Question: Ch . 1 2 Graded Homework ( 1 5 % ) Alosra trading is a training institute operated by three colleges. Information below is

Ch Graded Homework

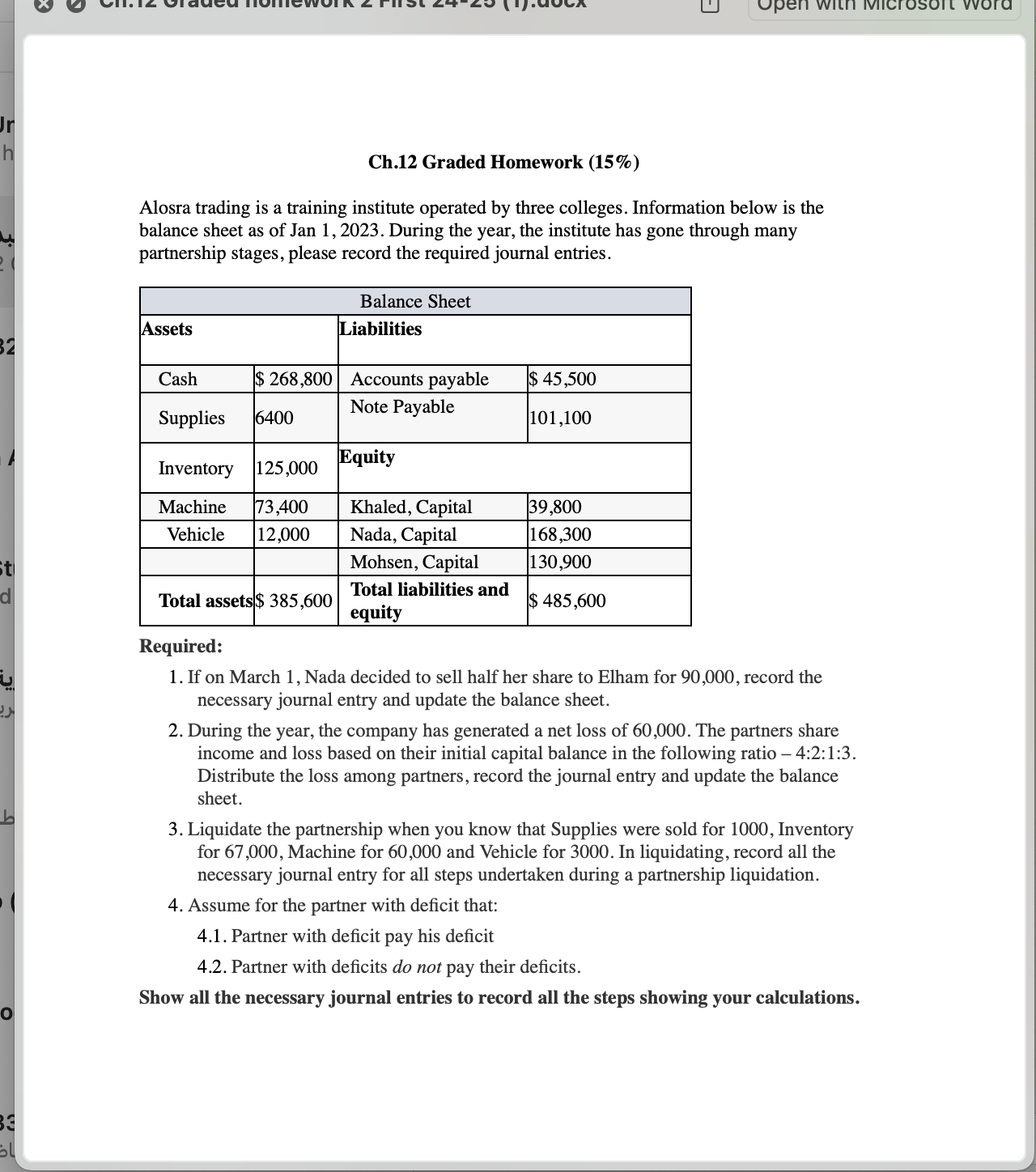

Alosra trading is a training institute operated by three colleges. Information below is the balance sheet as of Jan During the year, the institute has gone through many partnership stages, please record the required journal entries.

Required:

If on March Nada decided to sell half her share to Elham for record the necessary journal entry and update the balance sheet.

During the year, the company has generated a net loss of The partners share income and loss based on their initial capital balance in the following ratio ::: Distribute the loss among partners, record the journal entry and update the balance sheet.

Liquidate the partnership when you know that Supplies were sold for Inventory for Machine for and Vehicle for In liquidating, record all the necessary journal entry for all steps undertaken during a partnership liquidation.

Assume for the partner with deficit that:

Partner with deficit pay his deficit

Partner with deficits do not pay their deficits.

Show all the necessary journal entries to record all the steps showing your calculations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock