Question: Ch 09: End-of-Chapter Problems - Stocks and Their Valuation Back to Assignment Attempts: Keep the Highest: /3 4. Problem 9.04 Click here to read the

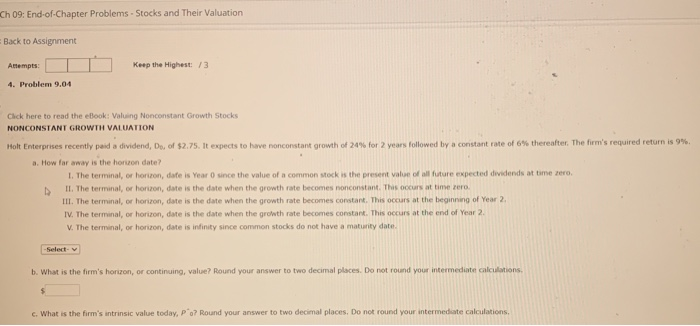

Ch 09: End-of-Chapter Problems - Stocks and Their Valuation Back to Assignment Attempts: Keep the Highest: /3 4. Problem 9.04 Click here to read the elbook: Valuing Nonconstant Growth Stocks NONCONSTANT GROWTH VALUATION Holt Enterprises recently paid a dividend, Do, of $2.75. It expects to have nonconstant growth of 24% for 2 years followed by a constant rate of 6% thereafter. The firm's required return is 9% a. How far away is the horizon date? 1. The terminal, or horizon, dat is Year O since the value of a common stock is the present value of all future expected dividends at time sero II. The terminal, or horizon, date is the date when the growth rate becomes nonconstant. This occurs at time zero. III. The terminal, or horizon, date is the date when the growth rate becomes constant. This occurs at the beginning of Year 2 IV. The terminal, or horizon, date is the date when the growth rate becomes constant. This occurs at the end of Year 2 V. The terminal, or horizon, date is infinity since common stocks do not have a maturity date -Select- b. What is the firm's horizon, or continuing, value? Round your answer to two decimal places. Do not round your intermediate calculations, c. What is the firm's intrinsic value today, P 07 Round your answer to two decimal places. Do not round your intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts