Question: Ch 11 Ex 11-10 Saved Help Save & Exit Submi Check my work 1 Exercise 11-10 NPV and profitability index LO P3 20 points Following

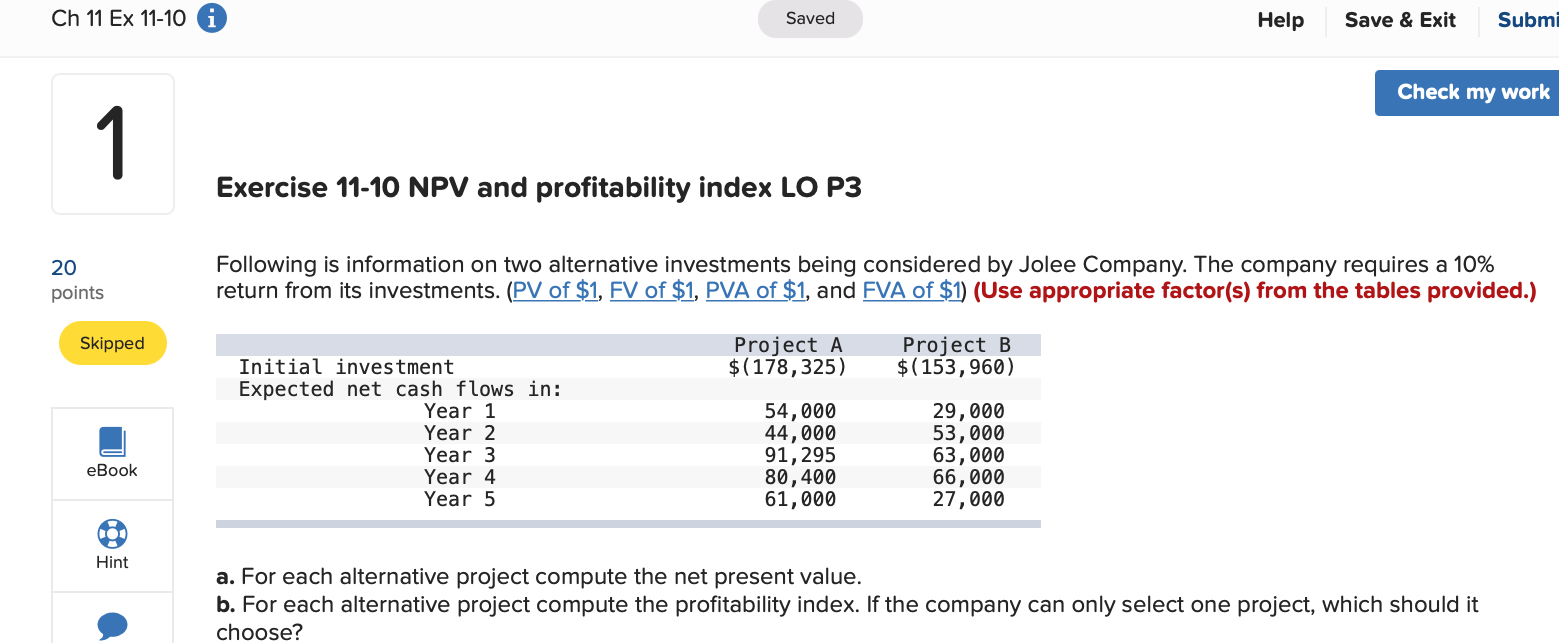

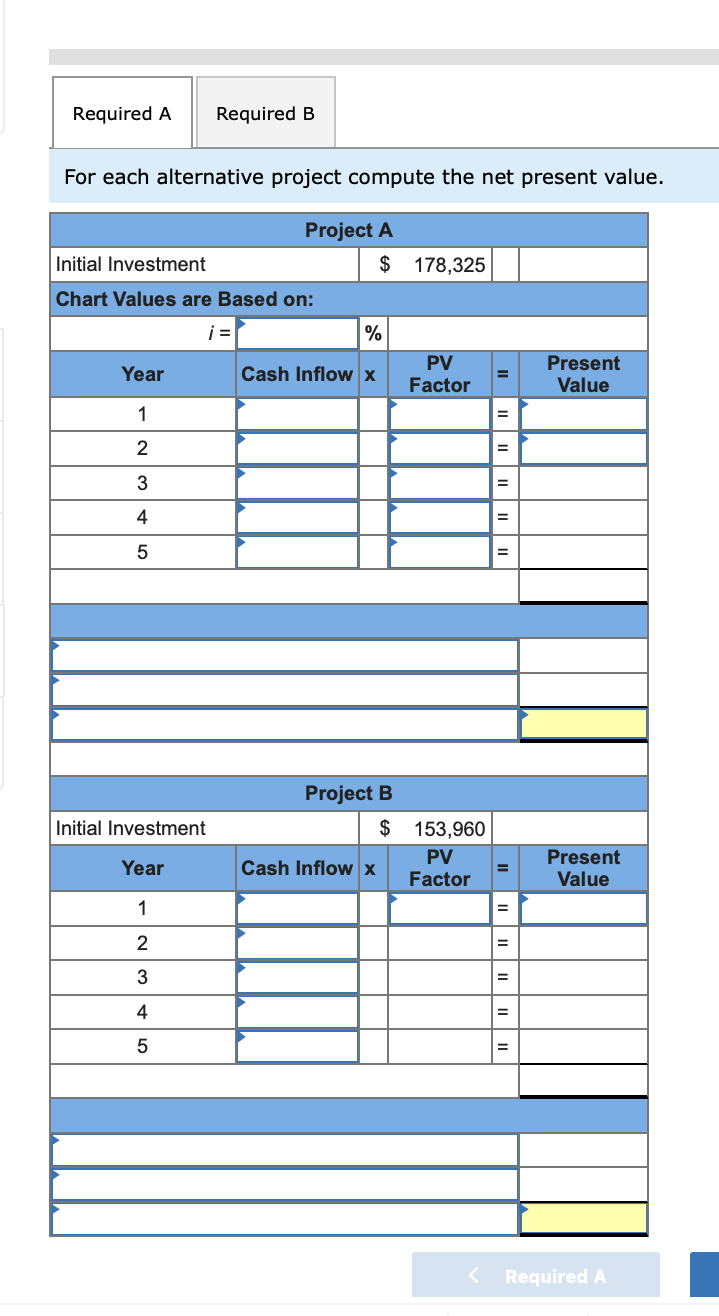

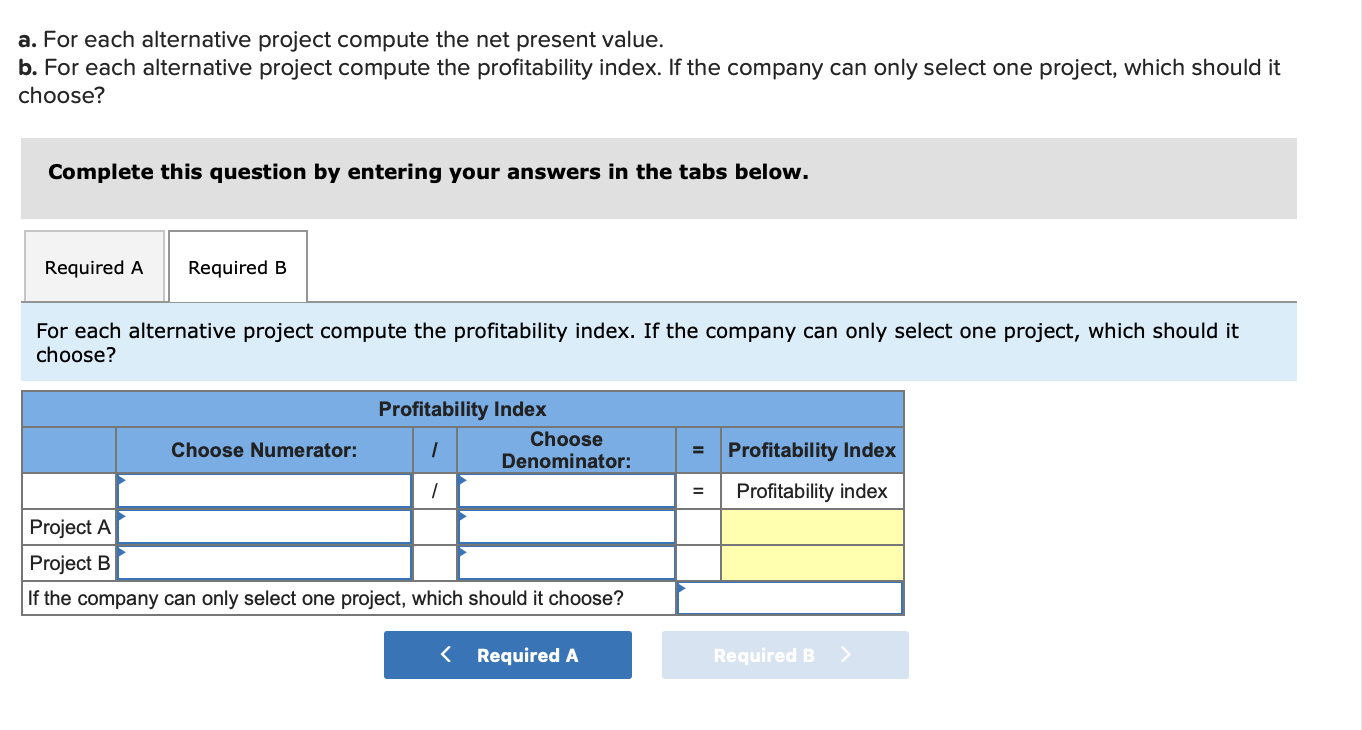

Ch 11 Ex 11-10 Saved Help Save & Exit Submi Check my work 1 Exercise 11-10 NPV and profitability index LO P3 20 points Following is information on two alternative investments being considered by Jolee Company. The company requires a 10% return from its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Skipped Project A $(178, 325) Project B $(153, 960) Initial investment Expected net cash flows in: Year 1 Year 2 Year 3 Year 4 Year 5 54,000 44,000 91, 295 80,400 61,000 29,000 53,000 63,000 66,000 27,000 eBook 10 Hint a. For each alternative project compute the net present value. b. For each alternative project compute the profitability index. choose? the company can only select one project, which should it Required A Required B For each alternative project compute the net present value. Project A $ 178,325 Initial Investment Chart Values are Based on: i = % Year Cash Inflow X PV Factor Present Value 1 2 = 3 = 4 = 5 = Initial Investment Project B $ 153,960 PV Cash Inflow X Factor Year " Present Value 1 = 2 = 3 = 4 = 5 "

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts