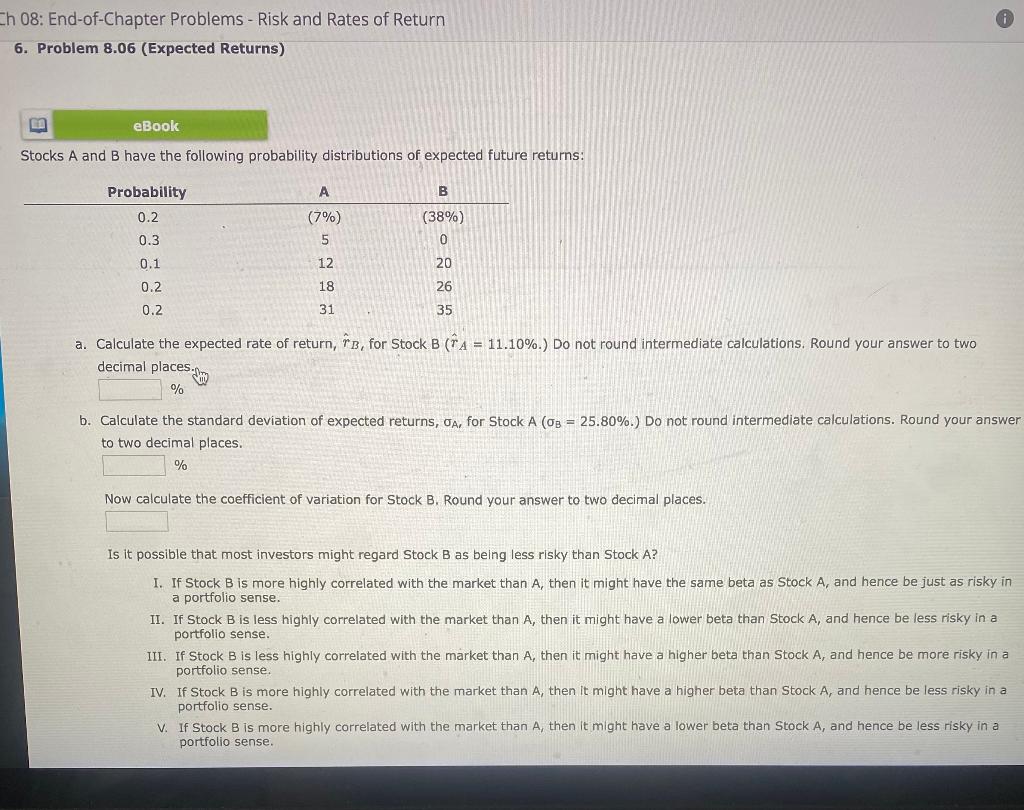

Question: Ch 08: End-of-Chapter Problems - Risk and Rates of Return 6. Problem 8.06 (Expected Returns) eBook Stocks A and B have the following probability distributions

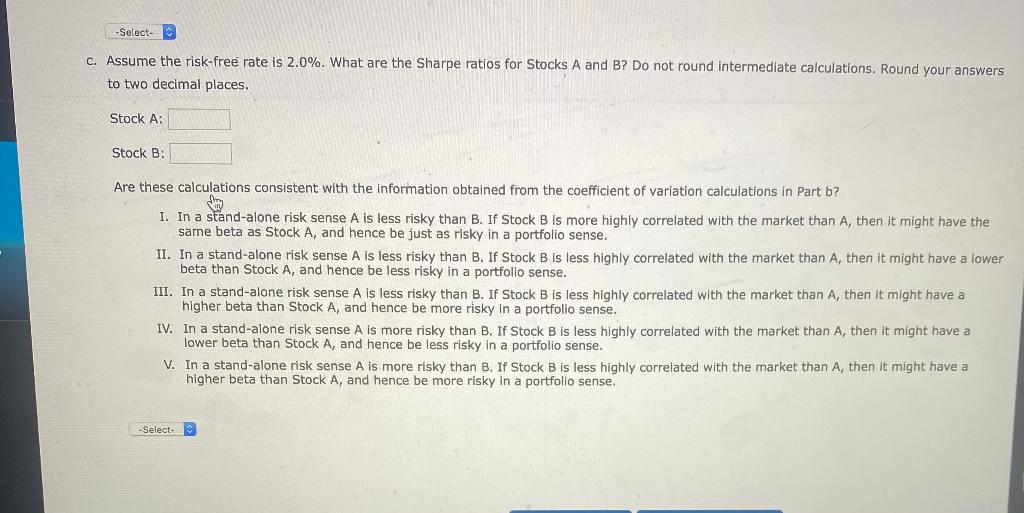

Ch 08: End-of-Chapter Problems - Risk and Rates of Return 6. Problem 8.06 (Expected Returns) eBook Stocks A and B have the following probability distributions of expected future returns: A B Probability 0.2 0.3 (38%) (7%) 5 0 0.1 12 20 18 26 0.2 0.2 31 35 a. Calculate the expected rate of return, TB, for Stock B (A = 11.10%.) Do not round intermediate calculations. Round your answer to two decimal places.hu % b. Calculate the standard deviation of expected returns, OA, for Stock A (0g = 25.80%.) Do not round intermediate calculations. Round your answer to two decimal places. % Now calculate the coefficient of variation for Stock B. Round your answer to two decimal places. Is it possible that most investors might regard Stock B as being less risky than Stock A? 1. If Stock B is more highly correlated with the market than A, then it might have the same beta as Stock A, and hence be just as risky in a portfolio sense. II. If Stock B is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense. III. If Stock B is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense. IV. If Stock B is more highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be less risky in a portfolio sense. V. If Stock B is more highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense. -Select- C. Assume the risk-free rate is 2.0%. What are the Sharpe ratios for Stocks A and B? Do not round intermediate calculations. Round your answers to two decimal places. Stock A: Stock B: Are these calculations consistent with the information obtained from the coefficient of variation calculations in Part b? I. In a stand-alone risk sense A is less risky than B. If Stock B is more highly correlated with the market than A, then it might have the same beta as Stock A, and hence be just as risky in a portfolio sense. II. In a stand-alone risk sense A is less risky than B. If Stock B is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense. III. In a stand-alone risk sense A is less risky than B. If Stock B is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense. IV. In a stand-alone risk sense A is more risky than B. If Stock B is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense. V. In a stand-alone risk sense A is more risky than B. If Stock B is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense. -Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts