Question: Ch 09- Assignment - Stocks and Their Valuation Robert Gillman, an equity research analyst at Gillman Advisors, believes in efficient markets. He has been following

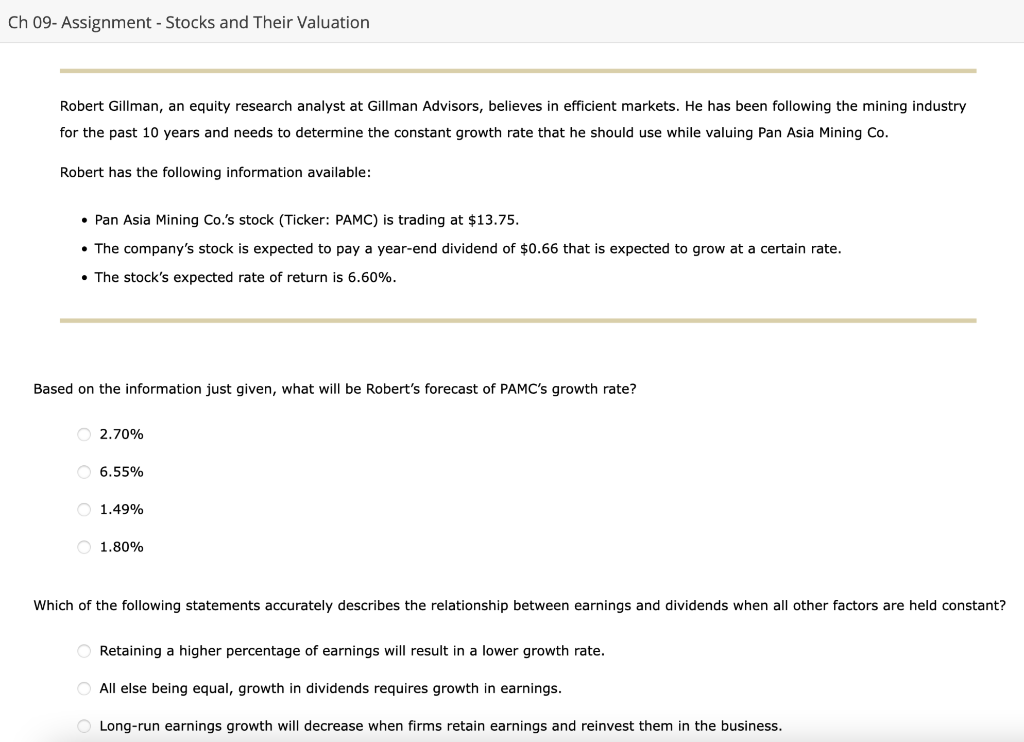

Ch 09- Assignment - Stocks and Their Valuation Robert Gillman, an equity research analyst at Gillman Advisors, believes in efficient markets. He has been following the mining industry for the past 10 years and needs to determine the constant growth rate that he should use while valuing Pan Asia Mining Co. Robert has the following information available: - Pan Asia Mining Co.'s stock (Ticker: PAMC) is trading at $13.75. - The company's stock is expected to pay a year-end dividend of $0.66 that is expected to grow at a certain rate. - The stock's expected rate of return is 6.60%. Based on the information just given, what will be Robert's forecast of PAMC's growth rate? 2.70%6.55%1.49%1.80% Which of the following statements accurately describes the relationship between earnings and dividends when all other factors are held constant? Retaining a higher percentage of earnings will result in a lower growth rate. All else being equal, growth in dividends requires growth in earnings. Long-run earnings growth will decrease when firms retain earnings and reinvest them in the business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts