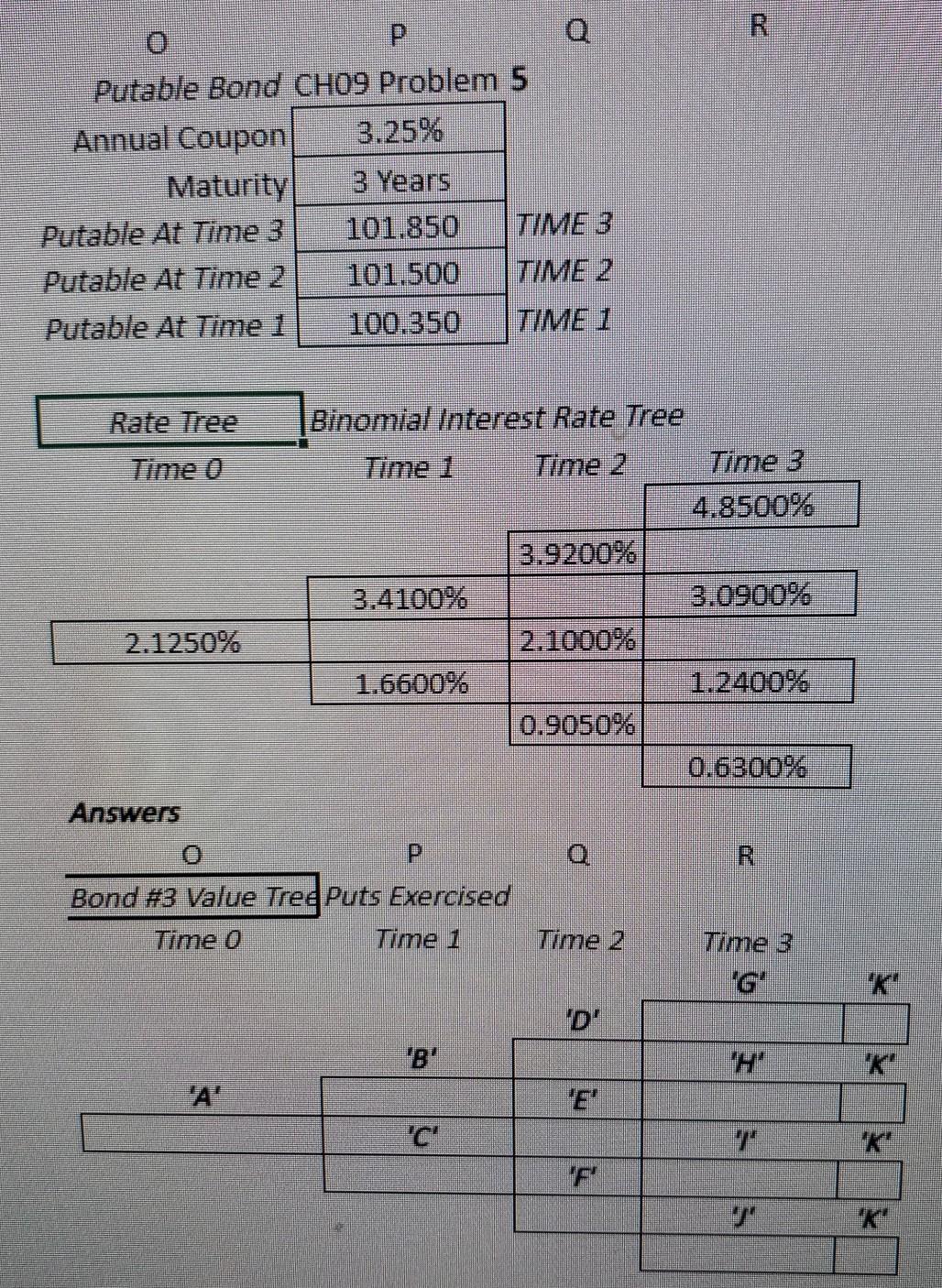

Question: cc P Q Putable Bond CH09 Problem 5 Annual Coupon 3.25% Maturity 3 Years Putable At Time 3 101.850 TIME 3 Putable At Time 2

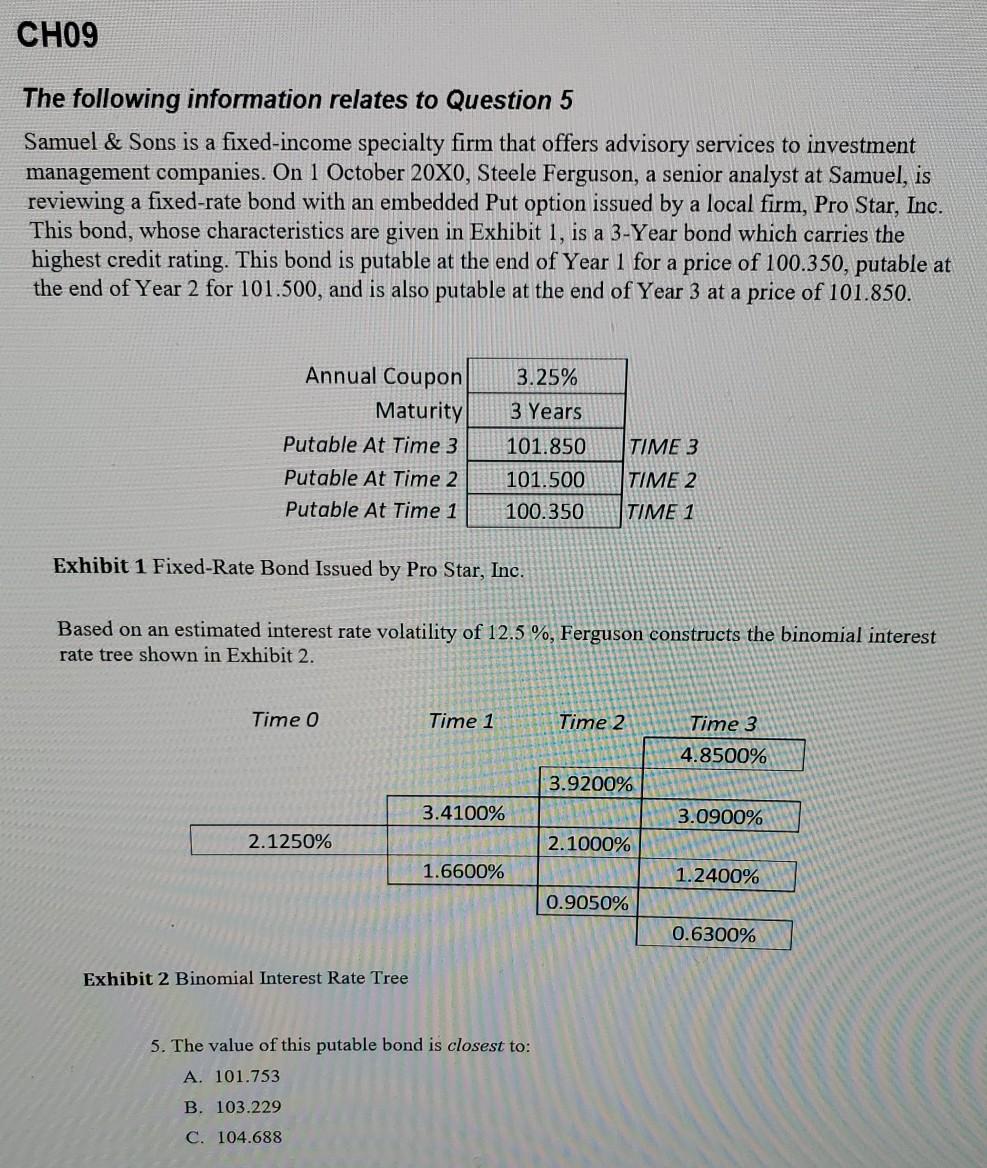

cc P Q Putable Bond CH09 Problem 5 Annual Coupon 3.25% Maturity 3 Years Putable At Time 3 101.850 TIME 3 Putable At Time 2 101.500 TIME 2 Putable At Time 1 100.350 TIME 1 Rate Tree Time 0 Binomial Interest Rate Tree Time 1 Time 2 Time 3 4.8500% 3.9200% 3.4100% 3.0900% 2.1000% 1.6600% 1.2400% 0.9050% 2.1250% 0.6300% Answers P Q R Bond #3 Value Tred Puts Exercised Time 0 Time 1 Time 2 Time 3 'G' D' 'H' 'A' "E' E 'C' CHO9 The following information relates to Question 5 Samuel & Sons is a fixed-income specialty firm that offers advisory services to investment management companies. On 1 October 20X0, Steele Ferguson, a senior analyst at Samuel, is reviewing a fixed-rate bond with an embedded Put option issued by a local firm, Pro Star, Inc. This bond, whose characteristics are given in Exhibit 1, is a 3-Year bond which carries the highest credit rating. This bond is putable at the end of Year 1 for a price of 100.350, putable at the end of Year 2 for 101.500, and is also putable at the end of Year 3 at a price of 101.850. 3.25% 3 Years Annual Coupon Maturity Putable At Time 3 Putable At Time 2 Putable At Time 1 101.850 TIME 3 101.500 TIME 2 100.350 TIME 1 Exhibit 1 Fixed-Rate Bond Issued by Pro Star, Inc. Based on an estimated interest rate volatility of 12.5 %, Ferguson constructs the binomial interest rate tree shown in Exhibit 2. Time 0 Time 1 Time 2 Time 3 4.8500% 3.9200% 3.4100% 3.0900% 2.1250% 2.1000% 1.6600% 1.2400% 0.9050% 0.6300% Exhibit 2 Binomial Interest Rate Tree 5. The value of this putable bond is closest to: A. 101.753 B. 103.229 C. 104.688

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts