Question: cell reference please 1 Given Data: S 7 2 Humpty Dumpty Inc, manufactures Yummy potato chips. 3 Production of the potato chips occurs in three

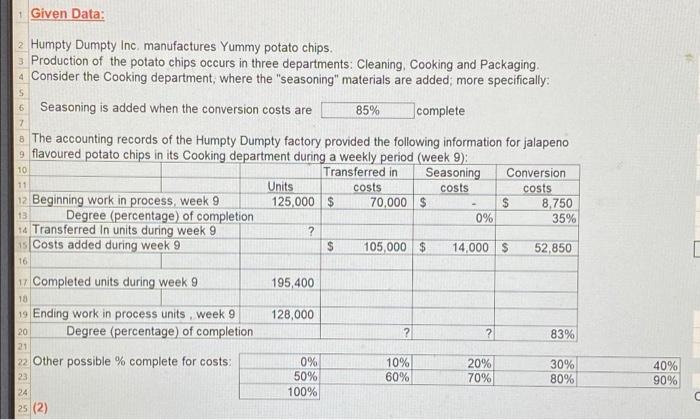

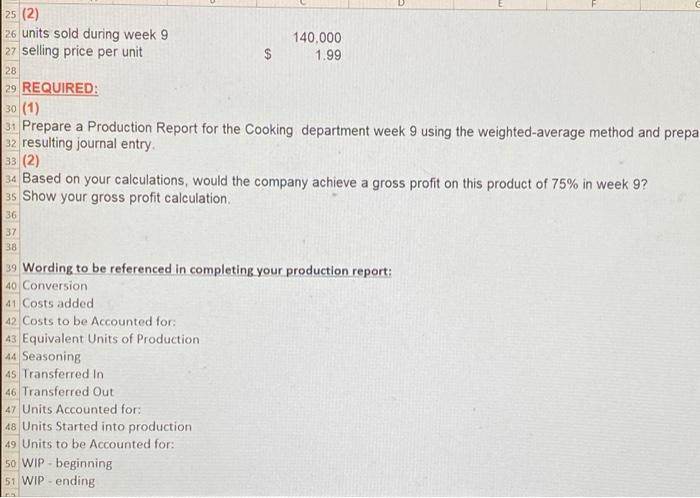

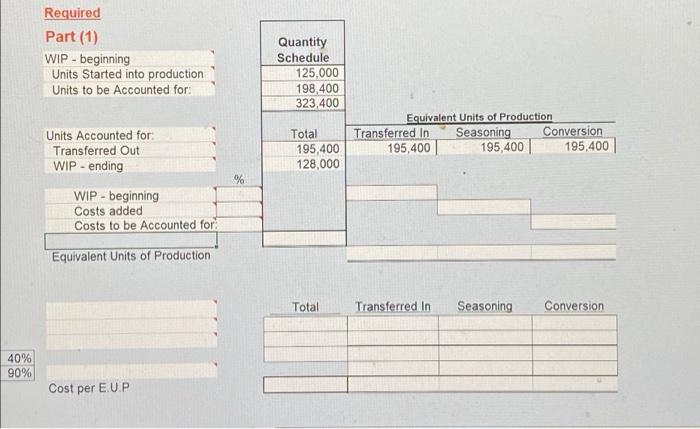

1 Given Data: S 7 2 Humpty Dumpty Inc, manufactures Yummy potato chips. 3 Production of the potato chips occurs in three departments: Cleaning, Cooking and Packaging 4 Consider the Cooking department, where the "seasoning" materials are added, more specifically: 6 Seasoning is added when the conversion costs are 85% complete a The accounting records of the Humpty Dumpty factory provided the following information for jalapeno 9 flavoured potato chips in its Cooking department during a weekly period (Week 9); Transferred in Seasoning Conversion Units costs costs costs 12 Beginning work in process, week 9 125,000 $ 70,000 $ $ 8,750 Degree (percentage) of completion 0% 35% 14 Transferred In units during week 9 1sCosts added during week 9 105,000 $ 14,000 $ 52,850 10 11 13 ? 16 195,400 18 Completed units during week 9 19 Ending work in process units, week 9 Degree (percentage) of completion 128,000 20 21 ? ? 83% 0% 50% 100% 10% 60% 20% 70% 22 Other possible % complete for costs: 23 24 25 (2) 30% 80% 40% 90% 25 (2) 26 units sold during week 9 27 selling price per unit 140,000 1.99 $ 28 29 REQUIRED: 30 (1) 3. Prepare a Production Report for the Cooking department week 9 using the weighted-average method and prepa 32 resulting journal entry. 33 (2) 34 Based on your calculations, would the company achieve a gross profit on this product of 75% in week 9? 35 Show your gross profit calculation 36 37 38 39 Wording to be referenced in completing your production report: 40 Conversion 41 Costs added 42 Costs to be Accounted for: 43 Equivalent Units of Production 44 Seasoning 4s Transferred in 46 Transferred Out 47 Units Accounted for: 48 Units Started into production 49 Units to be Accounted for: 50 WIP-beginning 51 WIP ending Required Part (1) WIP - beginning Units Started into production Units to be Accounted for: Quantity Schedule 125,000 198,400 323,400 Units Accounted for Transferred Out WIP - ending Total 195,400 128,000 Equivalent Units of Production Transferred In Seasoning Conversion 195,400 195,400 195,400 % WIP - beginning Costs added Costs to be Accounted for Equivalent Units of Production Total Transferred in Seasoning Conversion 40% 90% Cost per E.U.P M N 2 N % % Cost per E.U.P Total Costs Accounted for: Transferred Out WIP-ending Transferred in Seasoning Conversion Journal Entry Debit Credit Part (2) Would the company achiovo a 75% gross profit in week 92 Show calculations Gross Profit %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts