Question: ****caurent Strategy Selection PPROFIT I LOSS IK K A. What is your investment risk appetite, more specifically, risk tolerance? (risk overse, risk neutral or risk

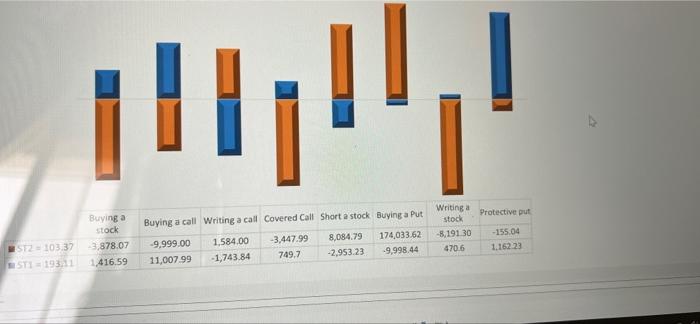

****caurent Strategy Selection PPROFIT I LOSS IK K A. What is your investment risk appetite, more specifically, risk tolerance? (risk overse, risk neutral or risk seker B. As a Consequence. Which investment scenarios will be your first second, and the one that you would never select and why B1. In case you were almost sure that it will go up to $193112 8.2. in case you were almost sure that it will go down to 103 37 However, there is a possibility that it could go around against your analysis Protective put Buying a stock 3,878.07 1,416.59 Writing a stock -8,19130 4706 Buying a call Writing a call Covered Call Short a stock Buying a Put -9.999.00 1.584.00 -3.447.99 8,084.79 174,033.62 11,00799 -1,743.84 749.7 -2.953.23 -9,998.44 -155.04 1.162.23 10337 STIE 19311

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts