Question: Ch 12 Problem #9: You have been asked by the president of your company to evaluate the proposed acquisition of a new special-purpose truck for

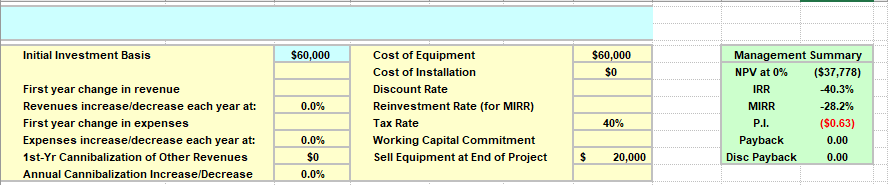

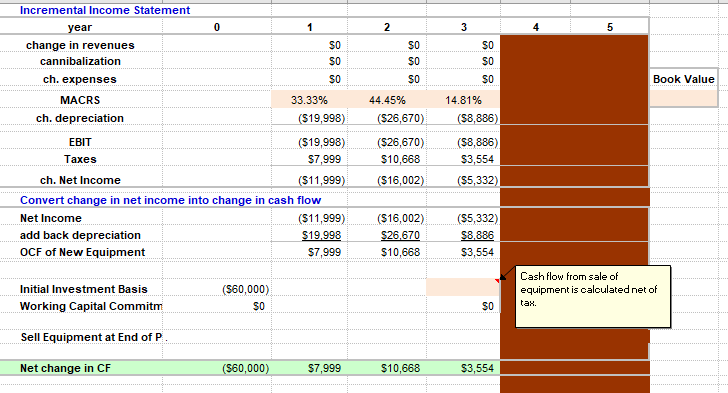

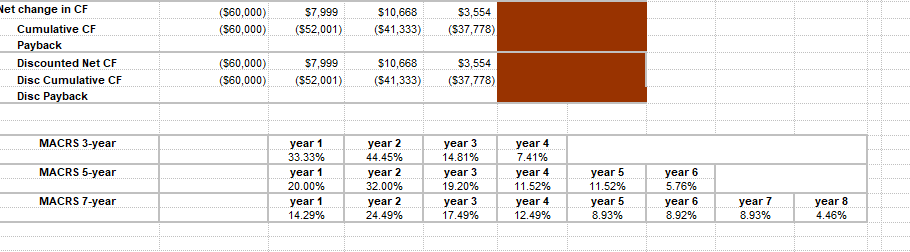

Ch 12 Problem #9: You have been asked by the president of your company to evaluate the proposed acquisition of a new special-purpose truck for $60,000. The truck falls into the MACRS (Links to an external site.)Links to an external site. 3-year class, and it will be sold after three years for $20,000. Use of the truck will require an increase in NWC (spare parts inventory) of $2,000. The truck will have no effect on revenues, but it is expected to save the firm $20,000 per year in before-tax operating costs, mainly labor. The firms marginal tax rate is 40 percent, an opportunity cost of capital of 8 percent. What will the cash flows for this project be?

Ch 12.9 Deliverable (100 total points): Complete the Ch 12 Problem #9 Excel worksheet and answer the following questions (50 points). Q.3 What will the cash flows for this project be? (25 points) Q.4 According to the Management Report, should KADS go forward with the project? (25 points) Explain you answers in detail using the Capital Budgeting key topic and tools in Ch 13 and Ch 13 from the M: Finance textbook readings.

This is how the instructor would like the question to be formatted in excel. He has formulas in most excel squares. I just need to know what I'm missing to get the correct final answer.

.

$60,000 Initial Investment Basis Cost of Equipment Cost of Installation Discount Rate Reinvestment Rate (for MIRR) Tax Rate Working Capital Commitment Sell Equipment at End of Project S60,000 S0 Management Summary NPV at 0% ($37,778) IRR MIRR First year change in revenue Revenues increaseldecrease each year at: First year change in expenses Expenses increaseldecrease each year at: 1st-Yr Cannibalization of Other Revenues Annual Cannibalization Increase/Decrease -40.3% -28.2% (S0.63) 0.00 0.0% 40% Payback Disc Payback 0.00 0.0% S0 0.0% 20 Incremental Income Statement ar change in revenues cannibalization ch. expenses MACRS ch. depreciation EBIT Taxes ch. Net Income S0 S0 S0 S0 S0 S0 Book Value 44.45% 33.33% 14.81% 886 (S19,998)($26,670)($8,886) S3,554 (S5,332) $19,998 670 $7,999 S10,668 $11,999 $16,002 Convert change in net income into change in cash flow Net Income add back depreciation OCF of Ne Equipment (S11,999 (16,002) (S5332) (S5,332) $7,999 S10,668 S3,554 Cash flow from sale of equipment is calculated net of Initial Investment Basis ($60,000) S0 Working Capital Commitm Sell Equipment at End of P Net change in CF S0 57,999 S10,668 S3,554 et change in CF s60,00) $7,999 (S60,000). ($52,001)(S41,333 ($37,778) 10,668 $3,554 7 1 Cumulative CF Payback Discounted Net CF Disc Cumulative CF Disc Payback (S60,000)$7,999 (S60,000$52,001)(S4133(S37,778) $7,999$10,668 S3,554 MACRS 3-year MACRS 5-year MACRS 7-year year 1 33.33% year 1 year 2 44.45% year 2 year 3 14.81% year 4 7.41% | year 3 year 4 11.52% year 5 11.5296 . year 5 8.93% year 6 5.76% 32.00% year 2 19.20% year 3 17.49% ve year 1 year 4 12.49% 1 year 7 8.93% year 6 year 8 4.46% $60,000 Initial Investment Basis Cost of Equipment Cost of Installation Discount Rate Reinvestment Rate (for MIRR) Tax Rate Working Capital Commitment Sell Equipment at End of Project S60,000 S0 Management Summary NPV at 0% ($37,778) IRR MIRR First year change in revenue Revenues increaseldecrease each year at: First year change in expenses Expenses increaseldecrease each year at: 1st-Yr Cannibalization of Other Revenues Annual Cannibalization Increase/Decrease -40.3% -28.2% (S0.63) 0.00 0.0% 40% Payback Disc Payback 0.00 0.0% S0 0.0% 20 Incremental Income Statement ar change in revenues cannibalization ch. expenses MACRS ch. depreciation EBIT Taxes ch. Net Income S0 S0 S0 S0 S0 S0 Book Value 44.45% 33.33% 14.81% 886 (S19,998)($26,670)($8,886) S3,554 (S5,332) $19,998 670 $7,999 S10,668 $11,999 $16,002 Convert change in net income into change in cash flow Net Income add back depreciation OCF of Ne Equipment (S11,999 (16,002) (S5332) (S5,332) $7,999 S10,668 S3,554 Cash flow from sale of equipment is calculated net of Initial Investment Basis ($60,000) S0 Working Capital Commitm Sell Equipment at End of P Net change in CF S0 57,999 S10,668 S3,554 et change in CF s60,00) $7,999 (S60,000). ($52,001)(S41,333 ($37,778) 10,668 $3,554 7 1 Cumulative CF Payback Discounted Net CF Disc Cumulative CF Disc Payback (S60,000)$7,999 (S60,000$52,001)(S4133(S37,778) $7,999$10,668 S3,554 MACRS 3-year MACRS 5-year MACRS 7-year year 1 33.33% year 1 year 2 44.45% year 2 year 3 14.81% year 4 7.41% | year 3 year 4 11.52% year 5 11.5296 . year 5 8.93% year 6 5.76% 32.00% year 2 19.20% year 3 17.49% ve year 1 year 4 12.49% 1 year 7 8.93% year 6 year 8 4.46%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts