Question: Ch 07- Blueprint Problems - Bonds and Their Valuation 0 x Price of bond + (1+r)(1+) Calculate YTC using a financial calculator by entering the

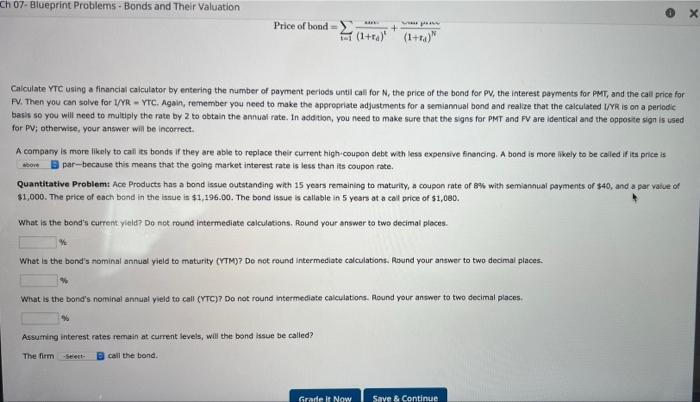

Ch 07- Blueprint Problems - Bonds and Their Valuation 0 x Price of bond + (1+r)(1+) Calculate YTC using a financial calculator by entering the number of payment periods until call for N, the price of the bond for PV, the interest payments for PMT, and the call price for PV. Then you can solve for 1/YR - YTC. Again, remember you need to make the appropriate adjustments for a semiannual bond and realize that the calculated I/YR is on a periodic basis so you will need to multiply the rate by 2 to obtain the annual rate. In addition, you need to make sure that the signs for PMT and FV are identical and the opposite sign is used for PV; otherwise, your answer will be incorrect. A company is more likely to call its bonds if they are able to replace their current high-coupon debt with less expensive financing. A bond is more likely to be called if its price is or Bar-because this means that the going market interest rate is less than its coupon rate. Quantitative Problem: Ace Products has a bond issue outstanding with 15 years remaining to maturity, coupon rate of 8% with semiannual payments of $40, and a par value of $1,000. The price of each bond in the issue is $1,196.00. The bond issue is callable in 5 years at a call price of $1,080. What is the bond's current, vitild? Do not round intermediate calculations. Round your answer to two decimal places. What is the band's nominal annual yield to maturity CYTM)? Do not found intermediate calculations. Round your answer to two decimal places. What is the band's nominal annual yield to call (YTC)? Do not round intermediate calculations. Round your answer to two decimal places Assuming interest rates remain at current levels, will the bond issue be called? call the bond The firm Select- Grade It Now Save & Continue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts