% Insurance is 1% Taxes are 1% The unit price of fuel is $1.25/gal Fuel Consumption (See Cat Handbook (page: 25-37)) - medium Lube oils, fillers and grease service is expected every 100 hours and cost $210 /service Tires' life in hours: 3,500 hours The repair cost is $3.39/ hour Special wear items: Set of teeth for $120 which will have to be replaced every 200hrs Operator's hourly wage is $25 /hour NOTE: An Excel O\&O Estimating Form is available, in electronic spreadsheet format, to calculate an Hourly Owning \& Operating Cost Estimate based on the procedure outlined in this section. The spreadsheet my be accessed via the website at https://dealer.cat.com - From the home page, select "Product Support," "Equipment Management Solutions," "Owning \& Operating Costs." Under the heading "Machine Technical Information," select "O\&O COST ESTIMATING Form." HOURLY OWNING AND OPERATING COST ESTIMATE DATE Estimate \# 1 Estimate \#2 A-Machine Designation. B-Estimated Ownership Period (Years) . C-Estimated Usage (Hours/Year) D-Ownership Usage (Total Hours) (BC). OWNING COSTS 1. a. Delivered Price (P), to the Customer (including attachments) b. Less Tire Replacement Cost if desired c. Delivered Price Less Tires. 2. Less Residual Value at Replacement (S) % \%) (See subsection 2A on back) 3. a. Net Value to be recovered through work. (line 1c less line 2) b. Cost Per Hour: Net Value (1) (2) 4. Interest Costs 2NP(N+1)+S(N1) Simple Int. \% Rate N= No. Yrs. Hours/Year2N= 5. Insurance 2NP(N+1)+S(N1) Insurance \% Rate N= No.Yrs. Hours/Year (Optional method when Insurance cost per year is known) Ins. $ PerYr. Hours/Yr. = Estimating Form Owning \& Operating Costs Estimate \#1 Estimate \#2 (Optional method when Property Tax cost per year is known) PropertyTax $ PerYr. Hours/Yr. = 7. TOTAL HOURLY OWNING COST (add lines 3b, 4, 5 and 6) 25 OPERATING COSTS 8. Fuel: Unit Price Consumption (1) (2) 9. Planned Maintenance (PM)-Lube Oils, Filters, Grease, Labor: (contact your local Cat dealer)...................... 10. a. Tires: Replacement Cost Life in Hours LifeCost (1) (2) b. Undercarriage (Impact + Abrasiveness +Z Factor) Basic Factor (1) 11. Repair Cost (Per Hour) (contact your local Cat dealer). 12. Special Wear Items: Cost Life (See subsection 12A on back) 13. TOTAL OPERATING COSTS (add lines 8, 9, 10a (or 10b), 11 and 12). 14. MACHINE OWNING PLUS OPERATING (add lines 7 and 13) . 15. OPERATOR'S HOURLY WAGE (include fringes) 16. TOTAL OWNING AND OPERATING COST Edition 45 25-3 CAT Handbook Example of Figuring Owning \& Operating Costs: Use the CAT Handbook and the attached chart to find the Owning and Operating cost of a 938K Wheel Loader with Tires. The application will be the production dozing of bank gravel. Minimal ripping will be required to loosen the material. It will be operating on partially penetrable surfaces, intermittently damp wet soils with a low proportion of hard, angular, or sharp particles with the following information. Note: As this is wheel-type equipment, you need to consider the tires rather than the undercarriage. Delivered price (P) with tires: $70,000 Expected life: 5 years Expected usage (hours/year): 1,500 hrs. Tire Replacement Cost: 4,000 PW of Salvage value (Residual Value): 31,680 Interest Cost is 16% Insurance is 1% Taxes are 1% The unit price of fuel is $1.25/gal Fuel Consumption (See Cat Handbook (page: 25-37)) - medium Lube oils, fillers and grease service is expected every 100 hours and cost $210 /service Tires' life in hours: 3,500 hours The repair cost is $3.39/ hour Special wear items: Set of teeth for $120 which will have to be replaced every 200hrs Operator's hourly wage is $25 /hour NOTE: An Excel O\&O Estimating Form is available, in electronic spreadsheet format, to calculate an Hourly Owning \& Operating Cost Estimate based on the procedure outlined in this section. The spreadsheet my be accessed via the website at https://dealer.cat.com - From the home page, select "Product Support," "Equipment Management Solutions," "Owning \& Operating Costs." Under the heading "Machine Technical Information," select "O\&O COST ESTIMATING Form." HOURLY OWNING AND OPERATING COST ESTIMATE DATE Estimate \# 1 Estimate \#2 A-Machine Designation. B-Estimated Ownership Period (Years) . C-Estimated Usage (Hours/Year) D-Ownership Usage (Total Hours) (BC). OWNING COSTS 1. a. Delivered Price (P), to the Customer (including attachments) b. Less Tire Replacement Cost if desired c. Delivered Price Less Tires. 2. Less Residual Value at Replacement (S) % \%) (See subsection 2A on back) 3. a. Net Value to be recovered through work. (line 1c less line 2) b. Cost Per Hour: Net Value (1) (2) 4. Interest Costs 2NP(N+1)+S(N1) Simple Int. \% Rate N= No. Yrs. Hours/Year2N= 5. Insurance 2NP(N+1)+S(N1) Insurance \% Rate N= No.Yrs. Hours/Year (Optional method when Insurance cost per year is known) Ins. $ PerYr. Hours/Yr. = Estimating Form Owning \& Operating Costs Estimate \#1 Estimate \#2 (Optional method when Property Tax cost per year is known) PropertyTax $ PerYr. Hours/Yr. = 7. TOTAL HOURLY OWNING COST (add lines 3b, 4, 5 and 6) 25 OPERATING COSTS 8. Fuel: Unit Price Consumption (1) (2) 9. Planned Maintenance (PM)-Lube Oils, Filters, Grease, Labor: (contact your local Cat dealer)...................... 10. a. Tires: Replacement Cost Life in Hours LifeCost (1) (2) b. Undercarriage (Impact + Abrasiveness +Z Factor) Basic Factor (1) 11. Repair Cost (Per Hour) (contact your local Cat dealer). 12. Special Wear Items: Cost Life (See subsection 12A on back) 13. TOTAL OPERATING COSTS (add lines 8, 9, 10a (or 10b), 11 and 12). 14. MACHINE OWNING PLUS OPERATING (add lines 7 and 13) . 15. OPERATOR'S HOURLY WAGE (include fringes) 16. TOTAL OWNING AND OPERATING COST Edition 45 25-3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts