Question: Ch 14: Assignment - Planning for Retirement 6. Projecting retirement income and the investment needs worksheet Estimating Future Retirement Needs ul and Courtney know that

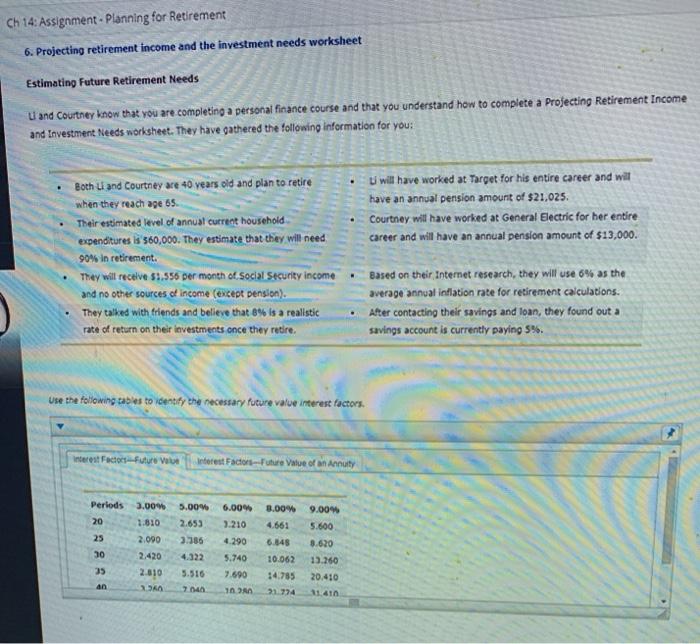

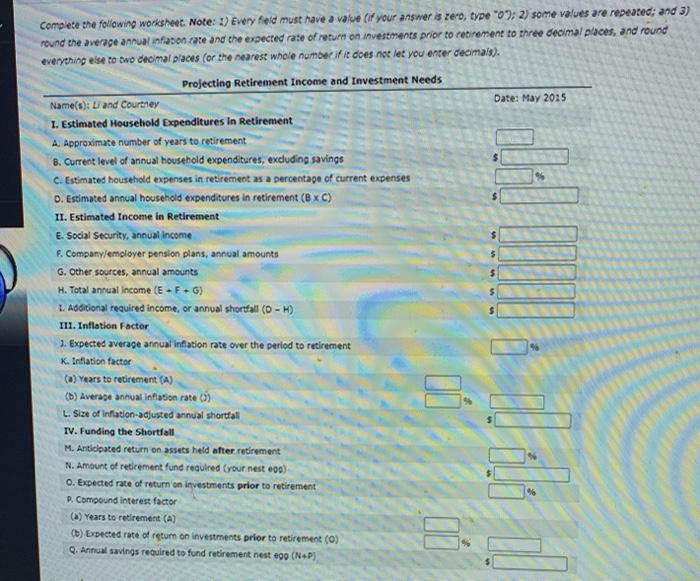

Ch 14: Assignment - Planning for Retirement 6. Projecting retirement income and the investment needs worksheet Estimating Future Retirement Needs ul and Courtney know that you are completing a personal finance course and that you understand how to complete a Projecting Retirement Income and Investment Needs worksheet. They have gathered the following information for you: Li will have worked at Target for his entire career and will have an annual pension amount of $21,025 Courtney will have worked at General Electric for her entire career and will have an annual pension amount of $13,000. Both Li and Courtney are 40 years old and plan to retire when they reach age 65 Their estimated level of annust current household expenditures is 360,000. They estimate that they will need 90% in retirement They will receive 5.556 per month of Social Security income and no other sources of income (except pension). They talked with friends and believe that 8% is a realistic rate of return on their investments once they retire. Based on their Internet research, they will use 6% as the average annual inflation rate for retirement calculations. After contacting their savings and loan, they found out a savings account is currently paying 5%. Use the following tables to identify the necessary future value interest factors. Interest Facto Future Value Interest Factor Future Value of an Annuity Periods 3.00 20 1.610 25 2.090 30 2.420 35 2.810 5.00 2.653 3.386 4.322 5.516 6.00% 3.210 4.290 5.740 7.690 8.00% 4.661 6.648 10.062 14.785 1774 9.00 5.600 8.620 19.260 an 20.410 11.410 7.04 10 Complete the following worksheet. Note: 1) Every field must have a value (if your answer is zero, type "0"); 2) some values are repeated; and 3) round the average annual infusion rate and the expected case of return on investments prior to retirement to three decimal places, and round everything else to two decimal places (or the nearest whole number if it does not let you enter decimals). Projecting Retirement Income and Investment Needs Date: May 2015 Name(s): Land Courtney 1. Estimated Household Expenditures in Retirement A. Approximate number of years to retirement 8. Current level of annual household expenditures, excluding savings c. Estimated household expenses in retirement as a percentage of current expenses D. Estimated annual household expenditures in retirement (BxC) 11. Estimated Income in Retirement E. Social Security, annual income F. Company/employer pension plans, annual amounts G. Other sources, annual amounts 5 H. Total anual income (E-F-G) 1. Additional required income, or annual shortfall (-H) 111. Inflation Factor 2. Expected average annual inflation rate over the period to retirement K. Inflation factor (a) Years to retirement (A) (D) Average annual inflation rate) L. Size of Inflation-adjusted annual shortfall IV. Funding the shortfall M. Anticipated return on assets held after retirement N. Amount of retirement fund required (your nest 000) 0. Expected rate of return on investments prior to retirement P. Compound interest factor (3) Years to retirement (A) (b) Expected rate of return on investments prior to retirement (0) Q. Annual savings required to fund retirement nest egg (N.) DD DIT U ila li

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts