Question: ce A $29,000 bond with interest at 7.1% payable semi-annually and redeemable at par is bought two years before maturity to yield 9,8% compounded semi-annually.

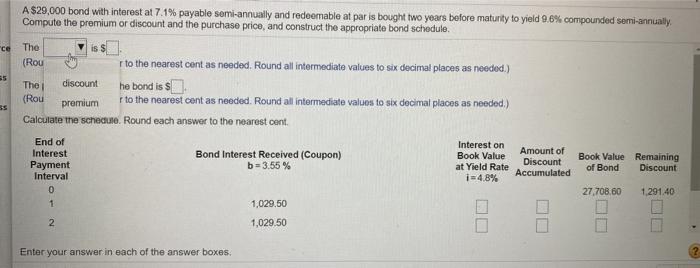

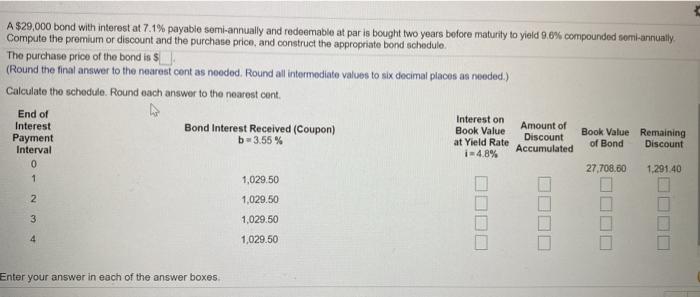

ce A $29,000 bond with interest at 7.1% payable semi-annually and redeemable at par is bought two years before maturity to yield 9,8% compounded semi-annually. Compute the premium or discount and the purchase price, and construct the appropriate bond schedule, The (Rou r to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) he bond is $ (Rou premium to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) Calculate the schedule. Round each answer to the nearest cent. The discount Bond Interest Received (Coupon) b=3.55% End of Interest Payment Interval 0 1 Interest on Book Value at Yield Rate i=4.8% Amount of Discount Accumulated Book Value Remaining of Bond Discount 27,708,60 1.291.40 1,029,50 1,029,50 2 Enter your answer in each of the answer boxes. 2 A $29,000 bond with interest at 7.1% payable semi-annually and redeemable at par is bought two years before maturity to yield 9.8% compounded somi-annually. Compute the premium or discount and the purchase price, and construct the appropriate bond schedule. The purchase price of the bond is $ (Round the final answer to the nearest cont as needed. Round all intermediate values to six decimal places as needed.) Calculate the schedule. Round each answer to the nearest cont. End of Interest on Interest Bond Interest Received (Coupon) Amount of Book Value Book Value Remaining Payment b=3.55% Discount at Yield Rate of Bond Discount Interval i 4.8% Accumulated 0 27.708.60 1.291.40 1,029.50 1 2 1,029.50 3 1,029.50 4 1,029.50 Enter your answer in each of the answer boxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts