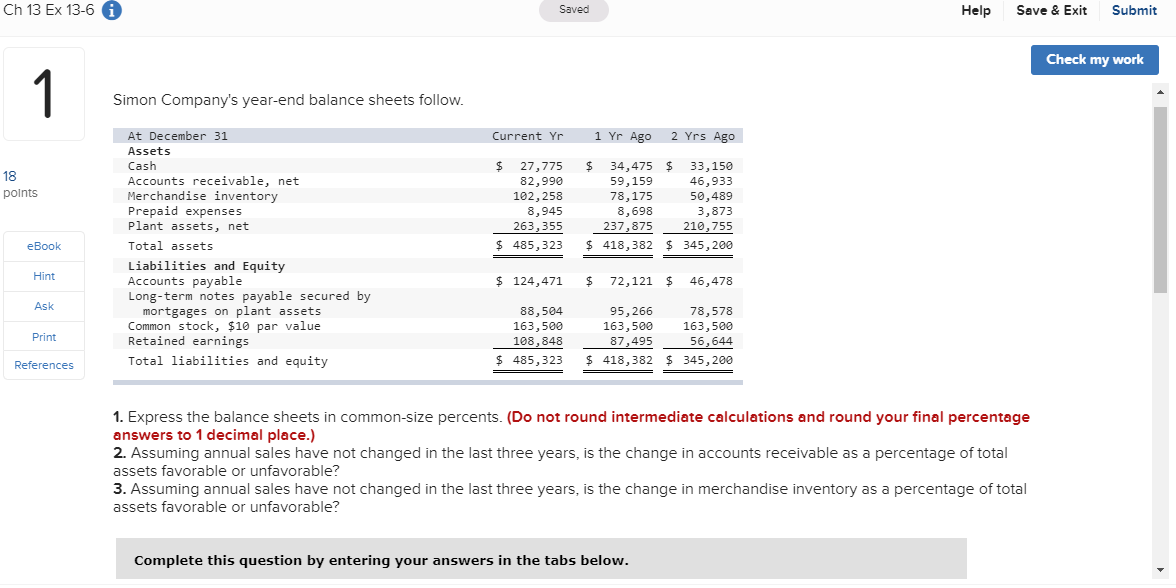

Question: Ch 13 Ex 13-6 i Saved Help Save & Exit Submit Check my work 1 Simon Company's year-end balance sheets follow. 1 Yr Ago At

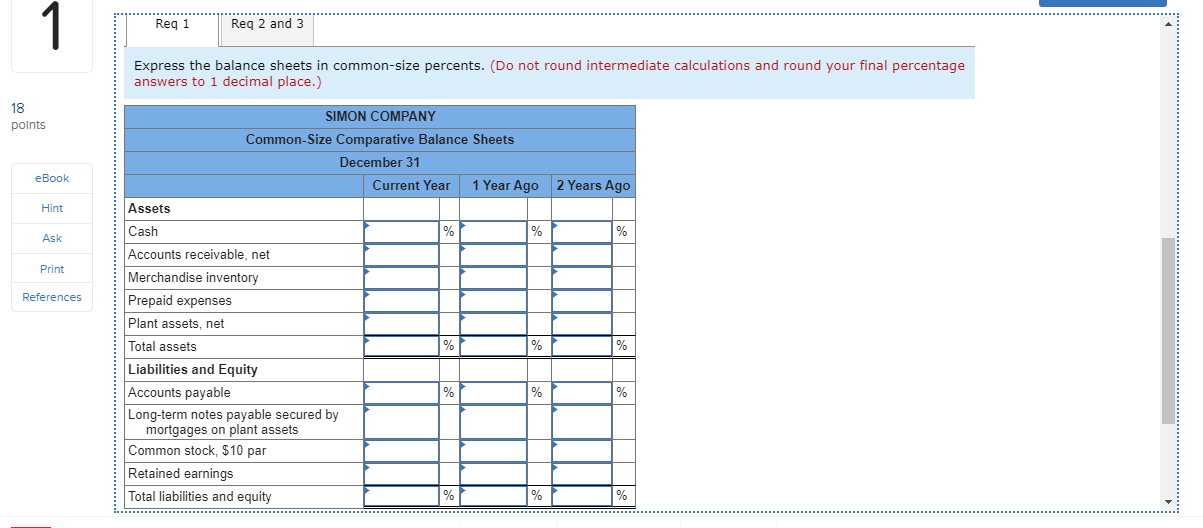

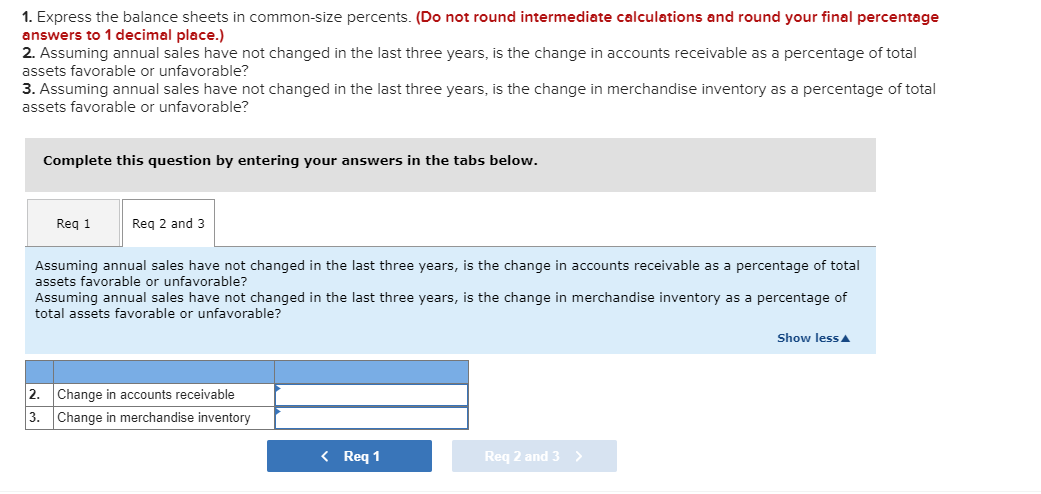

Ch 13 Ex 13-6 i Saved Help Save & Exit Submit Check my work 1 Simon Company's year-end balance sheets follow. 1 Yr Ago At December 31 Current Yr 2 Yrs Ago Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net 27,775 82,990 102,258 8,945 263,355 34,475 $ 33,150 46,933 50,489 3,873 18 59,159 78,175 8,698 237,875 polnts 210,755 418,382 $ 345,200 $ 485,323 Total assets eBook Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Hint 124,471 $ 72,121 $ 46,478 Ask 88,504 163,500 108,848 78,578 163,500 56,644 95,266 163,500 Print 87,495 485,323 418,382 $ 345,200 Total liabilities and equity References 1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. 1 Req 2 and 3 Req 1 Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) 18 SIMON COMPANY polnts Common-Size Comparative Balance Sheets December 31 ook Current Year 1 Year Ago 2 Years Ago Assets Hint Cash % Ask Accounts receivable, net Print Merchandise inventory Prepaid expenses References Plant assets, net Total assets % Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par % Retained earnings Total liabilities and equity 1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Show less 2. Change in accounts receivable 3. Change in merchandise inventory Req 1 Reg 2 and 3>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts