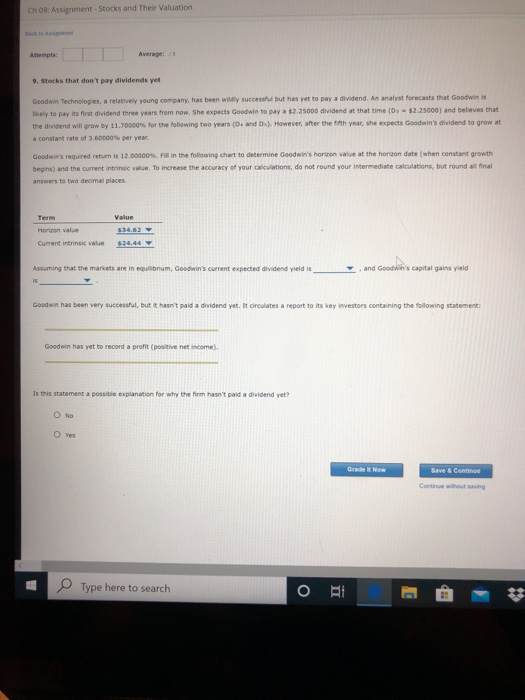

Question: Ch 09: Assignment - Stocks and Their Valuation . Stacks that don't pay dividends yet Goodwin Technologies, a relatively young company has been widely successful

Ch 09: Assignment - Stocks and Their Valuation . Stacks that don't pay dividends yet Goodwin Technologies, a relatively young company has been widely successful but has yet to pay a dividend. An analyst forecasts that Goodwin likely to pay its first dividend three years from now. She expects Goodwin to pay a $2.25000 dividend at that time -52.25000) and believes that the dividend will grow by 11.70000% for the following two years ( and Ds). However, after the year, she expects Goodwin's dividend to grow at a constant rate of 3.60000 per year Good 's required returns 12.00000% in the following that to determine Goodwin's horn value at the horizon date when constant growth begins) and the current r eale. To increase the accuracy of your calculations, do not round your intermediate calculations, but round final este decat Horon value Current intrinske value $34.62 $24.44 Assuming that the markets are in librum, God 's current expected dividend yield is and Goodwin's capital gains yuld Good has been very but that pada det. It does not investors containing the following statement Goodwin has yet to record a profit (positive net income) Is this statement a pote n tion for why the m an pada dividend yet? ON O res Save & Continue Contving Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts