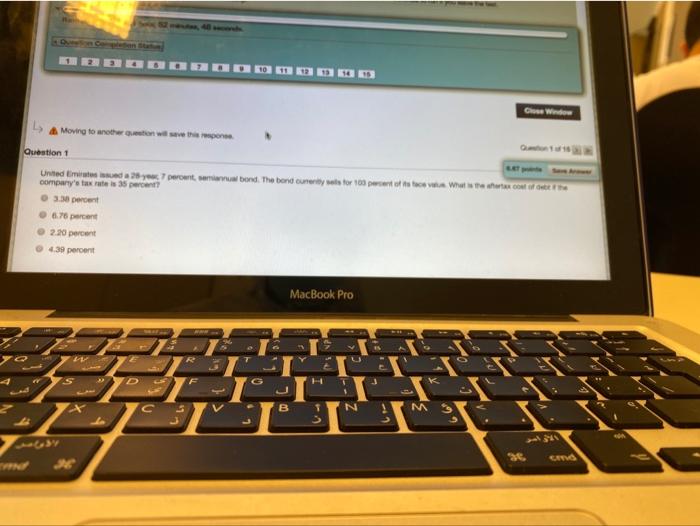

Question: Ce Window L A Moving to another within What is the ONE OF Question 1 Unted med percent bond. The band custom company's tax rate

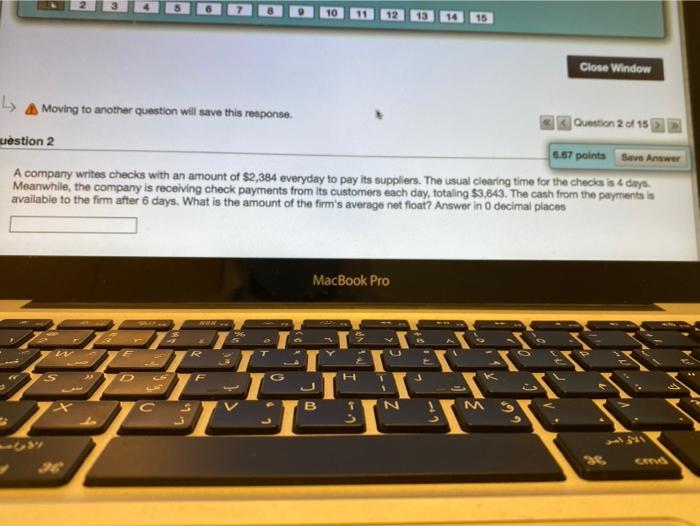

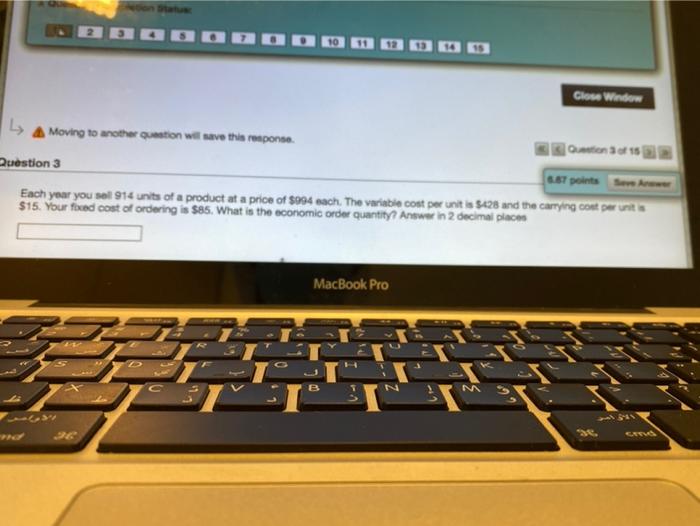

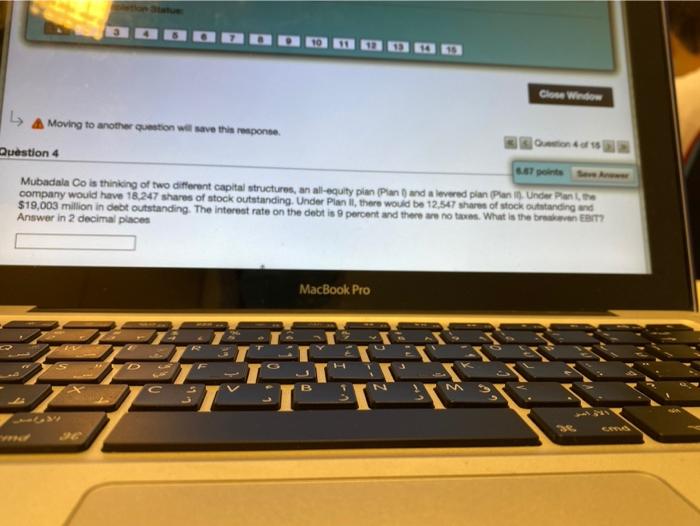

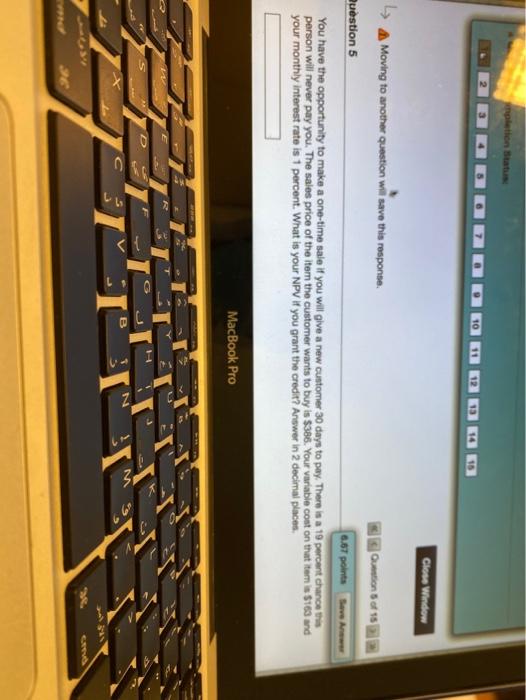

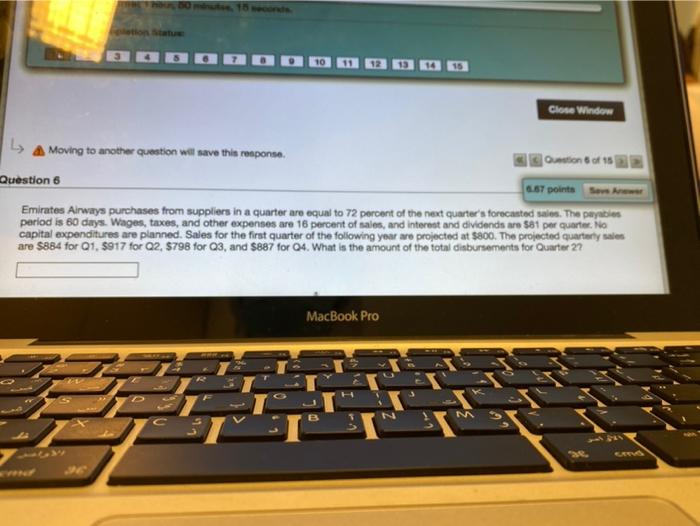

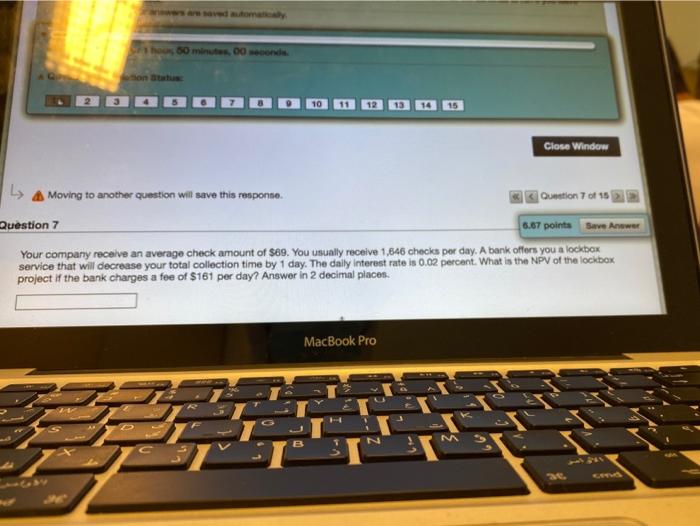

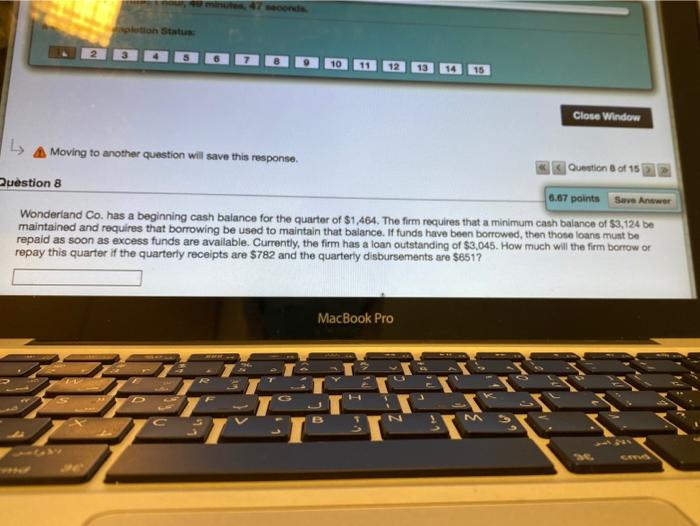

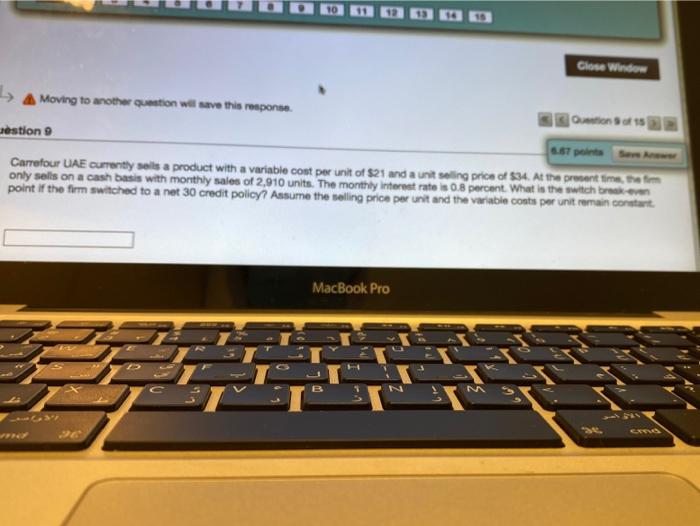

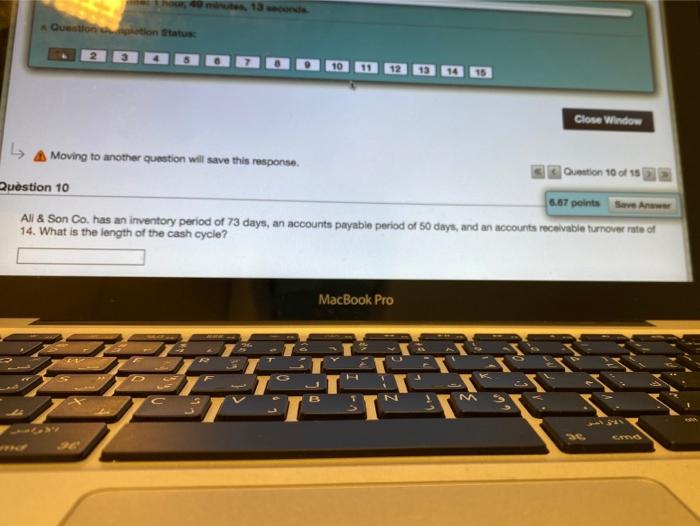

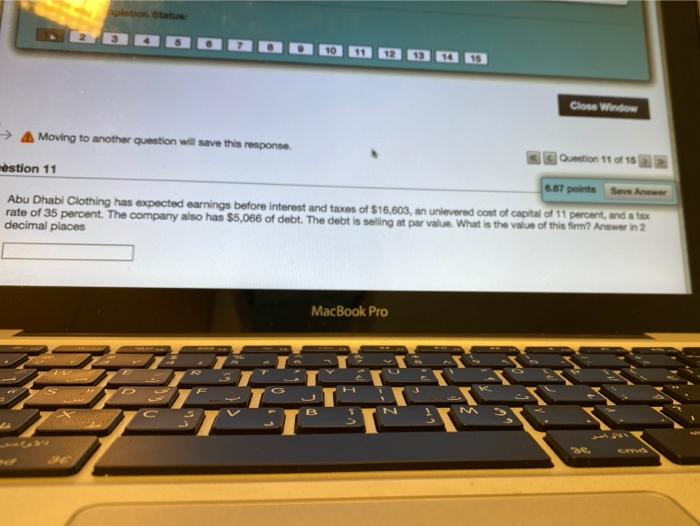

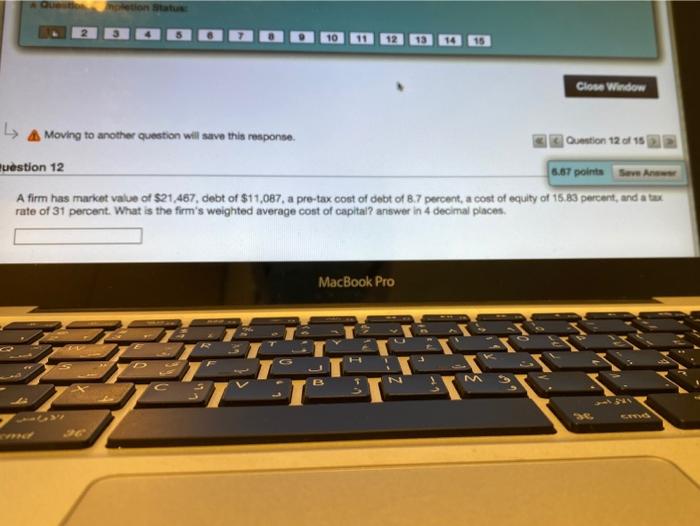

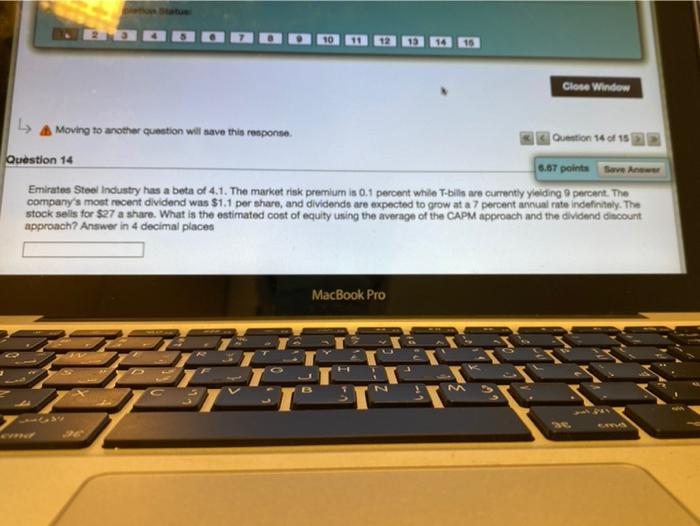

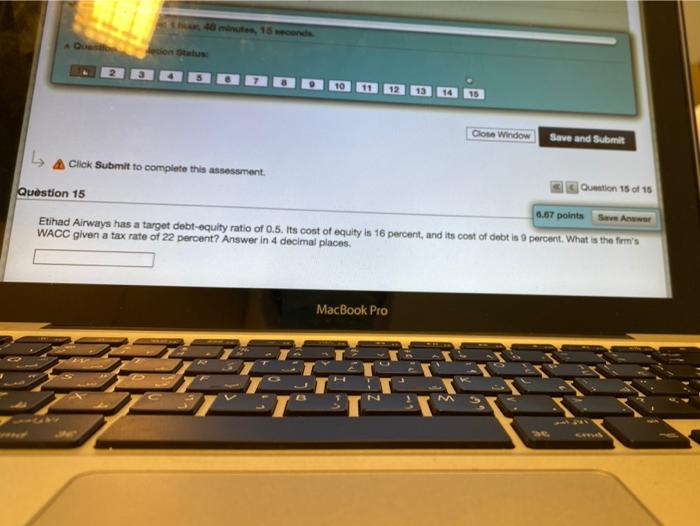

Ce Window L A Moving to another within What is the ONE OF Question 1 Unted med percent bond. The band custom company's tax rate percent? 3:30 percent 8.76 percent 2.20 percent 439 percent MacBook Pro F K B N M "9 * 1 3 CV 10 11 12 Close Window L A Moving to another question will save this response. Question 2015 Restion 2 6.67 points Save Anwwer A company writes checks with an amount of $2,384 everyday to pay its suppliers. The usual clearing time for the checks is 4 daye. Meanwhile, the company is receiving check payments from its customers each day, totaling $3,843. The cash from the payments is available to the firm after 6 days. What is the amount of the firm's average net float? Answer in 0 decimal places MacBook Pro O H K 1 B N M Close Window Moving to another question will save this response Ostion of Question 3 6.67 points Each year you sal 914 units of a product at a price of $994 sach. The variable cost per unit is $428 and the carrying cont permis $15. Your feed cost of ordering is $85. What is the economic order quantity? Answer in 2 decimal places MacBook Pro -3 B SI Close Window A Moving to another question will save the response Question 4 Mubadala Co is thinking of two different capital structures, an all-equity plan Plan and a levered plan Plan I Under Pan company would have 16.247shares of stock outstanding. Under Plan il, there would be 12.547 shares of stock standing and $19,003 million in debt outstanding. The interest rate on the debt is 9 percent and there are now. What is the brave EST? Answer in 2 decimal places MacBook Pro B N CREVO pletion Batu Close Window L A Moving to another question will save this response. Question of 15 Question 5 6.67 points Sven You have the opportunity to make a one-time sale if you will give a new customer 30 days to pay. There is a 19 percent chance the person will never pay you. The sales price of the item the customer wants to buy is $386. Your variable cost on that item is $169 and your monthly interest rate is 1 percent. What is your NPV if you grant the credit? Answer in 2 decimal places MacBook Pro B N M 9 C TI 10 Close Window A Moving to another question will save this response Question 6 Ostion of 15 4.67 points Emirates Airways purchases from suppliers in a quarter are equal to 72 percent of the next quarter's forecasted saies. The pays period is 60 days. Wages, taxes, and other expenses are 16 percent of sales, and interest and dividends are $81 per quarter. No capital expenditures are planned. Sales for the first quarter of the following year are projected at $800. The projected quarterly sales are $884 for Q1, 5917 for Q2, 5798 for 03, and $887 for 04. What is the amount of the total disbursements for Quarter 27 MacBook Pro B M I 60 min 00seconde Close Window Ls A Moving to another question will save this responno. Question 7 of 95 Question 7 6.67 points Save Answer Your company receive an average check amount of $69. You usually receive 1,846 checks per day. A bank offers you a lockbox service that will decrease your total collection time by 1 day. The daily interest rate is 0.02 percent. What is the NPV of the lockbox project if the bank charges a fee of $161 per day? Answer in 2 decimal places. MacBook Pro M pletion Status 15 Close Window La Moving to another question will save this response. Question 8 of 15 Question 8 0.67 points Save Anwwer Wonderland Co. has a beginning cash balance for the quarter of $1,464. The firm requires that a minimum cash balance of 53,124 be maintained and requires that borrowing be used to maintain that balance. If funds have been borrowed, then those loans must be repaid as soon as excess funds are available. Currently, the firm has a loan outstanding of $3,045. How much will the firm borrow or repay this quarter if the quarterly receipts are $782 and the quarterly disbursements are $651? MacBook Pro Close Window A Moving to another question will save this response Question of estion 9 67 points Carrefour UAE currently sells a product with a variable cont per unit of $21 and a unit seling price of $34. At the present time, em only sells on a cash basis with monthly sales of 2,910 units. The monthly interest rate is 0.8 percent. What is the switch broke point if the firm switched to a net 30 credit policy Assume the selling price per unit and the variable costs per unit remain constant MacBook Pro B Close Window L Moving to another question will save this response. Gestion 10 of 15 Ruestion 10 6.67 points Server All & Son Co. has an inventory period of 73 days, an accounts payable period of 50 days, and an accounts receivable turnover rate of 14. What is the length of the cash cycle? MacBook Pro o C B 15 Close Window Quon 11 of 15 Moving to another question will save this response estion 11 6.67 points See Abu Dhabi Clothing has expected earnings before interest and taxes of $16.803, an unlevered cost of capital of 11 percent, and a tax rate of 35 percent. The company also has $5,066 of debt. The debt is selling at par value. What is the value of this fiem? Answer in 2 decimal places MacBook Pro B NN Clow. Window 1 A Moving to another question will save this response. Question 12 of 18 muestion 12 6.67 points Seven A firm has Maricet value of $21,467, debt of $11,087, a pre-tax cost of debt of 8.7 percent, a cost of equity of 15.83 percent, and a tax rate of 31 percent. What is the firm's weighted average cost of capital? answer in 4 decimal places MacBook Pro Close Window A Moving to another question wil will save this response Question 14 of 15 Question 14 6.67 points Swewe Emirates Stool Industry has a beta of 4.1. The market risk premium is 0.1 percent while T-bills are currently yielding percent. The company's most recent dividend was $1.1 per share, and dividends are expected to grow at a 7 percent annual rate indefinitely. The stock sells for $27 a share. What is the estimated cost of equity using the average of the CAPM approach and the dividend dincount approach? Answer in 4 decimal places MacBook Pro Close Window Save and Submit 4 Click Submit to complete this assessment. Question 15 of 15 Question 15 6.67 points See Etihad Airways has a target debt-equity ratio of 0.5. Its cost of equity is 16 percent, and its cost of debt is 9 percent. What is the firm's WACC given a tax rate of 22 percent? Answer in 4 decimal places, MacBook Pro Ce Window L A Moving to another within What is the ONE OF Question 1 Unted med percent bond. The band custom company's tax rate percent? 3:30 percent 8.76 percent 2.20 percent 439 percent MacBook Pro F K B N M "9 * 1 3 CV 10 11 12 Close Window L A Moving to another question will save this response. Question 2015 Restion 2 6.67 points Save Anwwer A company writes checks with an amount of $2,384 everyday to pay its suppliers. The usual clearing time for the checks is 4 daye. Meanwhile, the company is receiving check payments from its customers each day, totaling $3,843. The cash from the payments is available to the firm after 6 days. What is the amount of the firm's average net float? Answer in 0 decimal places MacBook Pro O H K 1 B N M Close Window Moving to another question will save this response Ostion of Question 3 6.67 points Each year you sal 914 units of a product at a price of $994 sach. The variable cost per unit is $428 and the carrying cont permis $15. Your feed cost of ordering is $85. What is the economic order quantity? Answer in 2 decimal places MacBook Pro -3 B SI Close Window A Moving to another question will save the response Question 4 Mubadala Co is thinking of two different capital structures, an all-equity plan Plan and a levered plan Plan I Under Pan company would have 16.247shares of stock outstanding. Under Plan il, there would be 12.547 shares of stock standing and $19,003 million in debt outstanding. The interest rate on the debt is 9 percent and there are now. What is the brave EST? Answer in 2 decimal places MacBook Pro B N CREVO pletion Batu Close Window L A Moving to another question will save this response. Question of 15 Question 5 6.67 points Sven You have the opportunity to make a one-time sale if you will give a new customer 30 days to pay. There is a 19 percent chance the person will never pay you. The sales price of the item the customer wants to buy is $386. Your variable cost on that item is $169 and your monthly interest rate is 1 percent. What is your NPV if you grant the credit? Answer in 2 decimal places MacBook Pro B N M 9 C TI 10 Close Window A Moving to another question will save this response Question 6 Ostion of 15 4.67 points Emirates Airways purchases from suppliers in a quarter are equal to 72 percent of the next quarter's forecasted saies. The pays period is 60 days. Wages, taxes, and other expenses are 16 percent of sales, and interest and dividends are $81 per quarter. No capital expenditures are planned. Sales for the first quarter of the following year are projected at $800. The projected quarterly sales are $884 for Q1, 5917 for Q2, 5798 for 03, and $887 for 04. What is the amount of the total disbursements for Quarter 27 MacBook Pro B M I 60 min 00seconde Close Window Ls A Moving to another question will save this responno. Question 7 of 95 Question 7 6.67 points Save Answer Your company receive an average check amount of $69. You usually receive 1,846 checks per day. A bank offers you a lockbox service that will decrease your total collection time by 1 day. The daily interest rate is 0.02 percent. What is the NPV of the lockbox project if the bank charges a fee of $161 per day? Answer in 2 decimal places. MacBook Pro M pletion Status 15 Close Window La Moving to another question will save this response. Question 8 of 15 Question 8 0.67 points Save Anwwer Wonderland Co. has a beginning cash balance for the quarter of $1,464. The firm requires that a minimum cash balance of 53,124 be maintained and requires that borrowing be used to maintain that balance. If funds have been borrowed, then those loans must be repaid as soon as excess funds are available. Currently, the firm has a loan outstanding of $3,045. How much will the firm borrow or repay this quarter if the quarterly receipts are $782 and the quarterly disbursements are $651? MacBook Pro Close Window A Moving to another question will save this response Question of estion 9 67 points Carrefour UAE currently sells a product with a variable cont per unit of $21 and a unit seling price of $34. At the present time, em only sells on a cash basis with monthly sales of 2,910 units. The monthly interest rate is 0.8 percent. What is the switch broke point if the firm switched to a net 30 credit policy Assume the selling price per unit and the variable costs per unit remain constant MacBook Pro B Close Window L Moving to another question will save this response. Gestion 10 of 15 Ruestion 10 6.67 points Server All & Son Co. has an inventory period of 73 days, an accounts payable period of 50 days, and an accounts receivable turnover rate of 14. What is the length of the cash cycle? MacBook Pro o C B 15 Close Window Quon 11 of 15 Moving to another question will save this response estion 11 6.67 points See Abu Dhabi Clothing has expected earnings before interest and taxes of $16.803, an unlevered cost of capital of 11 percent, and a tax rate of 35 percent. The company also has $5,066 of debt. The debt is selling at par value. What is the value of this fiem? Answer in 2 decimal places MacBook Pro B NN Clow. Window 1 A Moving to another question will save this response. Question 12 of 18 muestion 12 6.67 points Seven A firm has Maricet value of $21,467, debt of $11,087, a pre-tax cost of debt of 8.7 percent, a cost of equity of 15.83 percent, and a tax rate of 31 percent. What is the firm's weighted average cost of capital? answer in 4 decimal places MacBook Pro Close Window A Moving to another question wil will save this response Question 14 of 15 Question 14 6.67 points Swewe Emirates Stool Industry has a beta of 4.1. The market risk premium is 0.1 percent while T-bills are currently yielding percent. The company's most recent dividend was $1.1 per share, and dividends are expected to grow at a 7 percent annual rate indefinitely. The stock sells for $27 a share. What is the estimated cost of equity using the average of the CAPM approach and the dividend dincount approach? Answer in 4 decimal places MacBook Pro Close Window Save and Submit 4 Click Submit to complete this assessment. Question 15 of 15 Question 15 6.67 points See Etihad Airways has a target debt-equity ratio of 0.5. Its cost of equity is 16 percent, and its cost of debt is 9 percent. What is the firm's WACC given a tax rate of 22 percent? Answer in 4 decimal places, MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts