Question: Ch 09: Assignment. Stocks and Their Valuation 6. Expected returns, dividends, and growth The constant growth valuation formula has dividends in the numerator. Dividends are

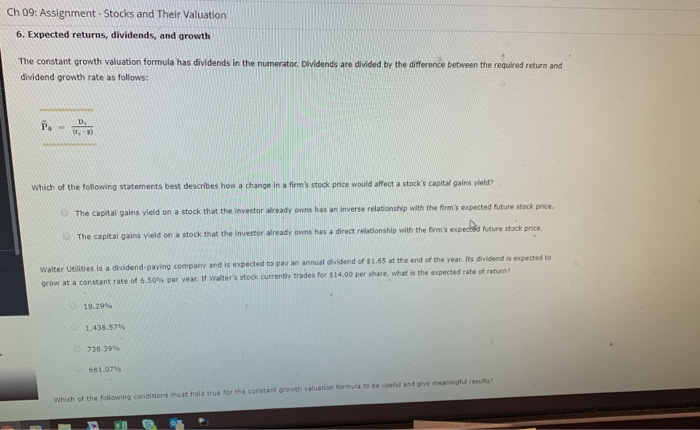

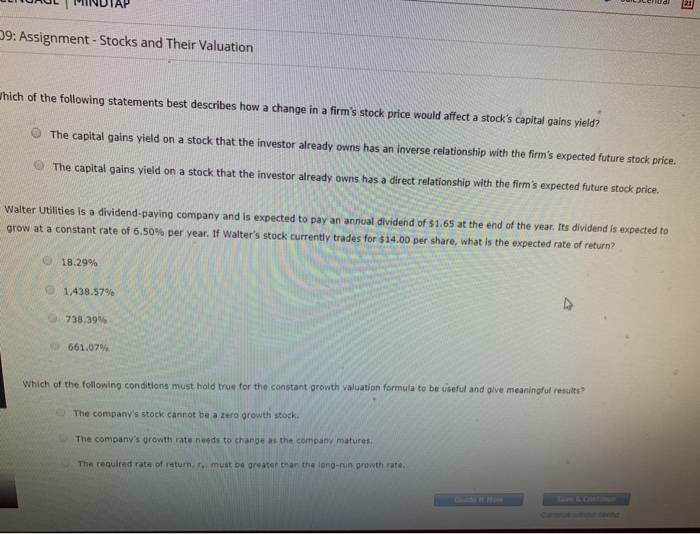

Ch 09: Assignment. Stocks and Their Valuation 6. Expected returns, dividends, and growth The constant growth valuation formula has dividends in the numerator. Dividends are divided by the difference between the required return and dividend growth rate as follows: PD - Which of the following statements best describes how a change in a firm's stock price would affect a stock's capital gains yield? The capital gains yield on a stock that the investor already owns has an inverse relationship with the firm's expected future stock price The capital gains yield on a stock that the investor already owns has a direct relationship with the firm's expechild future stock price Walter Utilities is a dividend paying company and is expected to pay an annual dividend of $1.65 at the end of the year. Its dividend is expected to grow at a constant rate of 5.50% per year. If Walter's stock currently trades for $14.00 per share, what is the expected rate of return 18.29% 1.435.5796 735.39 661.07 Which of the following conditions must hold true for the constant growth valuation formula to be useful and give meaningful results LURUL MINDIAP DULJCellul 21 09: Assignment - Stocks and Their Valuation Which of the following statements best describes how a change in a firm's stock price would affect a stock's capital gains yield? The capital gains yield on a stock that the investor already owns has an inverse relationship with the firm's expected future stock price. The capital gains yield on a stock that the investor already owns has a direct relationship with the firm's expected future stock price. Walter Utilities is a dividend-paying company and is expected to pay an annual dividend of $1.65 at the end of the year. Its dividend is expected to grow at a constant rate of 6.50% per year. If Walter's stock currently trades for $14.00 per share, what is the expected rate of return? 18.29% 1,438.57% 738.39% 661.07% Which of the following conditions must hold true for the constant growth valuation formula to be useful and give meaningful results? The company's stock cannot be a zero growth stock. The company's growth rate needs to change as the company matures. The required rate of return, r. must be greater than the long-run growth rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts