Question: CFING - CHAPTER 11 Integrative Problem Assume that you were recently hired as assistant to Jerry Lehman, financial VP of Coleman Technologies. Your first task

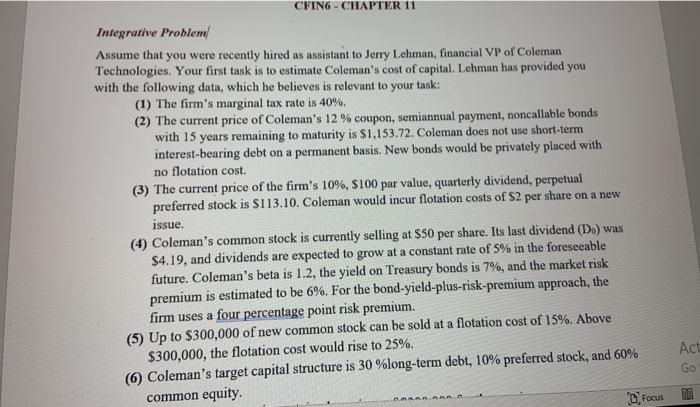

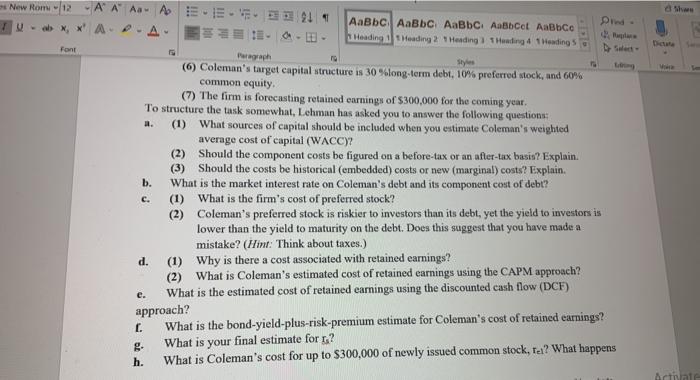

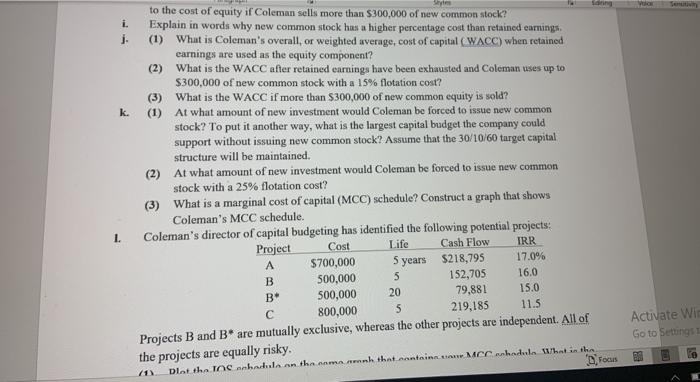

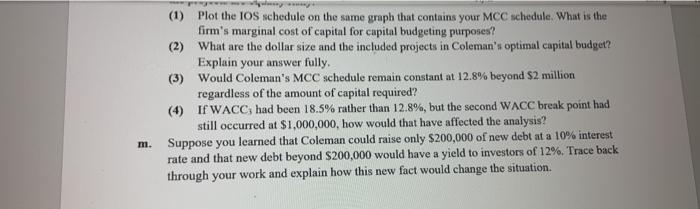

CFING - CHAPTER 11 Integrative Problem Assume that you were recently hired as assistant to Jerry Lehman, financial VP of Coleman Technologies. Your first task is to estimate Coleman's cost of capital. Lehman has provided you with the following data, which he believes is relevant to your task: (1) The firm's marginal tax rate is 40%. (2) The current price of Coleman's 12 % coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1,153.72. Coleman does not use short-term interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. (3) The current price of the firm's 10%, $100 par value, quarterly dividend, perpetual preferred stock is $113.10. Coleman would incur flotation costs of S2 per share on a new issue. (4) Coleman's common stock is currently selling at $50 per share. Its last dividend (Do) was $4.19, and dividends are expected to grow at a constant rate of 5% in the foreseeable future. Coleman's beta is 1.2, the yield on Treasury bonds is 7%, and the market risk premium is estimated to be 6%. For the bond-yield-plus-risk-premium approach, the firm uses a four percentage point risk premium. (5) Up to $300,000 of new common stock can be sold at a flotation cost of 15%. Above $300,000, the flotation cost would rise to 25%. (6) Coleman's target capital structure is 30 %long-term debt, 10% preferred stock, and 60% common equity. FOCUS Act GO New Rom 12A A A A Uab X, * A2-A Pred AaBbc AaBbc AaBbc Aabbet AaBbce Heading Heading 2 Heading IT Heading 4 Headings Da Font C. (6) Coleman's target capital structure is 30%long-term debt, 10% preferred stock, and 60% common equity. (7) The firm is forecasting retained earnings of $300,000 for the coming year. To structure the task somewhat, Lehman has asked you to answer the following questions: (1) What sources of capital should be included when you estimate Coleman's weighted average cost of capital (WACC)? (2) Should the component costs be figured on a before-tax or an after-tax basis? Explain. (3) Should the costs be historical (embedded) costs or new (marginal) costs? Explain. b. What is the market interest rate on Coleman's debt and its component cost of debt? (1) What is the firm's cost of preferred stock? (2) Coleman's preferred stock is riskier to investors than its debt, yet the yield to investors is lower than the yield to maturity on the debt. Does this suggest that you have made a mistake? (Hint: Think about taxes.) d. (1) Why is there a cost associated with retained earnings? (2) What is Coleman's estimated cost of retained earnings using the CAPM approach? What is the estimated cost of retained earnings using the discounted cash flow (DCF) approach? C. What is the bond-yield-plus-risk-premium estimate for Coleman's cost of retained earnings? g. What is your final estimate for 1 ? h. What is Coleman's cost for up to $300,000 of newly issued common stock, ta? What happens e. Activate son to the cost of equity if Coleman sells more than $300,000 of new common stock? i. Explain in words why new common stock has a higher percentage cost than retained earnings 1 (1) What is Coleman's overall, or weighted average, cost of capital (WACC) when retained earnings are used as the equity component? (2) What is the WACC after retained earnings have been exhausted and Coleman uses up to $300,000 of new common stock with a 15% flotation cost? (3) What is the WACC if more than $300,000 of new common equity is sold? k. (1) At what amount of new investment would Coleman be forced to issue new common stock? To put it another way, what is the largest capital budget the company could support without issuing new common stock? Assume that the 30/10/60 target capital structure will be maintained. (2) At what amount of new investment would Coleman be forced to issue new common stock with a 25% flotation cost? (3) What is a marginal cost of capital (MCC) schedule? Construct a graph that shows Coleman's MCC schedule. 1. Coleman's director of capital budgeting has identified the following potential projects: Project Cost Life Cash Flow IRR A $700,000 5 years $218,795 17.0% B 500,000 5 152,705 16.0 B 500,000 20 79,881 15.0 800,000 5 219,185 11.5 Projects B and B* are mutually exclusive, whereas the other projects are independent. All of the projects are equally risky. Dia the IOC anal anthem Arnh that nantaina tia MCC ahadul What in the DF Activate Wir Go to Settings (1) (1) Plot the IOS schedule on the same graph that contains your MCC schedule. What is the firm's marginal cost of capital for capital budgeting purposes? (2) What are the dollar size and the included projects in Coleman's optimal capital budget? Explain your answer fully. (3) Would Coleman's MCC schedule remain constant at 12.8% beyond $2 million regardless of the amount of capital required? (4) IF WACC; had been 18.5% rather than 12.8%, but the second WACC break point had still occurred at $1,000,000, how would that have affected the analysis? Suppose you learned that Coleman could raise only $200,000 of new debt at a 10% interest rate and that new debt beyond $200,000 would have a yield to investors of 12%. Trace back through your work and explain how this new fact would change the situation. m

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts