Question: CE300 Term Homework Spring X Ayarlar X + Dosya | C:/Users/user/Desktop/CE300_Term Homework_Spring_2020_2021(1).pdf TO 2 Q + Sayfa grndmu l A Sesli okul iz Vurgula Sil

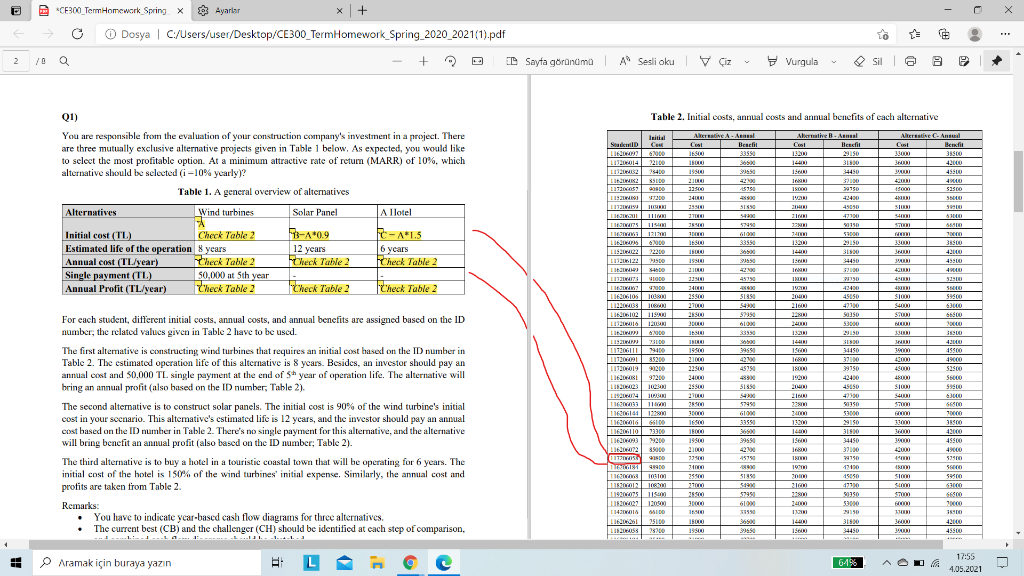

CE300 Term Homework Spring X Ayarlar X + Dosya | C:/Users/user/Desktop/CE300_Term Homework_Spring_2020_2021(1).pdf TO 2 Q + Sayfa grndmu l A Sesli okul iz Vurgula Sil + Q1) You are responsible from the evaluation of your construction company's investment in a project. There are three mutually exclusive alternative projects given in Table 1 below. As expected, you would like to select the most profitable option. At a minimum attractive rate of retum (MARR) of 10%, which alternative should be selected (-10% yearly)? Table 1. A general overview of alternatives Alternatives Wind turbines Solar Panel Allotel Check Table 2 Initial cost (TL) 73-A 0.9 -A*1.5 Estimated life of the operation 8 years 12 years 6 years Annual cost (TL/year) heck Table 2 Check Table 2 Check Table 2 Single payment (TL) 50,000 at 5th year Annual Profit (TL/year) Theck Table 2 Check Table 2 Check Check Table 2 TH For each student, different initial costs, annual costs, and annual benefits are assigned based on the ID number, the related values given in Table 2 have to be used. The first alternative is constructing wind turbines that requires an initial cort based on the ID number in Table 2. The estimated operation life of this alternative is 8 years. Besides, an investor should pay an annual cost and 50,000 TL single payment at the end of 5 year of operation life. The alternative will bring an annual profit (also based on the ID number, Table 2). The second alternative is to construct solar panels. The initial cost is 90% of the wind turbine's initial cost in your socuario. This altcmative's estimated life is 12 years, and the investor should pay an annual cost based on the ID number in Table 2. There's no single payment for this alternative, and the alternative will bring benefit an annual profit (also based on the ID number; Table 2). The third alternative is to buy a hotel in a touristic coastal town that will be operating for The initial cost of the hotel is 150% of the wind turbines initial expense. Similarly, the annual cost and profits are taken from Table 2. Remarks: You have to indicate year-based cash flow diagrams for three alternatives. The current best (CB) and the challenger (CH) should be identified at each step of comparison, ................. Table 2. Initial costs, annual costs and annual benefits of each alternative Initia Albertine A - ATAbelive B - Acoul1 Alkemistine CA SanD COM Benefit Benci Cost Benefit LINN 62000 650 33556 29150 30000 1500 22100 ISO 31500 WII 42000 19262 2446015500 SB 4450 45500 LINE 35100 2010 32300 402 4000 115200053 20800 32500 -15350 15.000 29750 43000 53500 119 7200 IVARI 43430 5 172 HARI 294 3150 21 4500 SIRI 50 ZINI 47200 SHO ILIPS 11 29 57450 50150 re Since 1211 HO 610% 94 59000 Nem 100 LINAS 130 600 650 33550 29150 3000 3ESLO 12200 ISULO 365 31500 OU 42000 1132112212500 1551 1930 32550 130 1 54450 49900 54800 57000 4 117WTS WIODO 224 45750 INEK 90 346 IVOTNI 43400 4 5 INIOS 25 25500 - 51890 2000 $1000 SY300 01220433 027000 54 2100 47300 $4000 63000 1201021128500 59950 50350 S.00 66600 11320 121 DOLL 61000 53000 30000 LIWA 33550 132 29150 3303 3551 73100 INILE 3858 144 39 WNERI 42000 79400 39551 1:56 3415 4550 113200091 35200 21000 42 JAN 3710 4900 11120019 90200 22900 45950 ISO 39 150 52500 13620 99200 24000 4893 1900 2430 S5000 1 25500 51350 45650 S1000 5900 1192 2900 540 21 200 S4000 63000 16 11 3590 5795 22 51350 37000 56800 11661 1220 9000 60 34000 53000 700 1160206 6610 16500 33550 150 300 38300 13.10 73300 16000 369 3181 two Team 42000 19900 39 39000 45500 3500 JADI 3710 400 1177 30 4579 WHI 29750 440 1 DING 99 33360 10 170 SHO 116006 Tom 10 5149 200 15656 SIM BRO 59500 1 760 519 1710 Som 119 AN IS 5299 150 S 5600 USB 1200 600X 240) 530 HO TO 1143 65100 ISO 15900 15100 1000 3650 124 31500 WO 42000 112005 200 19800 39550 1500 24450 - 30000 45500 34450 Aramak iin buraya yazn H 61% 17:55 4.05.2021 CE300 Term Homework Spring X Ayarlar X + Dosya | C:/Users/user/Desktop/CE300_Term Homework_Spring_2020_2021(1).pdf TO 2 Q + Sayfa grndmu l A Sesli okul iz Vurgula Sil + Q1) You are responsible from the evaluation of your construction company's investment in a project. There are three mutually exclusive alternative projects given in Table 1 below. As expected, you would like to select the most profitable option. At a minimum attractive rate of retum (MARR) of 10%, which alternative should be selected (-10% yearly)? Table 1. A general overview of alternatives Alternatives Wind turbines Solar Panel Allotel Check Table 2 Initial cost (TL) 73-A 0.9 -A*1.5 Estimated life of the operation 8 years 12 years 6 years Annual cost (TL/year) heck Table 2 Check Table 2 Check Table 2 Single payment (TL) 50,000 at 5th year Annual Profit (TL/year) Theck Table 2 Check Table 2 Check Check Table 2 TH For each student, different initial costs, annual costs, and annual benefits are assigned based on the ID number, the related values given in Table 2 have to be used. The first alternative is constructing wind turbines that requires an initial cort based on the ID number in Table 2. The estimated operation life of this alternative is 8 years. Besides, an investor should pay an annual cost and 50,000 TL single payment at the end of 5 year of operation life. The alternative will bring an annual profit (also based on the ID number, Table 2). The second alternative is to construct solar panels. The initial cost is 90% of the wind turbine's initial cost in your socuario. This altcmative's estimated life is 12 years, and the investor should pay an annual cost based on the ID number in Table 2. There's no single payment for this alternative, and the alternative will bring benefit an annual profit (also based on the ID number; Table 2). The third alternative is to buy a hotel in a touristic coastal town that will be operating for The initial cost of the hotel is 150% of the wind turbines initial expense. Similarly, the annual cost and profits are taken from Table 2. Remarks: You have to indicate year-based cash flow diagrams for three alternatives. The current best (CB) and the challenger (CH) should be identified at each step of comparison, ................. Table 2. Initial costs, annual costs and annual benefits of each alternative Initia Albertine A - ATAbelive B - Acoul1 Alkemistine CA SanD COM Benefit Benci Cost Benefit LINN 62000 650 33556 29150 30000 1500 22100 ISO 31500 WII 42000 19262 2446015500 SB 4450 45500 LINE 35100 2010 32300 402 4000 115200053 20800 32500 -15350 15.000 29750 43000 53500 119 7200 IVARI 43430 5 172 HARI 294 3150 21 4500 SIRI 50 ZINI 47200 SHO ILIPS 11 29 57450 50150 re Since 1211 HO 610% 94 59000 Nem 100 LINAS 130 600 650 33550 29150 3000 3ESLO 12200 ISULO 365 31500 OU 42000 1132112212500 1551 1930 32550 130 1 54450 49900 54800 57000 4 117WTS WIODO 224 45750 INEK 90 346 IVOTNI 43400 4 5 INIOS 25 25500 - 51890 2000 $1000 SY300 01220433 027000 54 2100 47300 $4000 63000 1201021128500 59950 50350 S.00 66600 11320 121 DOLL 61000 53000 30000 LIWA 33550 132 29150 3303 3551 73100 INILE 3858 144 39 WNERI 42000 79400 39551 1:56 3415 4550 113200091 35200 21000 42 JAN 3710 4900 11120019 90200 22900 45950 ISO 39 150 52500 13620 99200 24000 4893 1900 2430 S5000 1 25500 51350 45650 S1000 5900 1192 2900 540 21 200 S4000 63000 16 11 3590 5795 22 51350 37000 56800 11661 1220 9000 60 34000 53000 700 1160206 6610 16500 33550 150 300 38300 13.10 73300 16000 369 3181 two Team 42000 19900 39 39000 45500 3500 JADI 3710 400 1177 30 4579 WHI 29750 440 1 DING 99 33360 10 170 SHO 116006 Tom 10 5149 200 15656 SIM BRO 59500 1 760 519 1710 Som 119 AN IS 5299 150 S 5600 USB 1200 600X 240) 530 HO TO 1143 65100 ISO 15900 15100 1000 3650 124 31500 WO 42000 112005 200 19800 39550 1500 24450 - 30000 45500 34450 Aramak iin buraya yazn H 61% 17:55 4.05.2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts