Question: c,d and e in excel pls You are the owner of the Blue Bourbon Company we went over in class, and you decided against selling

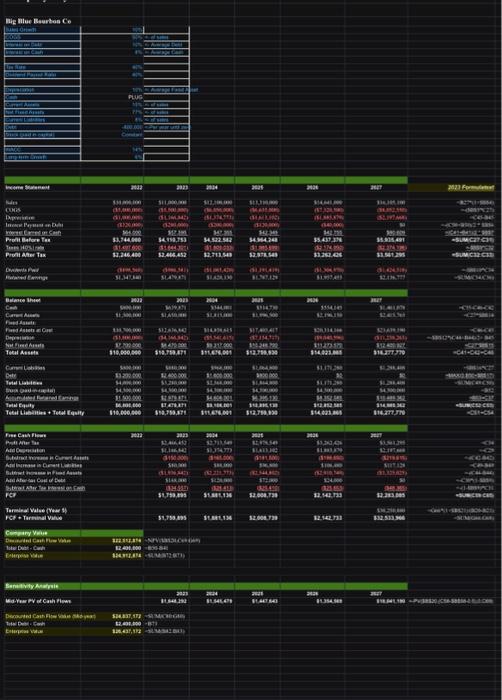

You are the owner of the Blue Bourbon Company we went over in class, and you decided against selling your business. Luckily, you have found the Red Bourbon Company that is similar in size and you get along with their owners. But they have more efficient operations and greater sales (see parameters in template). You and the owner of the Red Bourbon Company decide to merge your businesses rather than sell to big corporates. a. Build the pro forma and free cashflow for Big Red Bourbon Company b. Build the pro forma and free cashflow for the Combined business assuming you both adopted the more efficient manufacturing processes and capabilities of Big Red Bourbon company [Hint: don't overcomplicate this] c. What is the Discounted Cashflow Value (DCF) and enterprise value (EV) of the combined businesses? d. What is the DCF and enterprise value of the combined business if mid-year cashflows are used? e. What is the change in the DCF value of the combined businesses if you changed the COGS 30% to 60% (increment by 5% ) and changed the tax rate from 30%40% (increment by 2% ) [Hint: data table] You are the owner of the Blue Bourbon Company we went over in class, and you decided against selling your business. Luckily, you have found the Red Bourbon Company that is similar in size and you get along with their owners. But they have more efficient operations and greater sales (see parameters in template). You and the owner of the Red Bourbon Company decide to merge your businesses rather than sell to big corporates. a. Build the pro forma and free cashflow for Big Red Bourbon Company b. Build the pro forma and free cashflow for the Combined business assuming you both adopted the more efficient manufacturing processes and capabilities of Big Red Bourbon company [Hint: don't overcomplicate this] c. What is the Discounted Cashflow Value (DCF) and enterprise value (EV) of the combined businesses? d. What is the DCF and enterprise value of the combined business if mid-year cashflows are used? e. What is the change in the DCF value of the combined businesses if you changed the COGS 30% to 60% (increment by 5% ) and changed the tax rate from 30%40% (increment by 2% ) [Hint: data table]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts