Question: Ch 07: Assignment - Corporate Valuation and Stock Valuation Hackworth Co. is a privately owned firm with few investors. Investors forecast their earnings per share

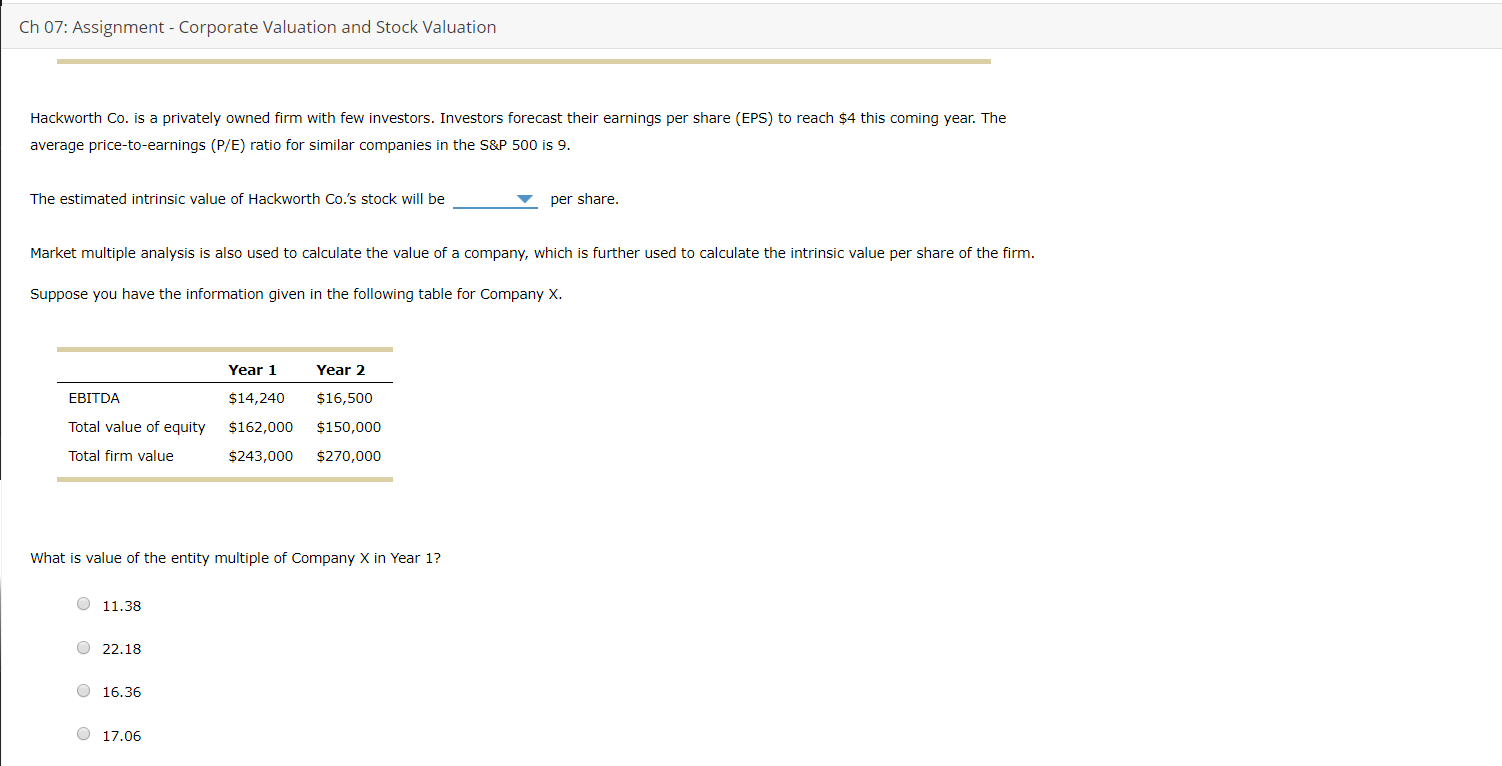

Ch 07: Assignment - Corporate Valuation and Stock Valuation Hackworth Co. is a privately owned firm with few investors. Investors forecast their earnings per share (EPS) to reach $4 this coming year. The average price-to-earnings (P/E) ratio for similar companies in the S&P 500 is 9. The estimated intrinsic value of Hackworth Co.'s stock will be per share. Market multiple analysis is also used to calculate the value of a company, which is further used to calculate the intrinsic value per share of the firm. Suppose you have the information given in the following table for Company X. EBITDA Year 1 $14,240 $162,000 $243,000 Year 2 $16,500 $150,000 $270,000 Total value of equity Total firm value What is value of the entity multiple of Company X in Year 1? 0 11.38 0 22.18 0 O 16.36 0 17.06

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts