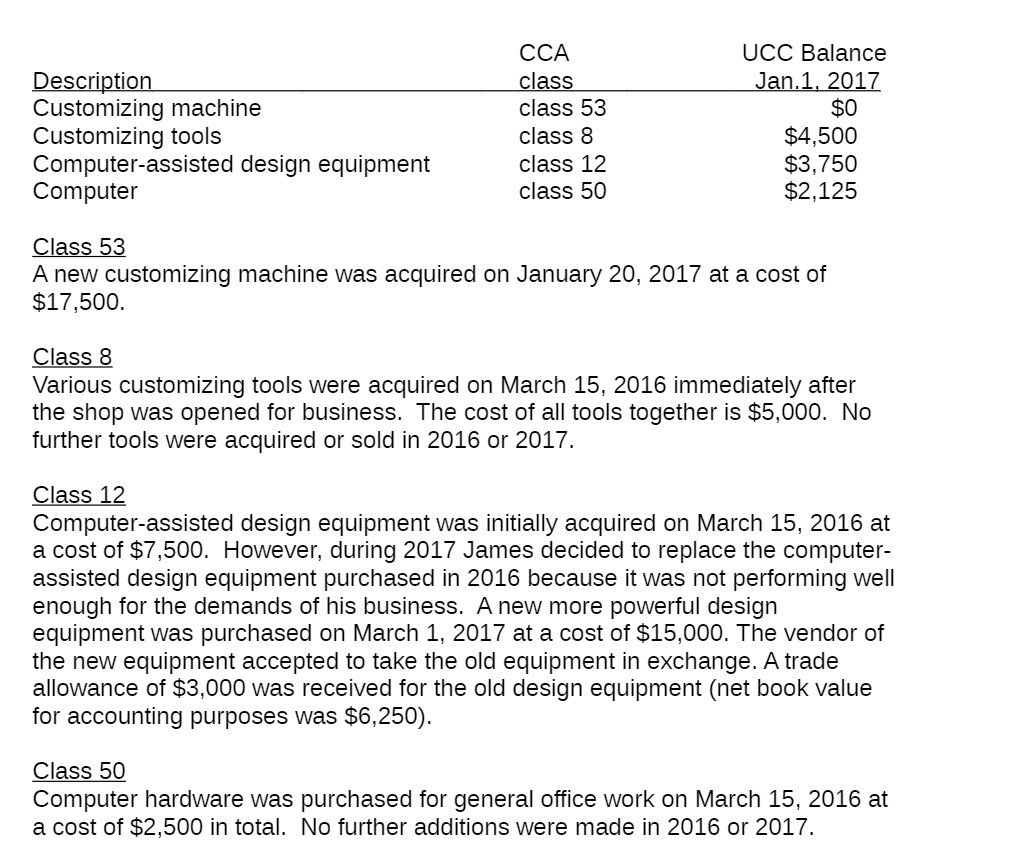

Question: CCA UCC Balance Description class Jan.1, 2017 Customizing machine class 53 $0 Customizing tools class 8 $4,500 Computer-assisted design equipment class 12 $3,750 Computer class

CCA UCC Balance Description class Jan.1, 2017 Customizing machine class 53 $0 Customizing tools class 8 $4,500 Computer-assisted design equipment class 12 $3,750 Computer class 50 $2,125 Class 53 A new customizing machine was acquired on January 20, 2017 at a cost of $17,500. Class 8 Various customizing tools were acquired on March 15, 2016 immediately after the shop was opened for business, The cost of at] tools together is $5,000. No further tools were acquired or sold in 2016 or 2017. Class 12 Computer-assisted design equipment was initially acquired on March 15, 2016 at a cost of $7,500. However, during 2017 James decided to replace the computer assisted design equipment purchased in 2016 because it was not performing well enough for the demands of his business. A new more powerful design equipment was purchased on March 1, 2017 at a cost of $15,000. The vendor of the new equipment accepted to take the old equipment in exchange. A trade allowance of $3,000 was received for the old design equipment (net book value for accounting purposes was $6,250). Class 50 Computer hardware was purchased for general office work on March 15, 2016 at a cost of $2,500 in total. No further additions were made in 2016 or 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts