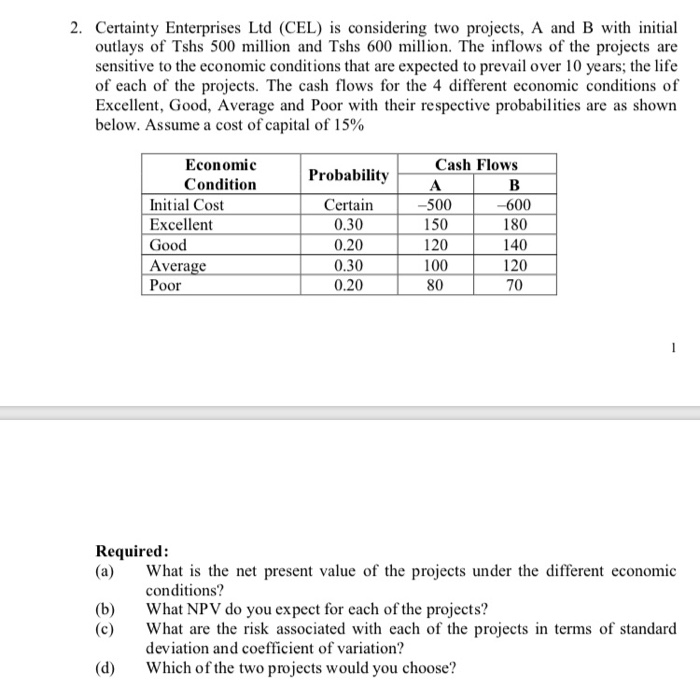

Question: Certainty Enterprises Ltd (CEL) is considering two projects, A and B with initial outlays of Tshs 500 million and Tshs 600 million. The inflows of

Certainty Enterprises Ltd (CEL) is considering two projects, A and B with initial outlays of Tshs 500 million and Tshs 600 million. The inflows of the projects are sensitive to the economic conditions that are expected to prevail over 10 years, the life of each of the projects. The cash flows for the 4 different economic conditions of Excellent, Good, Average and Poor with their respective probabilities are as shown below. Assume a cost of capital of 15% Cash Flows -500 -600 Economic Condition Initial Cost Excellent Good Average Poor Probability Certain 0.30 0.20 0.30 0.20 150 180 140 120 100 80 120 Required: (a) What is the net present value of the projects under the different economic conditions? What NPV do you expect for each of the projects? What are the risk associated with each of the projects in terms of standard deviation and coefficient of variation? Which of the two projects would you choose? (b) (c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts