Question: Cathy opens a retail store. Her sales during the first year are $450,000, of which $60,000 has not been collected at year-end. Her purchases are

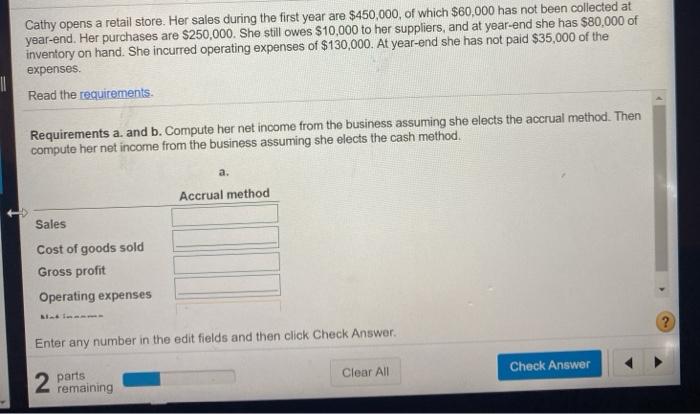

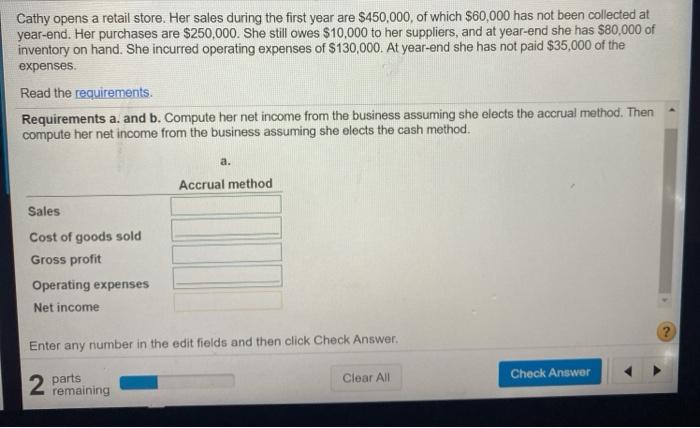

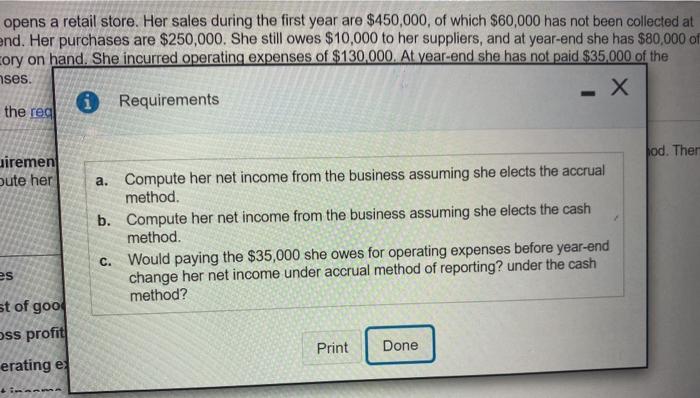

Cathy opens a retail store. Her sales during the first year are $450,000, of which $60,000 has not been collected at year-end. Her purchases are $250,000. She still owes $10,000 to her suppliers, and at year-end she has $80,000 of inventory on hand. She incurred operating expenses of $130,000. At year-end she has not paid $35,000 of the expenses Read the requirements Requirements a. and b. Compute her net income from the business assuming she elects the accrual method. Then compute her net income from the business assuming she elects the cash method. a. Accrual method Sales Cost of goods sold Gross profit Operating expenses Enter any number in the edit fields and then click Check Answer Clear All Check Answer 2 parts remaining Cathy opens a retail store. Her sales during the first year are $450,000, of which $60,000 has not been collected at year-end. Her purchases are $250,000. She still owes $10,000 to her suppliers, and at year-end she has $80,000 of inventory on hand. She incurred operating expenses of $130,000. At year-end she has not paid $35,000 of the expenses Read the requirements Requirements a, and b. Compute her net income from the business assuming she elects the accrual method. Then compute her net income from the business assuming she elects the cash method. a. Accrual method Sales Cost of goods sold Gross profit Operating expenses Net income ? Enter any number in the edit fields and then click Check Answer. Clear All Check Answer 2 parts remaining opens a retail store. Her sales during the first year are $450,000, of which $60,000 has not been collected at end. Her purchases are $250,000. She still owes $10,000 to her suppliers, and at year-end she has $80,000 of cory on hand. She incurred operating expenses of $130,000. At year-end she has not paid $35,000 of the ses. Requirements the real hod. Ther iremen Dute her a. Compute her net income from the business assuming she elects the accrual method. b. Compute her net income from the business assuming she elects the cash method. C. Would paying the $35,000 she owes for operating expenses before year-end change her net income under accrual method of reporting? under the cash method? es st of good oss profit erating e Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts