Question: Ch 14 He in Help Save & Exit Submit Check my work 3 1.71 points 1 Rank Wendell's Donut Shoppe is investigating the purchase of

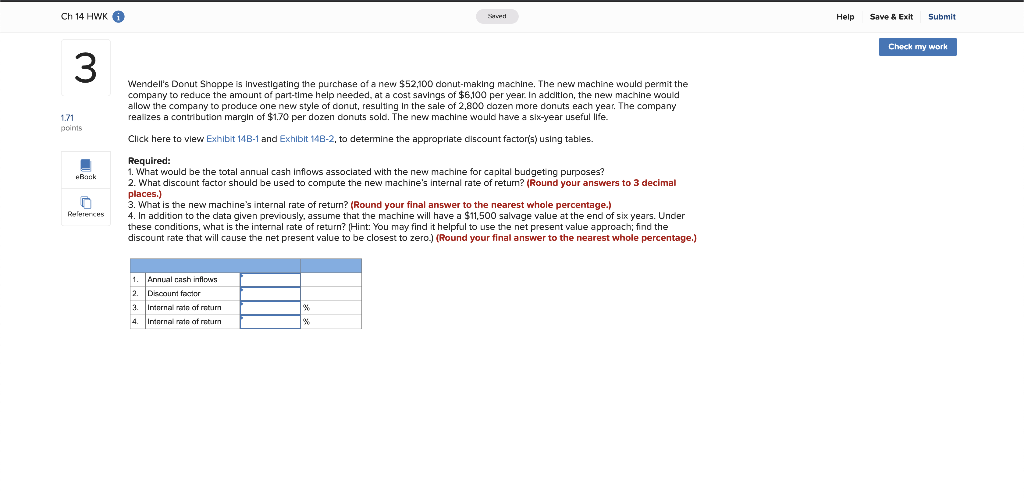

Ch 14 He in Help Save & Exit Submit Check my work 3 1.71 points 1 Rank Wendell's Donut Shoppe is investigating the purchase of a new $52,100 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $6,100 per year. In addition, the new machine would allow the company to produce one new style of conut, resulting in the sale of 2,800 dozen more donuts each year. The company realizes a contribution margin of $1.70 per dozen donuts sold. The new machine would have a six-year useful life. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor's) using tables. Required: 1. What would be the total annual cash inflows associated with the new machine for capital budgeting purposes? 2. What discount factor should be used to compute the new machine's internal rate of return? (Round your answers to 3 decimal places.) 3. What is the new machine's internal rate of return? (Round your final answer to the nearest whole percentage.) 4. In addition to the data given previously, assume that the machine will have a $11,500 salvage value at the end of six years. Under these conditions, what is the internal rate of return? (Hint: You may find it helpful to use the net present value approach; find the discount rate that will cause the net present value to be closest to zero.) (Round your final answer to the nearest whole percentage.) References 1. Annual cash infras 2. Discount factor 3. Internal min of matur 4. Internal rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts