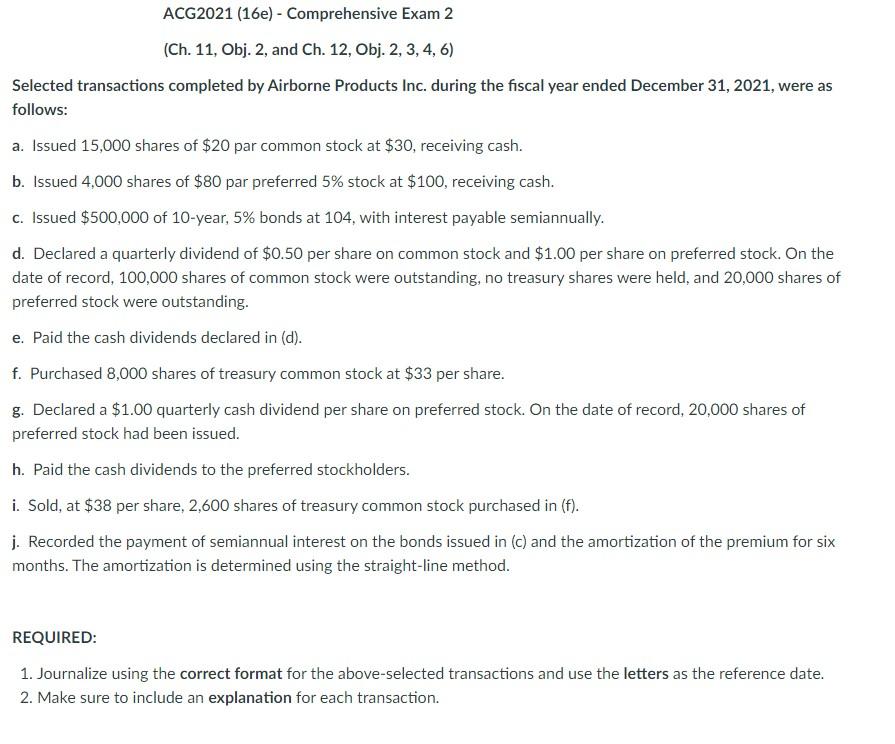

Question: (Ch. 11, Obj. 2, and Ch. 12, Obj. 2, 3, 4, 6) Selected transactions completed by Airborne Products Inc. during the fiscal year ended December

(Ch. 11, Obj. 2, and Ch. 12, Obj. 2, 3, 4, 6) Selected transactions completed by Airborne Products Inc. during the fiscal year ended December 31,2021 , were as follows: a. Issued 15,000 shares of $20 par common stock at $30, receiving cash. b. Issued 4,000 shares of $80 par preferred 5% stock at $100, receiving cash. c. Issued $500,000 of 10 -year, 5% bonds at 104 , with interest payable semiannually. d. Declared a quarterly dividend of $0.50 per share on common stock and $1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 8,000 shares of treasury common stock at $33 per share. g. Declared a $1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. h. Paid the cash dividends to the preferred stockholders. i. Sold, at $38 per share, 2,600 shares of treasury common stock purchased in (f). j. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method. REQUIRED: 1. Journalize using the correct format for the above-selected transactions and use the letters as the reference date. 2. Make sure to include an explanation for each transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts