Question: Ch 05: Assignment - Bonds, Bonds Valuation, and interest Rates 3. More on the characteristics of bonds Based on the descriptions given in the following

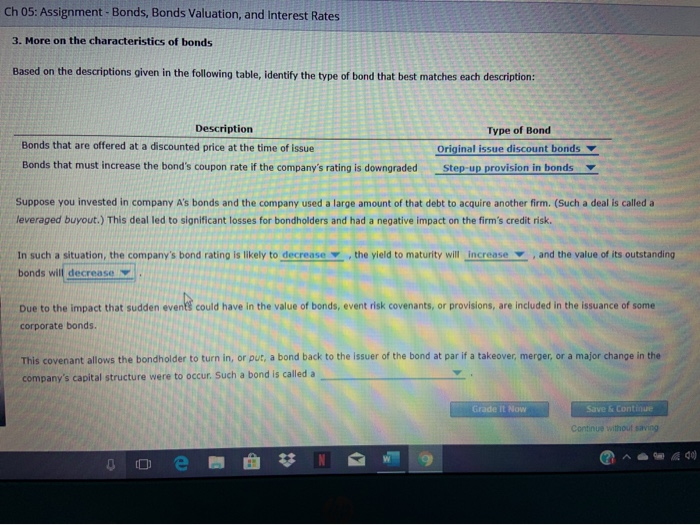

Ch 05: Assignment - Bonds, Bonds Valuation, and interest Rates 3. More on the characteristics of bonds Based on the descriptions given in the following table, identify the type of bond that best matches each description: Description Bonds that are offered at a discounted price at the time of issue Bonds that must increase the bond's coupon rate if the company's rating is downgraded Type of Bond Original issue discount bonds Step-up provision in bonds Suppose you invested in company A's bonds and the company used a large amount of that debt to acquire another firm. (Such a deal is called a leveraged buyout.) This deal led to significant losses for bondholders and had a negative impact on the firm's credit risk. the yield to maturity will increase , and the value of its outstanding In such a situation, the company's bond rating is likely to decrease bonds will decrease sease Due to the impact that sudden events could have in the value of bonds, event risk covenants, or provisions are included in the issuance of some corporate bonds. This covenant allows the bondholder to turn in, or put, a bond back to the issuer of the bond at par ifa takeover, merger or a major change in the company's capital structure were to occur. Such a bond is called Now Save & Continue Continue without saving (2 O A 400 e 3 N 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts