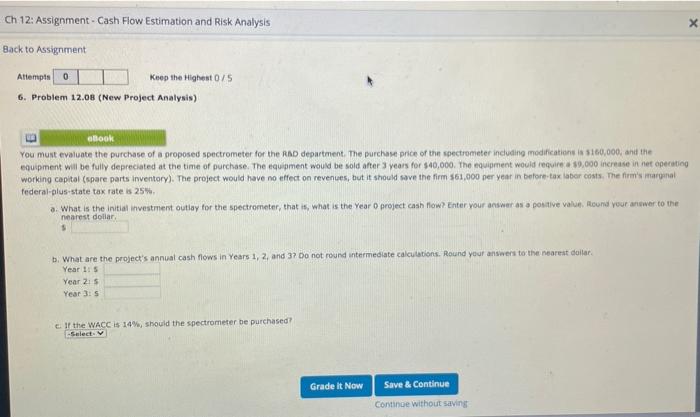

Question: Ch 12: Assignment - Cash Flow Estimation and Risk Analysis Back to Assignment Attempts 0 Keep the Highest 0/5 6. Problem 12.08 (New Project Analysis)

Ch 12: Assignment - Cash Flow Estimation and Risk Analysis Back to Assignment Attempts 0 Keep the Highest 0/5 6. Problem 12.08 (New Project Analysis) obook You must evaluate the purchase of a proposed spectrometer for the RAD department. The purchase price of the spectrometer including modification is 5160,000, and the equipment will be fully depreciated at the time of purchase. The equipment would be sold after years for $40,000. The equipment would require a $9,000 increase in net operating working capital (spare parts Inventory). The project would have no effect on revenues, but it should save the firm 561,000 per year in before tax labor costs. The firm's marginal federal-plus-state tax rate is 25 a. What is the initial investment outlay for the spectrometer, that is what is the Year o project cash flow? Enter your answer as a positive value, Round your answer to the 0 nearest dollar b. What are the project's annual cash flows in Years 1, 2 and 3? Do not round intermediate calculations. Round your answers to the nearest dollar. Year is Year 215 Year 3:5 If the WACC is 14%, should the spectrometer be purchased? Select Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts