Question: ces You have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the

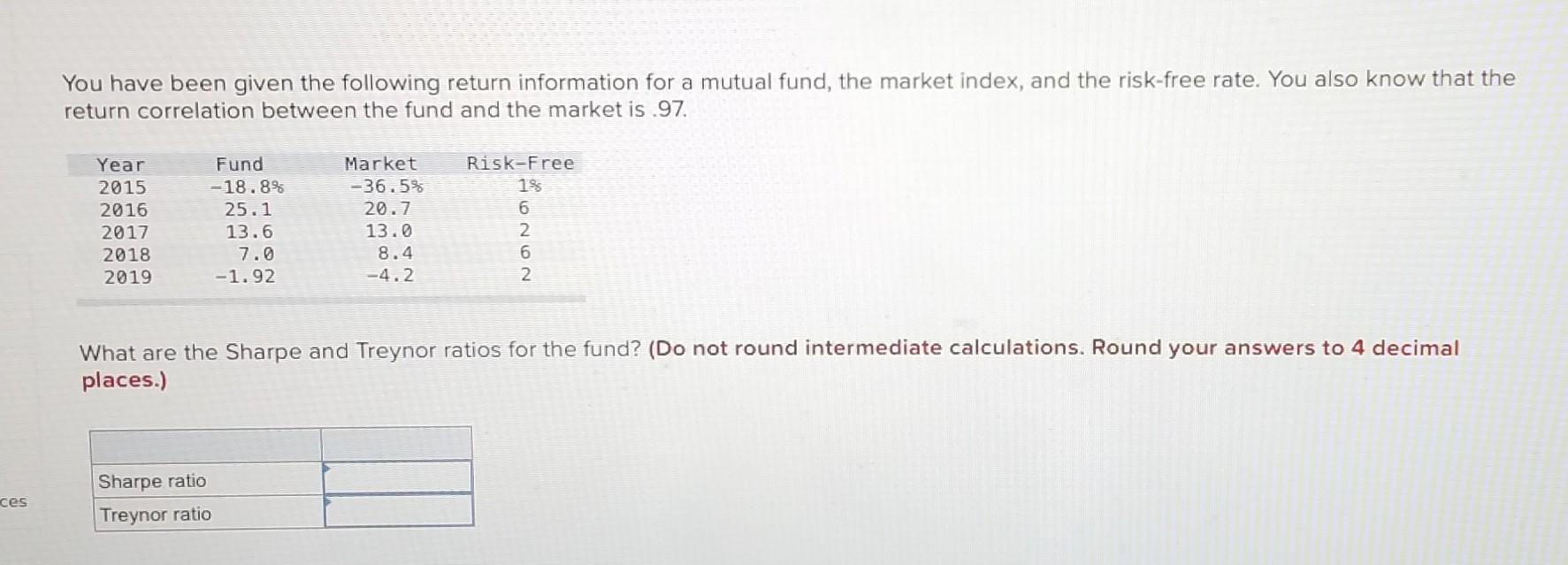

ces You have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is .97. Year Risk-Free Fund -18.8% Market -36.5% 2015 1% 2016 25.1 20.7 6 2017 13.6 13.0 2 2018 7.0 8.4 6 2019 -1.92 -4.2 2 What are the Sharpe and Treynor ratios for the fund? (Do not round intermediate calculations. Round your answers to 4 decimal places.) Sharpe ratio Treynor ratio

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock