Question: ce Commor Size Statements com Online 441. (Preparing common-size financial statements) As the newest hire to the financial analy- back sis group at Patterson Printing

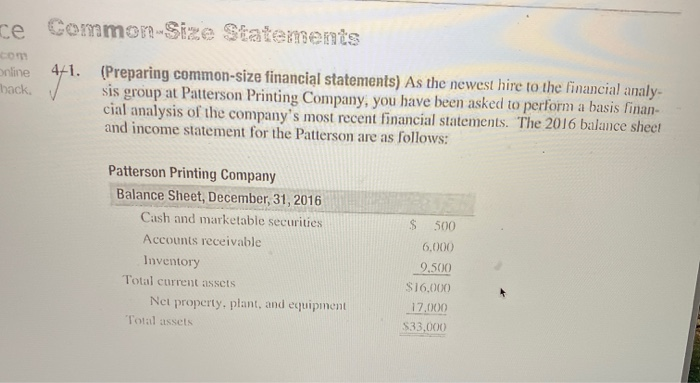

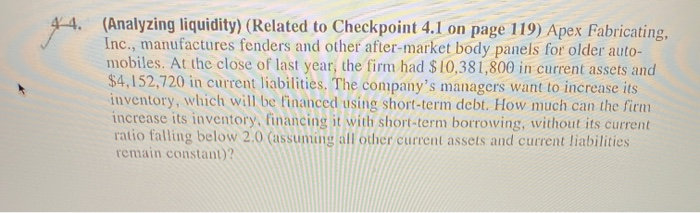

ce Commor Size Statements com Online 441. (Preparing common-size financial statements) As the newest hire to the financial analy- back sis group at Patterson Printing Company, you have been asked to perform a basis finan cial analysis of the company's most recent financial statements. The 2016 balance sheet and income statement for the Patterson are as follows: S 500 Patterson Printing Company Balance Sheet, December 31, 2016 Cash and marketable securities Accounts receivable Inventory Total current assets Net property, plant, and equipment Total assets 6,000 9.500 $16.000 17.000 $33,000 44. (Analyzing liquidity) (Related to Checkpoint 4.1 on page 119) Apex Fabricating, Inc., manufactures fenders and other after-market body panels for older auto- mobiles. At the close of last year, the firm had $10,381,800 in current assets and $4,152,720 in current liabilities. The company's managers want to increase its inventory, which will be financed using short-term debt. How much can the firm increase its inventory, financing it with short-term borrowing, without its current ratio falling below 2.0 (assuming all other current assets and current liabilities remain constant)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts