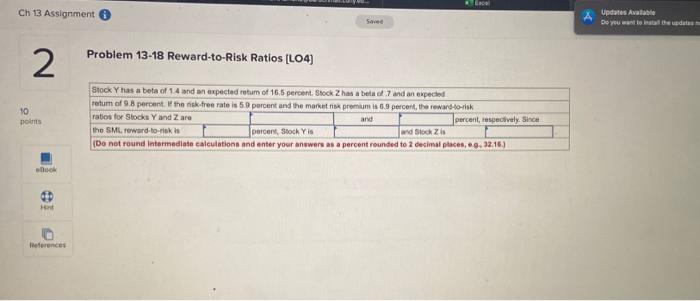

Question: Ch 13 Assignment Sovee Updates Available Do you want to installe updates Problem 13-18 Reward-to-Risk Ratios (L04) 2 10 points Stock Y has a beta

Ch 13 Assignment Sovee Updates Available Do you want to installe updates Problem 13-18 Reward-to-Risk Ratios (L04) 2 10 points Stock Y has a beta of 14 and an expected retum of 16.6 percent Stock Z has a beta 7 and an expected rotum of 9.8 percent. If the nisk-free rate is 5.9 percent and the market nok premijm is 6.9 percent, the reward torisk ratios for Stocks Y and Z are and percent, respectively. Since the SML reward-torok percent Stock Yis und Stock Zh Do not found Intermediate calculations and enter your answers as a percent rounded to a decimal places, e9, 22:16 Book 0 References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts