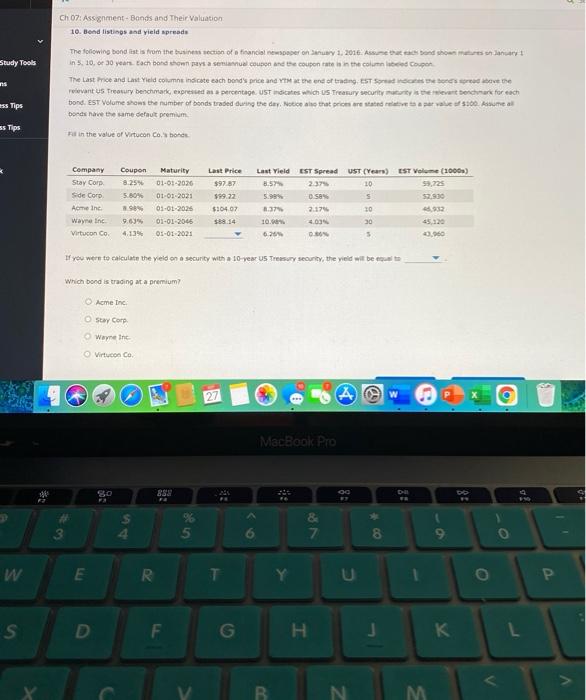

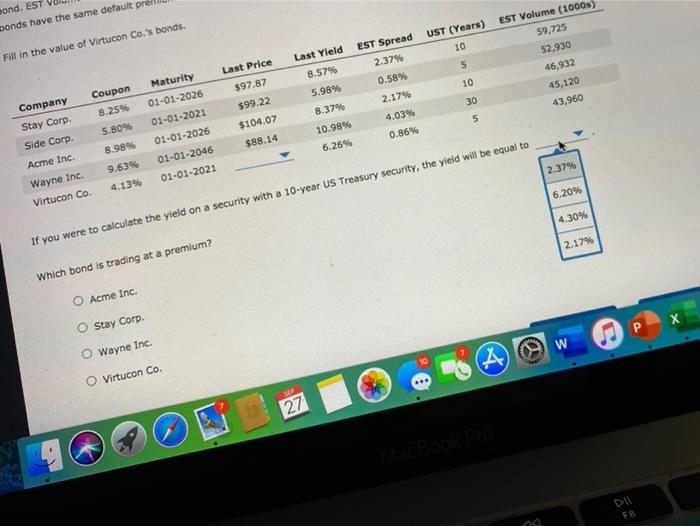

Question: Ch 07: Assignment - Bonds and Their Valuation 10. Bond listings and yield spreads Study Tools ns The following bond lists from the business section

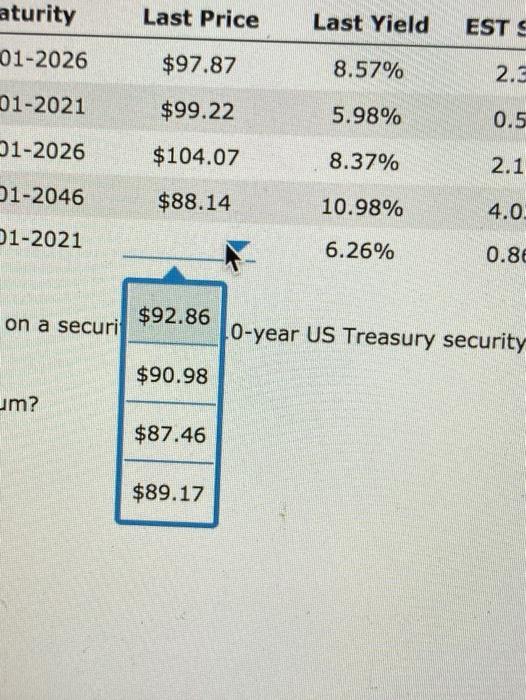

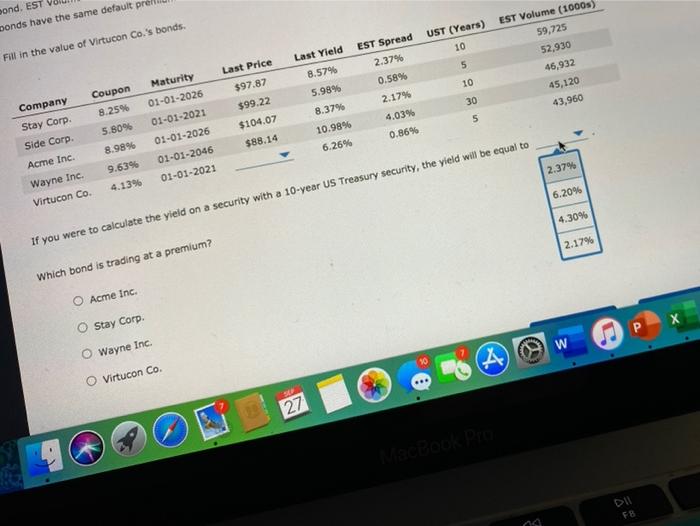

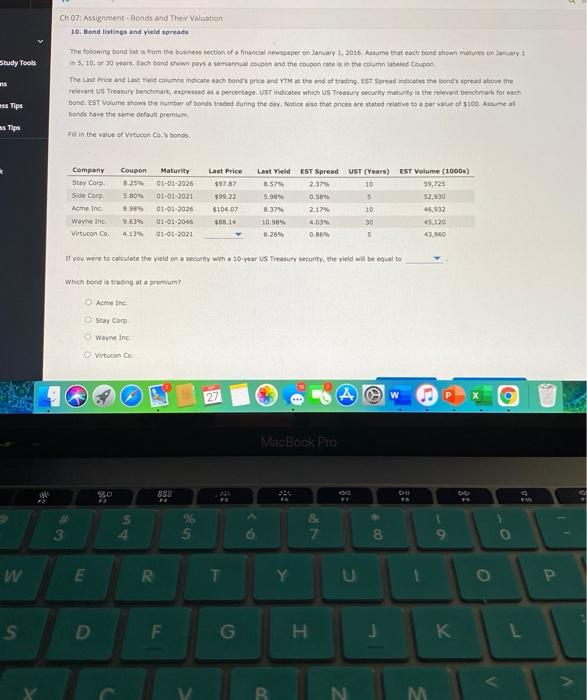

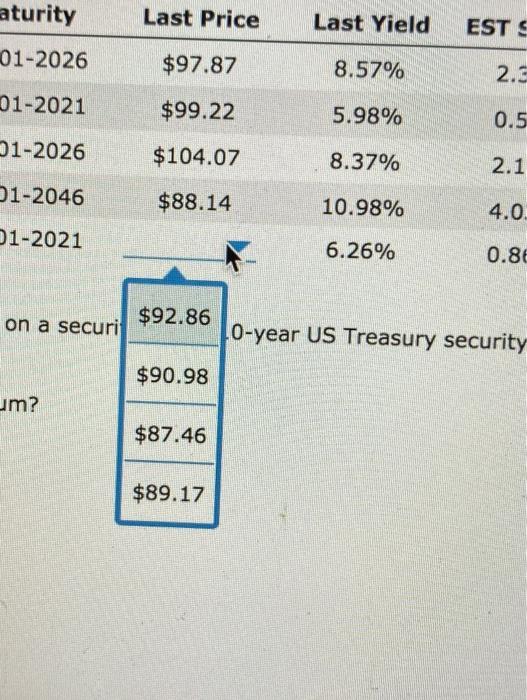

Ch 07: Assignment - Bonds and Their Valuation 10. Bond listings and yield spreads Study Tools ns The following bond lists from the business section of financial newspaper on any 1, 2016. Assume and comes only ins. 10. or 30 years. Each bord hown paysa semana coupon and the coupon rates in the column Coupon The Last Price and Last Yield count indicate each bond's price and I are end of trading EST Sebeste evant us Treasury benchmark expressed as a percentage UST atates US Treasury security Doors for each bond. EST Volume shows the number of bonds traded during the day, Notice so that prices are stated 5:00. Asume at borde have the same default premium 5 Tips ss Tips in the value of Virtucon Cotone Company Stay Corp Side Corp Acme in Wayne Inc Virtucon Co. Coupon Maturity 8.25% 01.01.2026 5.80% 01-01-2023 01-01-2025 9.63% 01-01-2005 4.13% 03-01-2021 Last Price $9787 $99.22 $.04.07 S8814 Last Yield EST Spread UST (Years) EST Volume (1000) 8.57% 2379 10 59.25 5. OS s 52.900 6.37 2.17 20 932 10.00 4.035 30 67 D 5 0.060 If you were to calculate the yield on a security with a 10 year US Tresory security, the yield wil be which bond is trading at a premium Acme Inc Stay Con Wayne Inc Virtucon Co 27 MacBook Pro So BS Du 183 : S A % 5 3 7 8 9 W E R U 0 s D F. G . . L N M aturity Last Price Last Yield ESTS 01-2026 $97.87 8.57% 2.0 01-2021 $99.22 5.98% 0.5 21-2026 $104.07 8.37% 2.1 1-2046 $88.14 10.98% 4.0 1-2021 6.26% 0.88 $92.86 on a securi 0-year US Treasury security $90.98 um? $87.46 $89.17 pond. EST Donds have the same default pre UST (Years) 10 Fill in the value of Virtucon Co.'s bonds. Last Yield 5 EST Volume (1000) 59,725 52.930 46,932 45,120 43,960 Last Price $97.87 $99.22 8.57% 5.98% 10 Coupon 8.25% EST Spread 2.37% 0.58% 2.17% 4,03% 0.86% Maturity 01-01-2026 01-01-2021 01-01-2026 30 8.37% 5 Company Stay Corp. Side Corp. Acme Inc. 5.80% $104.07 $88.14 10.98% 6.26% 8.9896 9.63% 01-01-2046 01-01-2021 2.37% 4.1396 Wayne Inc. Virtucon Co. 6.20% 4.30% if you were to calculate the yield on a security with a 10-year US Treasury security, the yield will be equal to 2.17% Which bond is trading at a premium? O Acme Inc. Stay Corp W O Wayne Inc. A Virtucon Co. SP 27 Dll FB Ch 07: Assignment-Bonds and Their valuation 10. Bond listings and yield spreade Study Tools ns The following bondit from the business section of a financial newspaper os January 1, 2016. Anume that each bond shown matures on January 1 in 5, 10, or 30 years, ach bond hown pays a semanal coupon and the coupons in the column labeled Coupon The Last Price and Last Tield columns indicate each one price and the end of trading, EST Soread dictes the band's spread above the relevant US Treasury benchmark, expressed as a percentage. UST indicates which US Treasury security maturity is the relevant benchmark for each bond. EST Volume shows the nomber of bonds traded during the day. Hotice niso that prices are stated relative to a pat value of $100. Assume at bonds have the same default premium oss Tips ss Tips All in the value of Vrtucon Carbonds Company Stay Corp Side Corp. Acme Inc Wayne Inc Virtucon Co Coupon 5.25% 5.809 8.98% 9.639 4.134 Maturity 01-01-2026 01-01-2021 01-01-2025 01-01-2046 01-01-2021 Last Price $97.87 $99.22 $104.07 Last Yield 8.57 5.98% 8.37 10.90 6.26 EST Spread 2.37 0.58% 2.179 4,03% 0.86% UST (Years) EST Volume (1000) 10 59,725 5 52.930 10. 46,932 30 45.120 5 43.960 If you were to calculate the yield on a security with a 10-year US Treasury security, the virid will be equal to which one is traong at a premium? Acme Inc. Stay Corp Wayne Inc Virton Co C 27 . A @ w . MacBook Pro RO Del DO F os % 5 & 7 . 3 6 8 9 W E R 0 S D F. G . J K N M pond. EST ponds have the same default pre UST (Years) 10 Fill in the value of Virtucon Co.'s bonds. Last Yield EST Spread 2.37% 0.58% 5 Last Price $97.87 $99.22 EST Volume (1000) 59,725 52,930 46,932 45,120 43,960 10 Coupon 8.57% 5.98% 8.37% 30 8.25% 5.80% 2.17% 4.03% 0.86% 5 Maturity 01-01-2026 01-01-2021 01-01-2026 01-01-2046 01-01-2021 $104.07 $88.14 10.98% 6.26% Company Stay Corp. Side Corp Acme Inc. Wayne Inc. Virtucon Co. 8.9896 2.37% 9.63% 4.136 6.20% 4.30% if you were to calculate the yield on a security with a 10-year US Treasury security, the yield will be equal to 2.17% Which bond is trading at a premium? O Acme Inc. Stay Corp W O Wayne Inc. A Virtucon Co. 27 Dll aturity Last Price Last Yield ESTS 01-2026 $97.87 8.57% 2.2 01-2021 $99.22 5.98% 0.5 21-2026 $104.07 8.37% 2.1 D1-2046 $88.14 10.98% 4.0. D1-2021 6.26% 0.88 on a securi $92.86 0-year US Treasury security $90.98 um? $87.46 $89.17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts