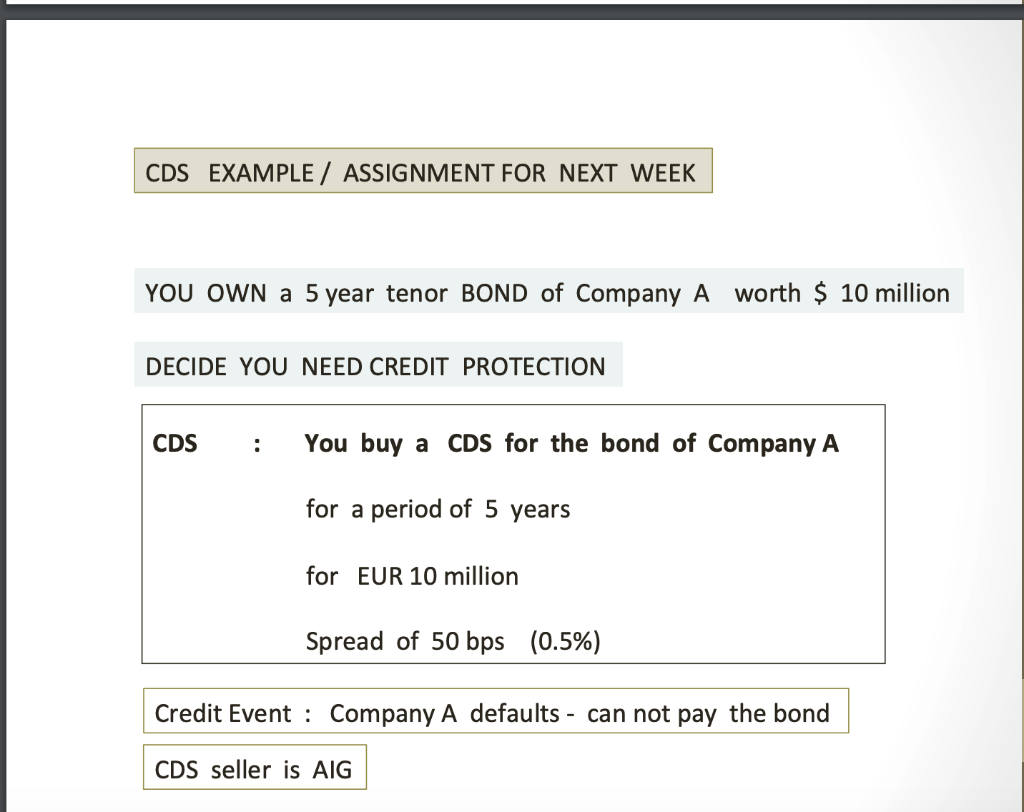

Question: CDS EXAMPLE / ASSIGNMENT FOR NEXT WEEK YOU OWN a 5 year tenor BOND of Company A worth $ 10 million DECIDE YOU NEED CREDIT

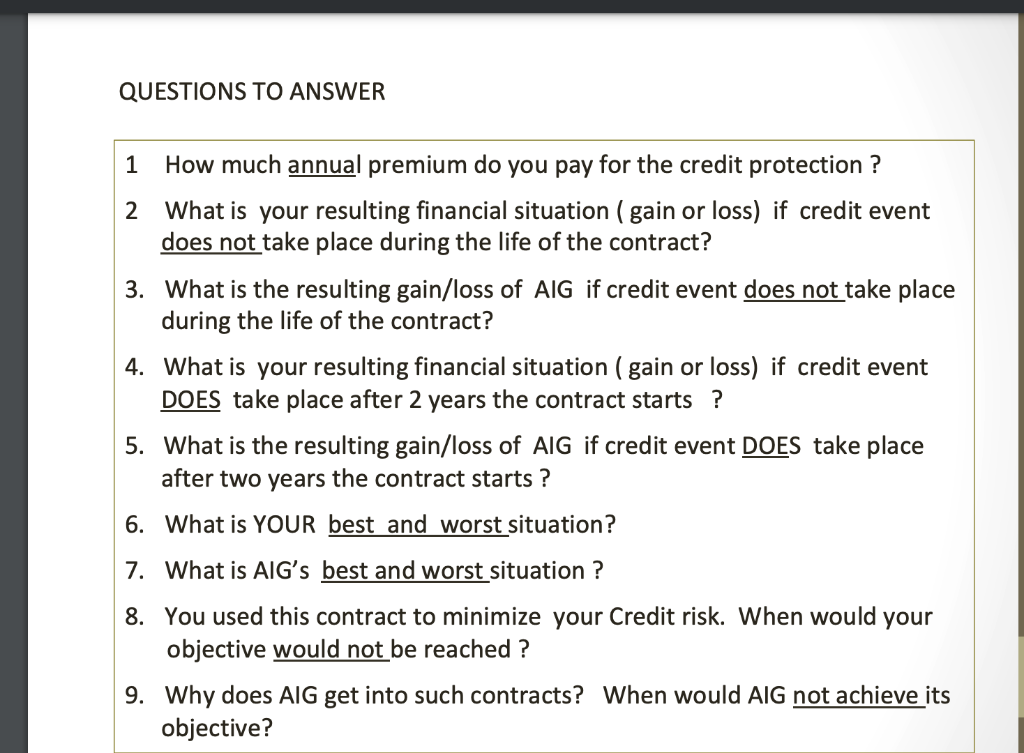

CDS EXAMPLE / ASSIGNMENT FOR NEXT WEEK YOU OWN a 5 year tenor BOND of Company A worth $ 10 million DECIDE YOU NEED CREDIT PROTECTION CDS : You buy a CDS for the bond of Company A for a period of 5 years for EUR 10 million Spread of 50 bps (0.5%) Credit Event : Company A defaults - can not pay the bond CDS seller is AIG QUESTIONS TO ANSWER 1 How much annual premium do you pay for the credit protection ? 2 What is your resulting financial situation ( gain or loss) if credit event does not take place during the life of the contract? 3. What is the resulting gain/loss of AIG if credit event does not take place during the life of the contract? 4. What is your resulting financial situation ( gain or loss) if credit event DOES take place after 2 years the contract starts ? 5. What is the resulting gain/loss of AIG if credit event DOES take place after two years the contract starts ? 6. What is YOUR best and worst situation? 7. What is AIG's best and worst situation ? 8. You used this contract to minimize your credit risk. When would your objective would not be reached ? 9. Why does AIG get into such contracts? When would AIG not achieve its objective? CDS EXAMPLE / ASSIGNMENT FOR NEXT WEEK YOU OWN a 5 year tenor BOND of Company A worth $ 10 million DECIDE YOU NEED CREDIT PROTECTION CDS : You buy a CDS for the bond of Company A for a period of 5 years for EUR 10 million Spread of 50 bps (0.5%) Credit Event : Company A defaults - can not pay the bond CDS seller is AIG QUESTIONS TO ANSWER 1 How much annual premium do you pay for the credit protection ? 2 What is your resulting financial situation ( gain or loss) if credit event does not take place during the life of the contract? 3. What is the resulting gain/loss of AIG if credit event does not take place during the life of the contract? 4. What is your resulting financial situation ( gain or loss) if credit event DOES take place after 2 years the contract starts ? 5. What is the resulting gain/loss of AIG if credit event DOES take place after two years the contract starts ? 6. What is YOUR best and worst situation? 7. What is AIG's best and worst situation ? 8. You used this contract to minimize your credit risk. When would your objective would not be reached ? 9. Why does AIG get into such contracts? When would AIG not achieve its objective

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts