Question: Ch 10: End-of-Chapter Problems - The Cost of Capital Ch 10: End-of-Chapter Problems - The Cost of Capital < Back to Assignment Attempts Keep the

Ch 10: End-of-Chapter Problems - The Cost of Capital

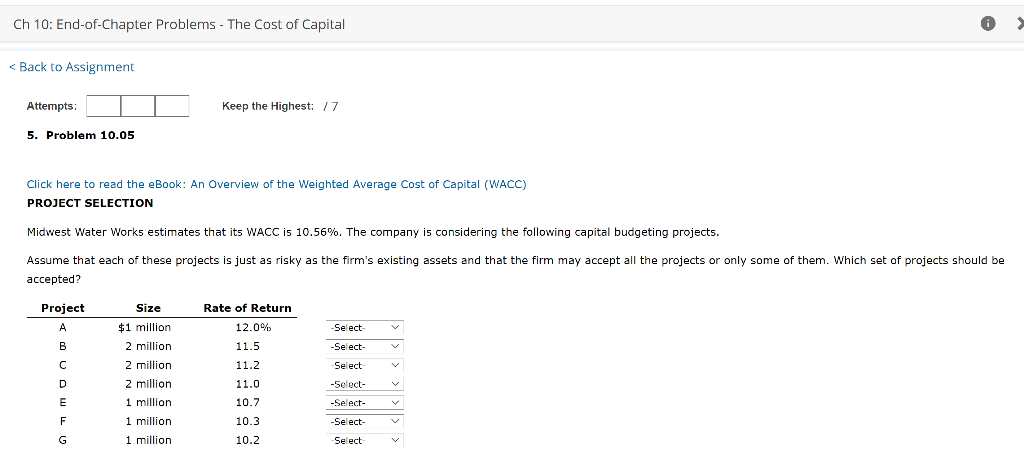

Ch 10: End-of-Chapter Problems - The Cost of Capital < Back to Assignment Attempts Keep the Highest; 5. Problem 10.05 -Select- -Se'ect o Click here to read the eBook: An Overview of the Weighted Average Cost of Capital (WACC) PROJECT SELECTION Midwest Water Works estimates that its WACC is 10.56%. The company is considering the following capital budgeting projects. Assume that each of these projects is just as risky as the firm's existing assets and that the firm may accept all the projects or only some of them. Which set of projects should b a ccepted? Project Size $1 million 2 million 2 million 2 million million I million I million Rate of Return 12.0% 11_5 11.2 11.0 10_7 10_3 10.2 -Select -SS ect- -Se'ect -select- -SS ect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts